How many days does the tax authority in Vietnam take to process an application for tax deferral?

How many days does the tax authority in Vietnam take to process an application for tax deferral?

According to Article 65 of the 2019 Law on Tax Administration, the receipt and processing of application for tax deferrals are regulated as follows:

Receipt and processing of application for tax deferrals

- The tax authority receives the application for tax deferral from the taxpayer through the following methods:

a) Directly receiving the application at the tax authority;

b) Receiving the application sent via postal services;

c) Receiving the electronic application through the electronic transaction portal of the tax authority.

- The tax authority processes the application for tax deferral as follows:

a) If the application is legal, complete, and in the correct form, a written notice of tax deferral shall be sent to the taxpayer within 10 working days from the date of complete receipt of the application;

b) If the application is incomplete, a written notice shall be sent to the taxpayer within 3 working days from the date of receipt of the application.

In the case where the application is legal, complete, and in the correct form, the tax authority shall process the application for tax deferral and send a written notice to the taxpayer within 10 working days from the date of complete receipt of the application.

If the application is incomplete, a written notice shall be sent to the taxpayer within 3 working days from the date of receipt of the application.

How many days does the tax authority in Vietnam take to process an application for tax deferral? (Image from the Internet)

Vietnam: What does the application for tax deferral include?

According to Article 64 of the 2019 Law on Tax Administration, the contents of the application for tax deferral are regulated as follows:

Application for tax deferral

- Taxpayers eligible for tax deferral under this Law shall prepare and send the application for tax deferral to the tax authority managing them directly.

- The application for tax deferral includes:

a) A written request for tax deferral, clearly stating the reasons, amount of tax, and extended payment deadline;

b) Documents proving the reason for the tax deferral.

- The Minister of Finance stipulates the details of the application for tax deferral.

Thus, the application for tax deferral includes:

- A written request for tax deferral;- Documents proving the reason for the tax deferral.

Additionally, the detailed application for tax deferral will be stipulated by the Minister of Finance.

What is the procedure for deadline extension for tax declaration submission in Vietnam?

According to Article 46 of the 2019 Law on Tax Administration, the procedure for deadline extension for tax declaration submission is regulated as follows:

(1) Taxpayers unable to submit a tax declaration on time due to natural disasters, catastrophes, epidemics, fires, or unforeseen accidents shall have the deadline for tax declaration submission extended by the head of the tax authority managing them directly.

(2) The extension period shall not exceed 30 days for monthly, quarterly, yearly, or each-time arising tax declarations; and 60 days for annual tax settlement declarations from the due date of the tax declaration submission.

(3) Taxpayers must send a written request for an extension of the deadline for tax declaration submission to the tax authority before the due date of the tax declaration submission, clearly stating the reasons for the extension request with confirmation from the People's Committee of the commune or the Police of the commune, ward, or commune-level town where the extension-obligatory situation arises.

(4) Within 3 working days from the date of receipt of the written request for an extension of the deadline for tax declaration submission, the tax authority shall respond in writing to the taxpayer on whether the extension is accepted or not.

When are taxpayers considered for tax deferral in Vietnam?

According to Clause 1, Article 62 of the 2019 Law on Tax Administration, tax deferral consideration is based on the request of the taxpayer in one of the following cases:

- Suffering material damage that directly affects production and business due to unavoidable circumstances such as:

Taxpayers suffer material damage due to natural disasters, catastrophes, epidemics, fires, or unforeseen accidents;

Other force majeure circumstances as stipulated by the Government of Vietnam.

- Having to suspend operations due to the relocation of production and business facilities as required by competent authorities, affecting the production and business results.

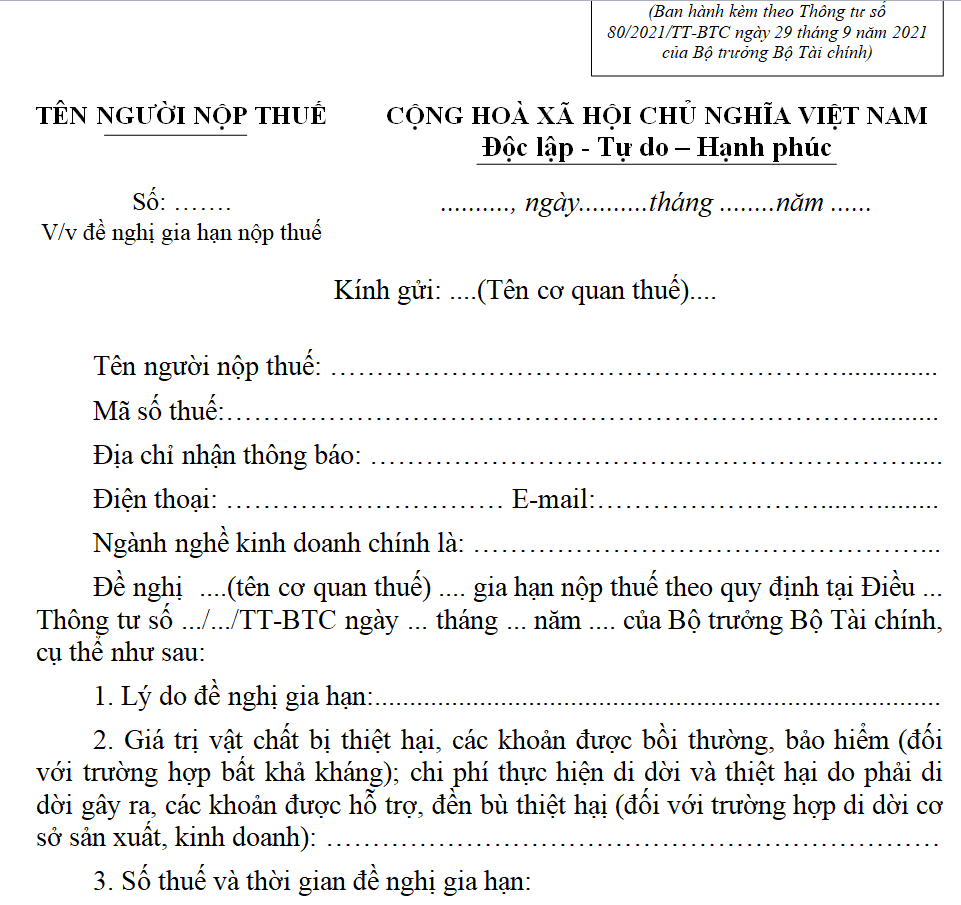

What is the format of Form No. 01/GHAN requesting a tax deferral by the taxpayer?

Form No. 01/GHAN requesting a tax deferral by the taxpayer, issued with Appendix 1 of Circular 80/2021/TT-BTC, is as follows:

Form No. 01/GHAN requesting a tax deferral by the taxpayer: Download