Decree 168 on administrative penalties for road traffic offences promulgated in Vietnam? What is the current registration fee for cars in Vietnam?

Decree 168 on administrative penalties for road traffic offences promulgated in Vietnam?

From January 1, 2025, Decree 168/2024/ND-CP...Download governs administrative penalties for road traffic offences, amending and replacing some articles, clauses, and points of Decree 100/2019/ND-CP (amended and supplemented by Decree 123/2021/ND-CP).

According to the new regulations in Decree 168/2024/ND-CP, many violations will face significantly higher administrative penalties compared to the present. Specifically, the act of opening a car door, leaving it open unsafely causing traffic accidents, will see the fine increase from 400,000-600,000 VND as per Decree 100/2019/ND-CP to 20-22 million VND according to Decree 168/2024/ND-CP...Download

Moreover, violations such as failing to obey traffic light signals also see fines increase several times, from 4-6 million VND to 18-20 million VND for cars and from 800,000 VND - 1 million VND to 4-6 million VND for motorcycles.

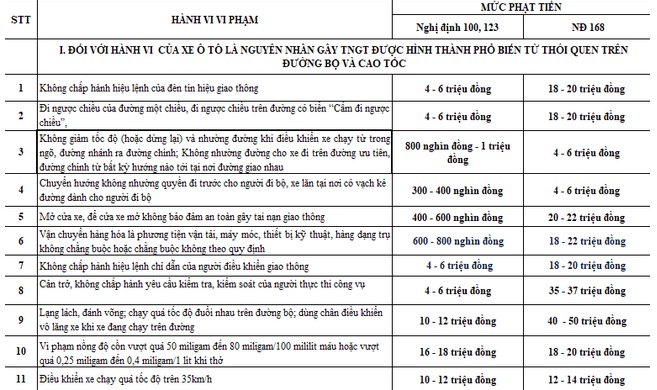

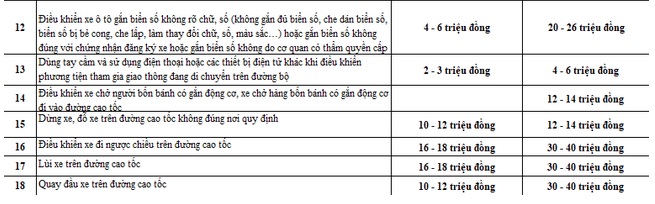

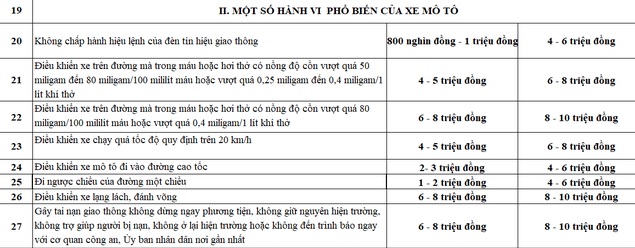

To be specific: 27 violations, groups of violations by cars and motorcycles will see increases in administrative penalties as follows:

(1) Penalty Levels for Cars:

(2) Penalty Levels for Motorcycles:

The Traffic Police Department explains that it is necessary to increase penalties sufficiently to ensure deterrence against certain groups of violations, intentional dangerous violations that directly cause traffic accidents.

Additionally, many individuals deliberately drive vehicles without license plates, cover or alter license plates to engage in illegal activities, smuggle, transport prohibited goods, engage in criminal activities, evade detection by authorities, and circumvent "cold" fines from surveillance systems. Therefore, it is necessary to increase the penalties to ensure the strictness of the law.

The Traffic Police Department has directed nationwide traffic police forces to inspect inner-city routes, major intersections, and complex traffic safety routes to strictly handle violations, prioritizing the use of surveillance systems, handheld cameras, and body-worn cameras on officers to document and remind, handling road users, contributing to gradually forming good habits when participating in traffic, building a civilized, safe traffic culture.

See more Decree 168/2024/ND-CP...Download

Decree 168 on administrative penalties for road traffic offences promulgated in Vietnam? (Image from the Internet)

See also:

>> From January 1, 2025, cars running a red light may be fined up to 20 million VND?

>> List of 26 traffic violations with significantly increased penalties according to Decree 168?

>> Rewards up to 5 million VND for those reporting traffic violations from January 1, 2025?

What is the current registration fee for cars in Vietnam?

Based on Clause 5, Article 8 of Decree 10/2022/ND-CP stipulating the registration fee rates for cars, trailers, or semi-trailers pulled by cars, and vehicles similar to cars will be 2% except in the following cases:

(1) Cars carrying up to 09 passengers (including pick-up cars): pay the initial registration fee at a rate of 10%.

In case there is a need to apply a higher rate suitable for the actual conditions in each locality, the People's Council of provinces and centrally-managed cities decides to adjust and increase but not exceeding 50% of the general rate prescribed in this point.

(2) Pick-up trucks carrying goods with a permissible transport load of less than 950 kg and with up to 5 seats, and VAN trucks with a permissible transport load of less than 950 kg pay the initial registration fee at a rate equal to 60% of the initial registration fee rate for passenger cars carrying up to 09 seats.

(3) Battery-powered electric cars:

+ Within 3 years from the effective date of Decree 10/2022/ND-CP: pay the initial registration fee at a rate of 0%.

+ In the following 2 years: pay the initial registration fee at a rate equal to 50% of the fee for gasoline or diesel cars with the same seating capacity.

Note: The types of cars stipulated in (1), (2), and (3): pay the subsequent registration fees at a rate of 2% and this is applied uniformly nationwide.

Based on the type of vehicle specified in the Certificate of Technical Safety and Environmental Protection issued by the Vietnam Registry, the tax authority determines the registration fee rate for cars, trailers, or semi-trailers pulled by cars, and vehicles similar to cars according to the above regulations.

When to declare and pay vehicle registration fees for cars in Vietnam?

Based on Article 11 of Decree 10/2022/ND-CP on declaring vehicle registration fees for cars is stipulated as follows:

- Organizations and individuals declare and pay registration fees according to the law on tax management when registering ownership rights, rights to use assets with competent state agencies.

- Electronic data on registration fee payments through the State Treasury, commercial banks, or intermediary payment service providers digitally signed by the General Department of Taxation and provided on the National Public Service Portal, holds the same value as paper documents for police agencies to

- How to check for camera fines 2025? What are 02 ways to check camera fines in Vietnam? Which types of motorcycles and cars are subject to excise tax in Vietnam?

- What are regulations on deferment of registration fees in Vietnam in 2025? What is the procedure for deferment of registration fees in Vietnam in 2025?

- Vietnam issues Official Dispatch 1767 BTC TCCB of 2025 on principles for resolving policies on early retirement, termination of employment as per Decree 178?

- What is the download link for software HTKK 5.3.0? What is the latest update for related-party transaction declaration in Vietnam?

- HTKK 5.3.0 software update: Related-party transaction declaration in Vietnam according to Circular 132

- What are 06 changes in the 2025 Law on organizing the local government of Vietnam? Does the merger and change of administrative units at the commune level in Ho Chi Minh City require re-registration of electronic invoice usage information?

- Vietnam issues the Law on organizing the local government 2025: What are the regulations for the organizational structure of the Tax Department of Vietnam from March 1, 2025?

- Vietnam issues Decree 34 of 2025 amending Decrees in the maritime in Vietnam: What is the VAT rate applicable when a vessel is sold to a foreign organization?

- Is land used for building private schools in urban areas subject to non-agricultural land use tax in Vietnam?

- Are incomes from organizing extra class exempt from income tax in Vietnam?