How to cancel a second personal TIN in Vietnam?

How to cancel a second personal TIN in Vietnam?

To cancel a second personal TIN online, citizens should follow these steps:

Step 1: Access the General Department of Taxation’s electronic tax website via the following link: thuedientu.gdt.gov.vn => Select Individual

Step 2: Log into your account

Step 3: Select "Tax Registration" => Choose "Declare and Submit Registration Dossier"

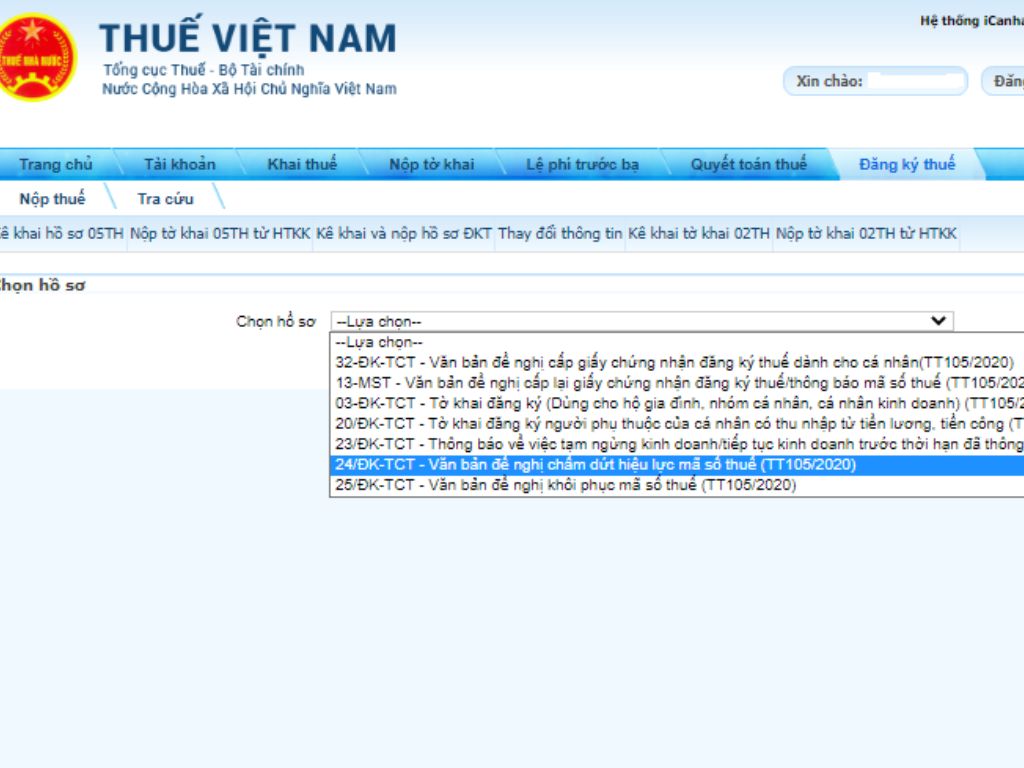

Step 4: In "Select dossier" => Choose "24/DK-TCT - Proposal to terminate the validity of TIN (TT105/2020)" => Continue

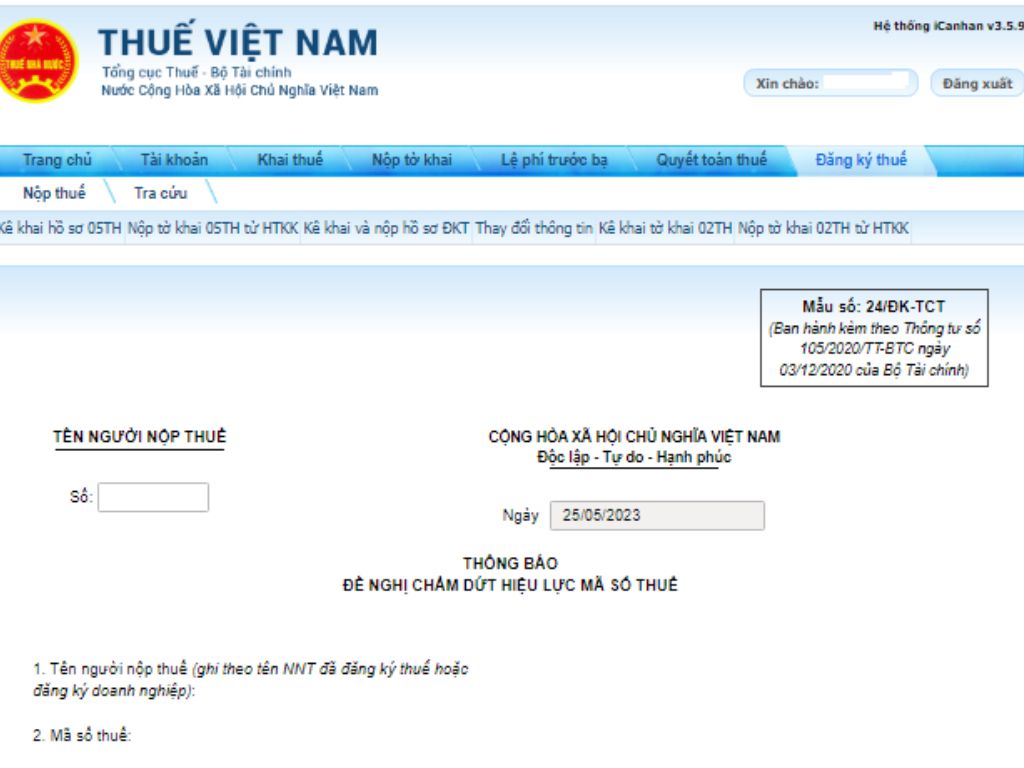

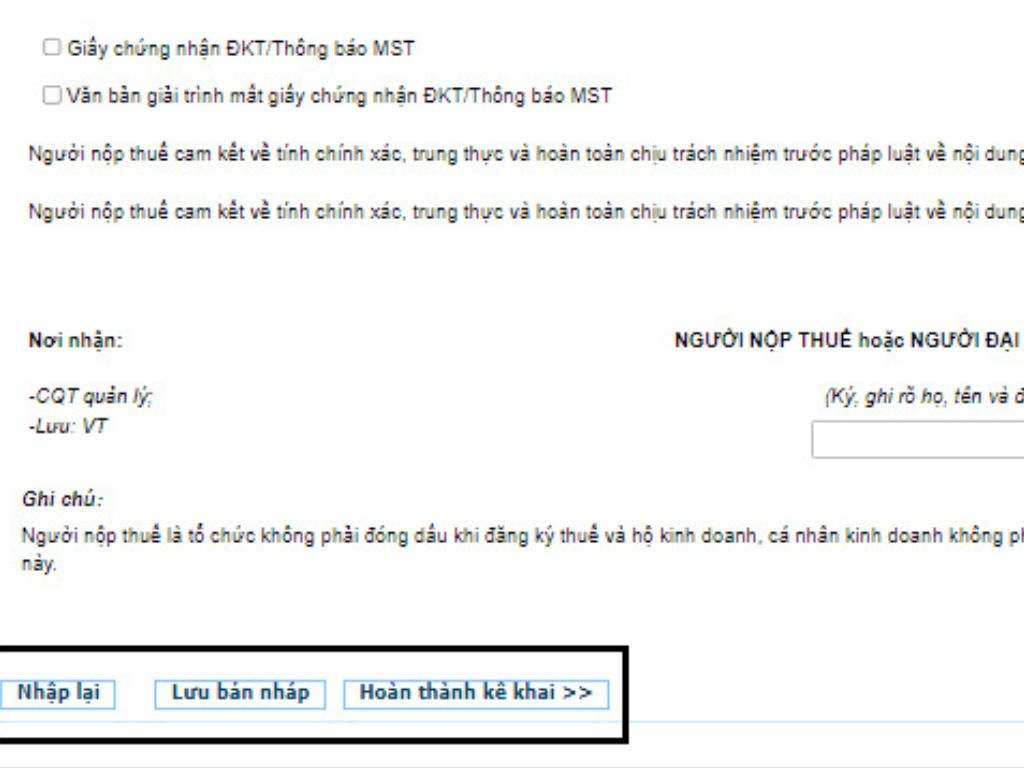

Step 5: Fill in the declaration and attach corresponding documents

- Taxpayer's name

- TIN

- Main office address

- Business address

- Reason for terminating the validity of the TIN

Step 6: Submit the dossier and wait for confirmation from the tax agency

How to cancel a second personal TIN in Vietnam? (Image from Internet)

Shall a person without personal TIN be considered dependant in Vietnam??

According to Clause 3, Article 33 of the 2019 Law on Tax Administration, the regulations for the initial taxpayer registration deadline are as follows:

Initial taxpayer registration deadline

1. Taxpayers registering concurrently with enterprise registration, cooperative registration, or business registration shall have the taxpayer registration deadline as the deadline for enterprise, cooperative, or business registration as stipulated by law.

2. Taxpayers registering directly with the tax agency have a taxpayer registration deadline of 10 working days from one of the following dates:

a) Issuance of business household registration certification, license for establishment and operation, investment registration certificate, establishment decision;

b) Commencement of business activities for organizations not subject to business registration or business individuals subject to business registration but have not been issued a business registration certificate;

c) Incurrence of a tax withholding obligation and paying tax on behalf according to business cooperation contracts or documents;

d) Signing of contractor agreements by foreign contractors or subcontractors, declaring taxes directly with the tax agency; signing foreign oil agreements;

dd) Incurrence of personal income tax obligations;

e) Incurrence of a tax refund request;

g) Incurrence of other obligations to the State budget.

3. Organizations and individuals paying income shall register taxpayers on behalf of individuals earning income no later than 10 working days from the date of incurrence of tax obligations in cases where the individuals do not have a TIN; register taxpayers on behalf of dependants of taxpayers no later than 10 working days from the date the taxpayer registers for personal exemptions according to the law if the dependant does not have a TIN.

Hence, based on the mentioned regulations, taxpayers can still claim family deductions for dependants without a TIN. Furthermore, the company shall have the responsibility to register taxpayers on behalf of the taxpayer's dependants no later than 10 working days from the date the taxpayer registers for personal exemptions.

What are regulations on the use of TINs in Vietnam?

Based on Article 35 of the 2019 Law on Tax Administration, the regulations regarding the use of TINs are as follows:

- Taxpayers must state the assigned TINs on invoices, supporting documents, and materials when conducting business transactions; opening deposit accounts at commercial banks or other credit institutions; declaring taxes, paying taxes, tax exemption, tax reduction, tax refund, non-collection of tax, customs declaration registration, and executing other tax transactions concerning all obligations to the state budget, including cases where taxpayers conduct production and business in multiple locations.

- Taxpayers must provide TINs to relevant agencies or organizations or note TINs in the dossiers when carrying out administrative procedures in coordination with the tax administration agency.

- Tax administration agencies, State Treasury, commercial banks cooperating in collecting the state budget, and agencies authorized by the tax agency to collect taxes use the TINs of taxpayers in tax management and tax collection into the state budget.

- Commercial banks and other credit institutions must record TINs in documents for account opening and transaction records through taxpayer accounts.

- Other organizations and individuals participating in tax management must use the already assigned taxpayer TINs when providing information pertaining to tax obligation determinations.

- When Vietnamese entities pay foreign organizations or individuals conducting business across borders via a digital platform not present in Vietnam, they must use the assigned TIN to withhold and remit taxes on behalf.

- When personal identification numbers are issued to the entire population, they will replace TINs.