For taxpayers who calculate tax by the credit method and have business activities, which form should they use to submit declaration dossier supplementary in Vietnam?

For taxpayers who calculate tax by the credit method and have business activities, which form should they use to submit declaration dossier supplementary in Vietnam?

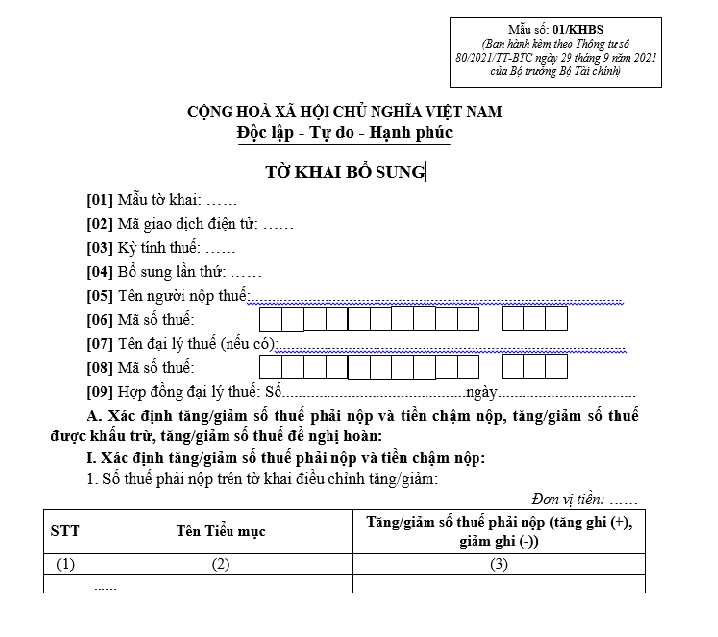

The VAT return form according to Circular 80/2021/TT-BTC is stipulated in Appendix 2 issued together with Circular 80/2021/TT-BTC, applicable to taxpayers who calculate tax by the credit method and have business activities.

The VAT return form according to Circular 80/2021/TT-BTC....download

Thus, for taxpayers who calculate tax by the credit method and have business activities, they shall submit declaration dossier supplementary according to form 01/GTGT.

For taxpayers who calculate tax by the credit method and have business activities, which form should they use to submit declaration dossier supplementary in Vietnam? (Image from Internet)

What is the penalty for late submission of VAT declaration dossiers in Vietnam?

According to the provisions of Article 13 Decree 125/2020/ND-CP stipulating sanctions for violations regarding the deadline for submitting tax declaration dossiers as follows:

- A warning shall be given for the act of submitting tax declaration dossiers late from 01 day to 05 days and having mitigating circumstances.

- A fine ranging from 2,000,000 VND to 5,000,000 VND shall be imposed for the act of submitting tax declaration dossiers late from 01 day to 30 days, except for cases specified in Clause 1 of this Article.

- A fine ranging from 5,000,000 VND to 8,000,000 VND shall be imposed for the act of submitting tax declaration dossiers late from 31 days to 60 days.

- A fine ranging from 8,000,000 VND to 15,000,000 VND shall be imposed for one of the following acts:

- Submitting tax declaration dossiers late from 61 days to 90 days;

- Submitting tax declaration dossiers late from 91 days or more but no tax payable arises;

- Failing to submit tax declaration dossiers but no tax payable arises;

- Failing to submit appendices as required by tax management regulations for enterprises with related-party transactions accompanying corporate income tax finalization dossiers.

- A fine ranging from 15,000,000 VND to 25,000,000 VND shall be imposed for the act of submitting tax declaration dossiers late for over 90 days from the deadline for submitting tax declaration dossiers, with tax payable arising and the taxpayer has fully paid the tax and late payment amount into the state budget before the tax authority announces the decision on tax inspection, tax audit or before the tax authority establishes a record of the act of late submission of tax declaration dossiers as prescribed in Clause 11 Article 143 of the Law on Tax Administration.

Note: For the same administrative violation regarding tax, invoices, the fine amount for an organization is twice the fine amount for an individual.

How to extend the deadline for submitting VAT in Vietnam?

According to Clause 1, Article 4 Decree 64/2024/ND-CP, it is specifically provided as follows:

- For value-added tax (excluding value-added tax on imports)

+ Extension of the deadline for tax payment regarding the arising payable value-added tax (including the amount allocated to other provincial localities where the taxpayer has the head office, tax paid per each occurrence) of the tax period from May to September 2024 (for cases of monthly VAT declarations) and the tax period of the second quarter of 2024, the third quarter of 2024 (for cases of quarterly VAT declarations) for those enterprises, organizations specified in Article 3 of this Decree. The extension period is 05 months for the VAT of May 2024, June 2024, and the second quarter of 2024, 04 months for the VAT of July 2024, 03 months for the VAT of August 2024, and 02 months for the VAT of September 2024 and the third quarter of 2024. The extension period specified in this point is calculated from the deadline for VAT payment as stipulated by tax management laws.

- Enterprises, organizations eligible for extension shall comply with current legal regulations on monthly, quarterly VAT return submissions, but are not required to pay the arising VAT on the VAT returns declared. The extended VAT payment deadlines are as follows:

+ The VAT payment deadline for the tax period of May 2024 is no later than November 20, 2024.

+ The VAT payment deadline for the tax period of June 2024 is no later than December 20, 2024.

+ The VAT payment deadline for the tax period of July 2024 is no later than December 20, 2024.

+ The VAT payment deadline for the tax period of August 2024 is no later than December 20, 2024.

+ The VAT payment deadline for the tax period of September 2024 is no later than December 20, 2024.

+ The VAT payment deadline for the tax period of the second quarter of 2024 is no later than December 31, 2024.

+ The VAT payment deadline for the tax period of the third quarter of 2024 is no later than December 31, 2024.

- If enterprises, organizations specified in Article 3 Decree 64/2024/ND-CP have branches, subsidiaries declaring VAT separately to their direct tax management agencies, the branches, subsidiaries are also eligible for the extension of VAT payment.

- If the branches, subsidiaries of enterprises, organizations stated in Clauses 1, 2, and 3, Article 3 Decree 64/2024/ND-CP do not have business activities in the economic sectors, fields eligible for the extension, these branches, subsidiaries are not eligible for the extension of VAT payment.