Are smartphones eligible for value-added tax reduction in Vietnam?

Are smartphones eligible for value-added tax reduction in Vietnam?

The groups of goods and services not eligible for value-added tax reduction in 2024 are specified in Clause 1, Article 1 of Decree 72/2024/ND-CP regarding the policy for value-added tax reduction as follows:

* Value-added tax reduction for groups of goods and services currently applying a tax rate of 10%, except for the following groups of goods and services:

[1] Telecommunications, financial activities, banking, securities, insurance, real estate business, metals and products from pre-fabricated metals, mining products (excluding coal mining), coke, refined petroleum, chemical products. Details in Appendix 1 issued together with this Decree. (Download Appendix 1)

[2] Products and services subject to special consumption tax. Details in Appendix 2 issued together with this Decree. (Download Appendix 2)

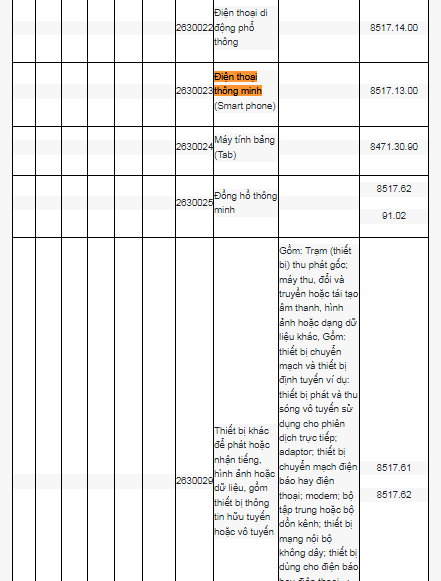

[3] Information technology products and services according to the law on information technology. Details in Appendix 3 issued together with this Decree. (Download Appendix 3)

[4] The reduction of value-added tax for each type of goods and services specified in Clause 1, Article 1 of Decree 72/2024/ND-CP is uniformly applied at the stages of import, production, processing, and commercial business.

For mined coal sold (including cases where mined coal is subsequently screened and classified under a closed process before being sold) that is subject to value-added tax reduction.

Coal products listed in Appendix 1 issued together with this Decree

(Download Appendix 1), at other stages besides the stage of mined coal sales, are not eligible for value-added tax reduction.

The general companies and economic groups that implement a closed process before selling mined coal are also subject to value-added tax reduction for the sold mined coal products.

In cases where goods and services listed in Appendices 1, 2, and 3 issued together with this Decree are subject to a value-added tax exemption or a value-added tax rate of 5% according to the Value-Added Tax Law, the provisions of the Value-Added Tax Law will be applied, and no value-added tax reduction will be granted.

Accordingly, it can be seen that the groups of goods and services subject to a 10% value-added tax previously will receive a 2% value-added tax reduction, except for the cases mentioned above.

Among them, smartphones are products within the group of goods and services not eligible for value-added tax reduction.

Thus, according to the above regulations, smartphones will not be eligible for value-added tax reduction in 2024.

>>> See details List of goods and services not eligible for value-added tax reduction issued together with Decree 72/2024/ND-CP.

Are smartphones eligible for value-added tax reduction in Vietnam? (Image from the Internet)

What is the deadline for extending value-added tax payment in Vietnam for the third quarter of 2024?

According to Article 4 of Decree 64/2024/ND-CP regarding the extension of the tax payment and land rent deadline as follows:

- For value-added tax (excluding value-added tax at the import stage)

+ Extension of the tax payment deadline for value-added tax payable (including the tax allocated to other provincial-level localities where the taxpayer has its headquarters, the tax paid per occurrence) of the tax period from May to September 2024 (for monthly value-added tax declaration cases) and the second quarter of 2024, the third quarter of 2024 (for quarterly value-added tax declaration cases) for businesses and organizations specified in Article 3 of Decree 64/2024/ND-CP.

The extension time is 05 months for the value-added tax of May 2024, June 2024, and the second quarter of 2024, the extension time is 04 months for the value-added tax of July 2024, the extension time is 03 months for the value-added tax of August 2024, the extension time is 02 months for the value-added tax of September 2024, and the third quarter of 2024.

The extension time mentioned here is calculated from the end date of the value-added tax payment deadline as prescribed by the tax management law.

Businesses and organizations eligible for the extension will declare and submit the monthly, quarterly value-added tax declaration form according to current law, but are not required to pay the value-added tax payable arising on the declared value-added tax declaration form.

Thus, according to the regulations, the value-added tax for the third quarter of 2024 is extended by 02 months.

What is the procedure for extending value-added tax payment in Vietnam in 2024?

Additionally, regarding the extension procedure, according to Article 5 of Decree 64/2024/ND-CP, households engaged in aquaculture affected by natural disasters can extend value-added tax payment as follows:

- Taxpayers directly declaring and paying taxes to the tax authorities eligible for the extension submit the Application for extension of tax payment and land rent (hereinafter referred to as the Application for extension) initially or replaced upon detecting errors (via electronic means;

Submit a paper form directly to the tax authority or through postal services) according to the Form in the Appendix issued together with this Decree to the directly managing tax authority once for all tax and land rent amounts arising in the tax periods eligible for extension along with the time of tax declaration filing per month (or per quarter) as per tax management law.

If the Application for extension is not submitted along with the tax declaration filing time per month (or per quarter), the latest submission deadline is September 30, 2024, the tax authority still extends the tax and land rent of the eligible periods before the application submission time.

If taxpayers have payable amounts extended across multiple local tax authority jurisdictions, the directly managing tax authority is responsible for transmitting information and submitting the Application for extension to the relevant tax managing authorities.

- Taxpayers self-identify and take responsibility for requesting an extension to ensure eligibility according to this Decree.

If taxpayers submit the Application for extension to the tax authority after September 30, 2024, they will not be eligible for tax and land rent extension under this Decree.

If taxpayers supplement the tax declaration files of the extended tax period leading to an increased payable amount and submit to the tax authority before the expiration of the extended tax payment deadline, the extended tax amount includes the additional payable amount due to the supplementation.

If taxpayers supplement the tax declaration files of the extended tax period after the expiration of the extended tax payment deadline, the additional payable amount due to the supplementation will not be eligible for an extension.