Form 01-3/GTGT: What is the VAT distribution sheet for computerized lottery business in Vietnam in 2024?

What is the Form 01-3/GTGT - VAT distribution sheet for computerized lottery business in Vietnam in 2024?

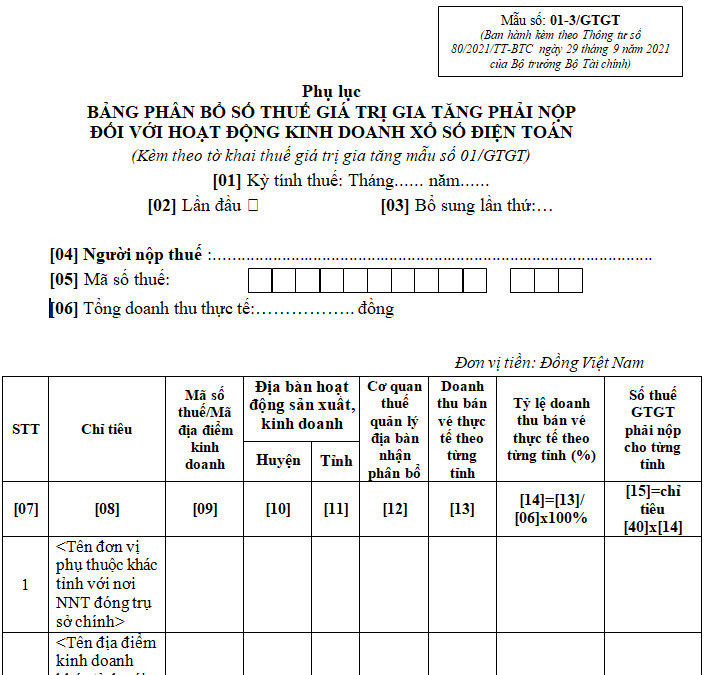

The VAT distribution sheet for computerized lottery business is implemented according to Form 01-3/GTGT in Section 2 of Appendix 2 issued together with Circular 80/2021/TT-BTC.

DOWNLOAD >>> Form 01-3/GTGT - VAT distribution sheet for computerized lottery business 2024

What are instructions for declaring the VAT distribution sheet for computerized lottery business in Vietnam?

* Column [08]:

- Name of the dependent entity in a different province from where the taxpayer's headquarters are located: Declare for the province where the dependent entity's headquarters are located in this item. In the case of multiple dependent entities in different districts of one province, choose one dependent entity in one district where revenue is generated to declare in column [08].

- Name of the business location in a different province from where the taxpayer's headquarters are located: Declare for the province where the business location is, if revenue from ticket sales is generated at each business location. In the case of multiple business locations in different districts of one province, choose one business location in one district where revenue is generated to declare in column [08].

- Where there is no dependent entity or business location: Declare for the province where there is no dependent entity or business location but revenue from ticket sales is generated. In the case of revenue from ticket sales in multiple districts of one province, choose one district where revenue is generated to declare in column [08].

* Indicators [10], [11]:

Declare the district and province where the dependent entity, business location, or ticket sale activity is different from where the taxpayer's headquarters are located.

- In case of multiple dependent entities, business locations, or ticket sale activities in multiple districts managed by one tax agency at the district level (Tax Department), choose 1 representative entity or district to declare in this indicator.

- In case of dependent entities, business locations, or ticket sale activities in multiple districts managed by one regional tax agency (Regional Tax Sub-Department), choose 1 representative entity or district managed by the Regional Tax Sub-Department to declare in this indicator.

* Indicator [17] + Indicator [18] must equal Indicator [40] on the VAT declaration form 01/GTGT.

* Indicator [40] is taken from the VAT declaration form 01/GTGT.

What is the Form 01-3/GTGT - VAT distribution sheet for computerized lottery business in Vietnam? (Image from the Internet)

What are methods of distributing VAT payable for computerized lottery business in Vietnam?

The method of distributing VAT payable for computerized lottery business is regulated in Clause 2, Article 13 of Circular 80/2021/TT-BTC as follows:

| VAT payable for each province where computerized lottery business occur | = | Total VAT payable for computerized lottery business | x | Actual ticket sale revenue ratio (%) from computerized lottery business in each province over total actual ticket sale revenue of the taxpayer |

Actual ticket sale revenue from computerized lottery business is determined as follows:

- In the case of distributing online lottery tickets via terminal devices: Revenue from computerized lottery business arises from terminal devices registered for selling online lottery tickets within the administrative boundaries of each province according to the lottery agency contracts signed with the online lottery company or the stores and points of sale established by the taxpayer in the locality.

- In the case of distributing online lottery tickets via telephone and internet: Revenue is determined in each province where customers register to participate in the lottery when opening a betting account according to legal regulations on online lottery business.