Are tax authorities in Vietnam required to notify tax identification number to each individual?

Are tax authorities in Vietnam required to notify tax identification number to each individual?

Based on Clause 2, Article 8 of Circular 105/2020/TT-BTC:

Issuance of the taxpayer registration certificate and Notification of tax identification number

...

2. Taxpayer registration certificate for individuals

a) “Taxpayer registration certificate for individuals,” Form No. 12-MST issued with this Circular, shall be provided by the tax authority to individuals who submit their taxpayer registration dossier directly to the tax authority in accordance with Points b.1, b.2, b.4, b.5, Clause 9, Article 7 of this Circular.

b) “Notification of individual tax identification number,” Form No. 14-MST issued with this Circular, shall be announced by the tax authority to the income paying agency responsible for taxpayer registration according to Point a, Clause 9, Article 7 of this Circular.

The income paying agency is responsible for informing each individual of their tax identification number or the reason for not being issued one, to adjust and supplement the individual's information. The income paying agency must resubmit the taxpayer registration dossiers to the tax authority to obtain the individual’s tax identification number in accordance with regulations.

...

Referring to Point a, Clause 9, Article 7 of Circular 105/2020/TT-BTC:

Place and dossier for initial taxpayer registration

...

9. For individual taxpayers specified at Points k, n, Clause 2, Article 4 of this Circular.

a) Individuals paying personal income tax through an income paying agency and authorizing the income paying agency for taxpayer registration must submit the taxpayer registration dossier at the income paying agency. In case of paying personal income tax at multiple income paying agencies within the same tax period, the individual shall authorize taxpayer registration at one income paying agency to be issued a tax identification number by the tax authority. The individual shall notify their tax identification number to other income paying agencies for use in tax declaration and payment.

The individual's taxpayer registration dossier includes: authorization document and one of the individual’s identification papers (a copy of the valid Citizen Identity Card or valid ID card for Vietnamese nationals; a copy of the valid Passport for foreign nationals or overseas Vietnamese nationals).

The income paying agency is responsible for compiling the individual’s taxpayer registration information into the taxpayer registration declaration form No. 05-DK-TH-TCT, issued with this Circular, and sending it to the tax authority directly managing the income paying agency.

...

Therefore, the tax authority does not notify each individual of their tax identification number but informs the income paying agency instead.

Are tax authorities in Vietnam required to notify tax identification number to each individual? (Picture from Internet)

How to find an individual tax identification number in Vietnam?

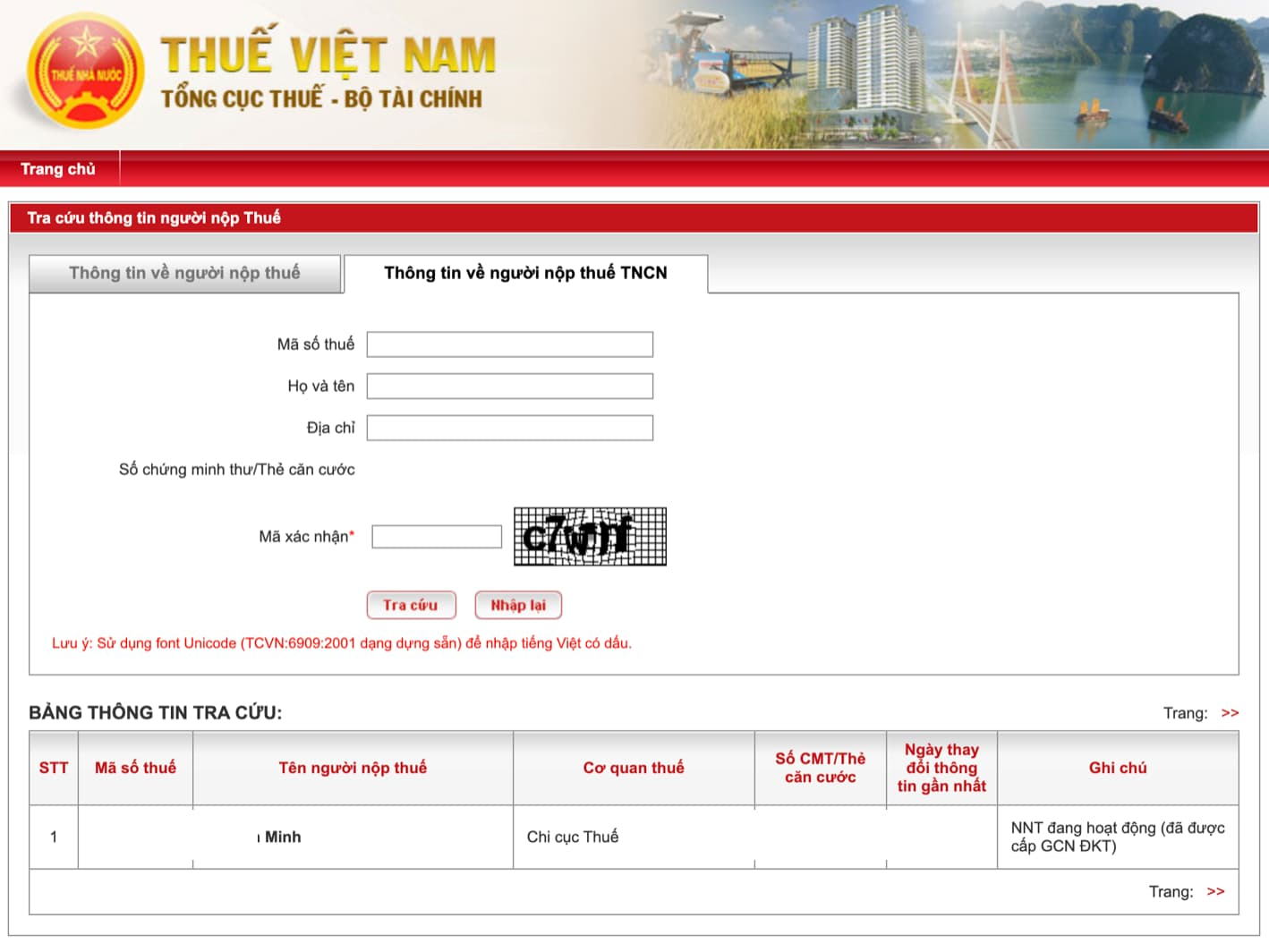

Below is a detailed guide on how to look up an individual tax identification number on the General Department of Taxation’s electronic information portal:

Step 1: Access https://tracuunnt.gdt.gov.vn/tcnnt/mstcn.jsp

Step 2: Enter one of the following information:

- Tax identification number

- Full name

- Address

- ID card

Enter the verification code and search.

Step 3: Click on the taxpayer’s name to view details and verify the taxpayer’s information.

How to use a tax identification number in Vietnam?

According to Article 35 of the Law on Tax Administration 2019, the use of tax identification numbers is regulated as follows:

- Taxpayers must record the issued tax identification number on invoices, receipts, documents when conducting business transactions; opening deposit accounts at commercial banks or other credit institutions; tax declarations, payments, exemptions, reductions, refunds, non-collection of taxes, customs declaration registrations, and other tax-related transactions for all obligations to the state budget, including cases where taxpayers conduct production and business activities in multiple locations.

- Taxpayers must provide their tax identification number to related agencies, organizations, or record it on documents when performing administrative procedures under the one-stop shop mechanism with the tax management authority.

- The tax management authority, State Treasury, commercial banks coordinated for state budget collection, and organizations authorized by the tax authority to collect taxes, use the taxpayer’s tax identification number in tax management and collection into the state budget.

- Commercial banks and other credit institutions must include the tax identification number in the account opening documents and transaction receipts through the taxpayer's account.

- Other organizations and individuals involved in tax management use the issued taxpayer identification number when providing information related to the determination of tax obligations.

- When Vietnamese entities pay money to organizations or individuals conducting cross-border business activities based on digital intermediary platforms without physical presence in Vietnam, they must use the issued tax identification number of these organizations or individuals for withholding and payment.

- When a personal identification number is issued to all residents, it shall be used in place of the tax identification number.