Download the direct credit accompaying with tax payment form in Vietnam according to Decree 11/2020/ND-CP in 2025

Download the direct credit accompaying with tax payment form in Vietnam according to Decree 11/2020/ND-CP in 2025

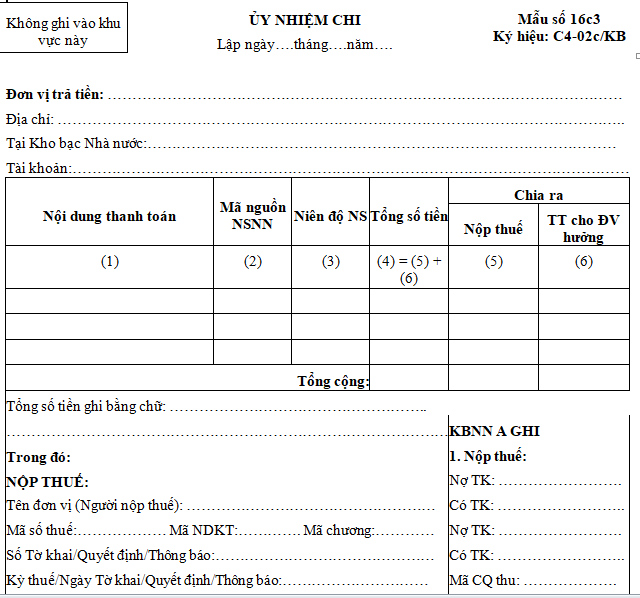

Currently, the direct credit accompaying with tax payment form (Code: C4-02c/KB) is implemented according to Form No. 16c3 as stipulated in Appendix 2 issued with Decree 11/2020/ND-CP.

DOWNLOAD >>> Latest direct credit accompaying with tax payment form 2025

Who may use direct credit accompaying with tax payment form in Vietnam according to Decree 11/2020/ND-CP?

Based on the regulations in Article 2 of Decree 11/2020/ND-CP, the entities applicable for the direct credit accompaying with tax payment form (Code: C4-02c/KB) include:

- Units within the State Treasury system.

- Financial agencies, tax offices, customs offices, and other agencies assigned or authorized by competent state authorities to organize the implementation of state budget collection tasks (hereinafter collectively referred to as collecting agencies).

- Commercial banks, wholly foreign-owned banks, foreign bank branches operating in Vietnam, and other credit institutions established and operating under the provisions of the Law on Credit Institutions (hereinafter collectively referred to as banks) and organizations providing intermediary payment services.

- Units and individuals transacting with the State Treasury.

Where to download the direct credit accompaying with tax payment form in Vietnam according to Decree 11/2020/ND-CP? (Image from the Internet)

What is the procedure for state budget e-payments in Vietnam?

Based on the regulations at Clause 4, Article 4 of Decree 11/2020/ND-CP about the procedure for state budget e-payments as follows:

* In case of paying into the state budget via the electronic portal of the tax management agency:

- The person paying into the state budget uses the electronic tax transaction account granted by the tax management agency to log into the electronic tax payment system on the electronic portal of the tax management agency to create the state budget payment document, confirm acceptance of payment, and send the state budget payment voucher to the tax management agency electronically.

- The electronic portal of the tax management agency sends a confirmation notice of receipt of the state budget payment document or the reason for not receiving the state budget payment document to the person paying into the state budget.

+ In the case where the person paying into the state budget uses value-added services for electronic transactions in tax payment (T-VAN), the electronic portal of the tax management agency sends a confirmation notice of receipt of the state budget payment document to the person paying into the state budget through the T-VAN service provider.

+ If the state budget payment document is valid, the electronic portal of the tax management agency performs an electronic signature with the tax management agency's digital certificate on the state budget payment document and sends it to the bank or intermediary payment service provider that the person paying into the state budget has selected when creating the state budget payment document.

- The bank or intermediary payment service provider checks the conditions for debiting the account of the person paying into the state budget.

+ If the account balance of the payer is sufficient to debit for the state budget, the bank or intermediary payment service provider processes the transfer of funds fully and promptly into the State Treasury's account based on the information stated on the state budget payment document (the transfer period is regulated under the Tax Management Law);

Simultaneously, send the state budget payment document with the digital signature of the bank or intermediary payment service provider to the person paying into the state budget via the electronic portal of the tax management agency to confirm the successful state budget payment.

+ If the account balance of the payer is insufficient to debit for the state budget, the bank or intermediary payment service provider sends a digitally signed notification of unsuccessful state budget payment to the person paying into the state budget via the electronic portal of the tax management agency so that the person paying into the state budget can redo the steps according to the above-mentioned procedure.

* In case of paying into the state budget via electronic payment services of the bank or intermediary payment service provider:

- The person paying into the state budget uses an account name and access password provided by the bank or intermediary payment service provider to log into the corresponding electronic payment application system of the bank or intermediary payment service provider (such as ATM, Internet Banking, Mobile Banking, or other electronic payment forms); creates the state budget payment document following the guidance on the electronic payment application system of each bank system or intermediary payment service provider.

- The bank or intermediary payment service provider checks the account information on the state budget payment document and the conditions for debiting the account of the person paying into the state budget.

+ If the check is appropriate, fully and promptly transfer the money into the State Treasury's account according to the information on the state budget payment document (the transfer period is regulated under the Tax Management Law); simultaneously, send the state budget payment document with the digital signature of the bank or intermediary payment service provider to the person paying into the state budget and send the information of successful payment into the state budget to the tax management agency and related units (if any).

+ If the check is inappropriate, send feedback with the digital signature of the bank or intermediary payment service provider about the unsuccessful state budget payment to the person paying into the state budget via the corresponding electronic payment application system so that the person paying into the state budget can redo the steps according to the above-mentioned procedure.

* In case of paying into the state budget via the National Public Service Portal:

After successfully logging into the National Public Service Portal, the person paying into the state budget follows the subsequent steps similar to the case of paying into the state budget via the electronic portal of the tax management agency as stipulated at point a, clause 4, Article 4 of Decree 11/2020/ND-CP.

- Shall the TIN of dependant be changed to a personal TIN in Vietnam?

- Shall an employee with a contract of less than 6 months be subject to enforcement by deduction of money from the taxpayer’ salary or income in Vietnam?

- How long is the tax enforcement decision effective in Vietnam?

- What is the deadline for submitting taxes of the fourth quarter in Vietnam? What types of taxes are declared quarterly in Vietnam?

- Do Lunar New Year gifts valued at 2 million for employees subject to personal income tax in Vietnam?

- What are cases where non-refundable ODA project owners are entitled to refund of VAT in Vietnam?

- What is the form for notification of payment of land and housing registration fee by tax authority in Vietnam according to Decree 126?

- What are 03 conditions for VAT deduction in Vietnam from July 1, 2025?

- Is the e-tax transaction code generated uniformly in Vietnam?

- What crime will be imposed for tax evasion with an amount of from VND 100,000,000 in Vietnam?