What is the application form for registration of changes and additions to e-transaction information - Form 02/DK-TDT in Vietnam?

What is the application form for registration of changes and additions to e-transaction information - Form 02/DK-TDT in Vietnam?

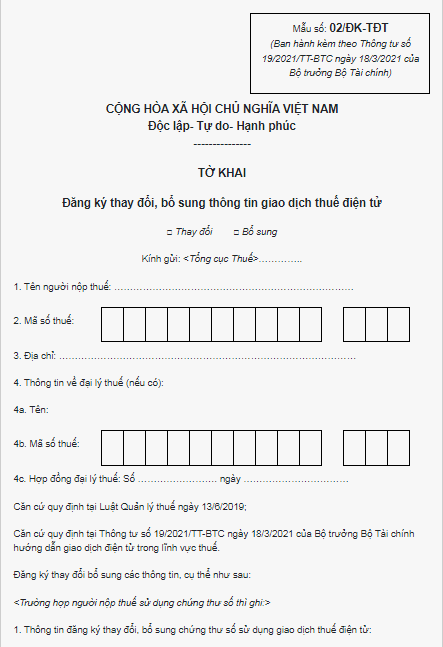

Under the list of forms/templates issued together with Circular 19/2021/TT-BTC, the application form for registration of changes and additions to e-transaction information will be 02/DK-TDT as follows:

*Note: When filling out the information in Form 02/DK-TDT, taxpayers are responsible for the legality, completeness, and accuracy of the registered information mentioned above and commit to receiving and responding to information related to electronic transactions with the tax authority; comply with decisions, notifications, and requirements of the tax authorities sent to the registered electronic mail address mentioned above and the taxpayer's electronic transaction account on the General Department of Taxation's web portal and managing, using the electronic transaction account in the tax field as issued by the tax authority under legal regulations and tax authority guidelines.

>>> Download the application form for registration of changes and additions to e-transaction information - Form 02/DK-TDT.

What is the application form for registration of changes and additions to e-transaction information - Form 02/DK-TDT in Vietnam? (Image from the Internet)

What are the regulations on registration of changes and additions to e-transaction information in Vietnam?

Under Article 11 of Circular 19/2021/TT-BTC, the registration of changes and additions to e-transaction information is specified are as follows:

- If any taxpayer that has been issued with an e-tax transaction account as prescribed in Article 10 of Circular 19/2021/TT-BTC wishes to make any change or addition to the information registered for e-tax transactions with the tax authority, such taxpayer shall sufficiently and promptly update such information.

The taxpayer shall access the GDT’s web portal to update the change or addition to the information registered for e-tax transactions with the tax authority (Form No. 02/ĐK-TDT (Download) issued together with Circular 19/2021/TT-BTC), e-sign and send it to the GDT’s web portal.

Within 15 minutes from the receipt of information about change or addition, the GDT’s web portal shall send the taxpayer a notification (Form No. 03/TB-TDT issued together with Circular 19/2021/TT-BTC) of acceptance or non-acceptance of the information about the change or addition.

- If any taxpayer that has registered transactions with the tax authority by electronic means through the web portal of a competent authority wishes to make any change or addition to the registered information, such taxpayer shall comply with the regulations of the competent authority.

- If any taxpayer that has been issued with an e-tax transaction account through a T-VAN service provider as prescribed in Article 42 of Circular 19/2021/TT-BTC wishes to make any change or addition to the information registered for e-tax transactions, such taxpayer shall comply with the regulations set out in Article 43 of Circular 19/2021/TT-BTC.

- Information about change or addition to the transaction account for e-tax payment at the bank or IPSP shall be registered by the taxpayer with the bank or IPSP where the taxpayer opens their account as prescribed in Clause 5 Article 10 of Circular 19/2021/TT-BTC.

- Taxpayers shall register change of any e-tax transaction method as prescribed in Clause 4 Article 4 of Circular 19/2021/TT-BTC and regulations set out in this Article.

What are the regulations on processing the application for change of taxpayer registration information not required to obtain a result in Vietnam?

Under Clause 3, Article 13 of Circular 19/2021/TT-BTC on the receipt of applications and return of results to taxpayers directly applying for e-taxpayer registration with tax authorities:

- For the application for change of taxpayer registration information not required to obtain a result:

+ The taxpayer shall rely on the regulations on application, deadline for submission and location of submission specified in the Tax Administration Law 2019, Decree 126/2020/ND-CP and Circular 105/2020/TT-BTC to prepare and send documents to the tax authority as stipulated in Point a, Clause 5, Article 4 of Circular 19/2021/TT-BTC.

+ The General Department of Taxation's web portal receives, checks, and sends a notification of the receipt of e-application for taxpayer registration (according to form number 01-1/TB-TDT issued together with Circular 19/2021/TT-BTC) to the taxpayer within 15 minutes from the receipt of the taxpayer's application.

+ If the electronic document is complete according to regulations, the tax authority updates the changes within the time specified in Circular 105/2020/TT-BTC.

+ If the e-application is insufficient as prescribed, within 02 (two) working days from the date of application receipt written on the notification of receipt of e-application for taxpayer registration, the tax authority shall send a notification of non-acceptance of the e-application for taxpayer registration (according to form number 01-2/TB-TDT issued together with Circular 19/2021/TT-BTC) to taxpayers as specified in Clause 2, Article 5 of Circular 19/2021/TT-BTC.

The taxpayer shall submit another e-application for taxpayer registration through the web portal selected by such taxpayer to replace the erroneous application already submitted to the tax authority.