Are establishments extracting resources in Vietnam required to finalize resource royalties annually?

Are establishments extracting resources in Vietnam required to finalize resource royalties annually?

Under point a, clause 6, Article 8 of Decree 126/2020/ND-CP, the regulation is as follows:

Taxes declared monthly, quarterly, annually, separately; tax finalization

...

6. The following taxes and amounts shall be declared annually and finalized when an enterprise is dissolved, shuts down, terminates a contract or undergoes rearrangement. In case of conversion (except equitized state-owned enterprises) where the enterprise after conversion inherits all tax obligations of the enterprise before conversion, tax shall be finalized at the end of the year instead of the issuance date of the decision on conversion. Tax shall be finalized at the end of the year):

a) Resource royalty.

...

Thus, according to the legal regulations, establishments extracting resources are required to finalize resource royalties annually.

Additionally, the procedure for carrying out the resource royalty finalization will be implemented in accordance with the guidelines on the National Public Service Portal and as per clause 3, Article 15 of Circular 80/2021/TT-BTC as follows:

- Step 1: Organizations or individuals extracting natural resources shall prepare the resource royalty finalization dossier and submit it to the supervisory tax authority.

If the organization or individual extracting natural resources has its head office in one province or municipality but carries out exploitation activities in another province or municipality, the tax finalization dossier shall be submitted to the Tax Department or Tax Sub-department prescribed by the Director of the Tax Department where the exploitation activity arises.

Organizations and individuals with hydropower plants shall prepare the resource royalty finalization dossier according to form No. 02/TAIN in Appendix 2 issued together with Circular 80/2021/TT-BTC (Download) and send it to the tax authority managing the state budget revenue where the water resource exploitation activity occurs.

In the case of organizations or individuals engaged in hydropower production where the hydropower reservoir is located in multiple provinces, the resource royalty finalization dossier and the appendix for resource royalty distribution for the benefiting localities from the hydropower production operations shall be submitted to the tax authority where the hydropower plant's executive office is located. The allocated tax amount shall be paid to the provinces with the hydropower reservoir as regulated.

Submission deadline: No later than the last day of the third month from the end of the calendar year or fiscal year or the 45th day from the cessation of operations, termination of contracts, or reorganization of enterprises.

- Step 2: The tax authority shall receive the dossier:

The tax authority receives and processes the dossier according to regulations for dossiers submitted directly at the tax authority or via postal mail. For dossiers submitted through electronic transactions, the processing, checking, acceptance, and resolution of the dossiers follow the tax authority’s electronic data processing system.

Additionally, the submitter can choose one of the following methods:

- Submit directly at the tax authority's office;

- Or send via postal system;

- Or send the electronic dossier to the tax authority through electronic transactions (Electronic Information Portal of the General Department of Taxation/ Electronic Information Portal of the authorized government agency or T-VAN service provider).

Are establishments extracting resources in Vietnam required to finalize resource royalties annually? (Image from the Internet)

What does the resource royalty finalization dossier for establishments extracting resources in Vietnam include?

Under sub-item 5.2 of Section 5, Appendix 1 issued together with Decree 126/2020/ND-CP, the resource royalty finalization dossier for establishments extracting resources includes:

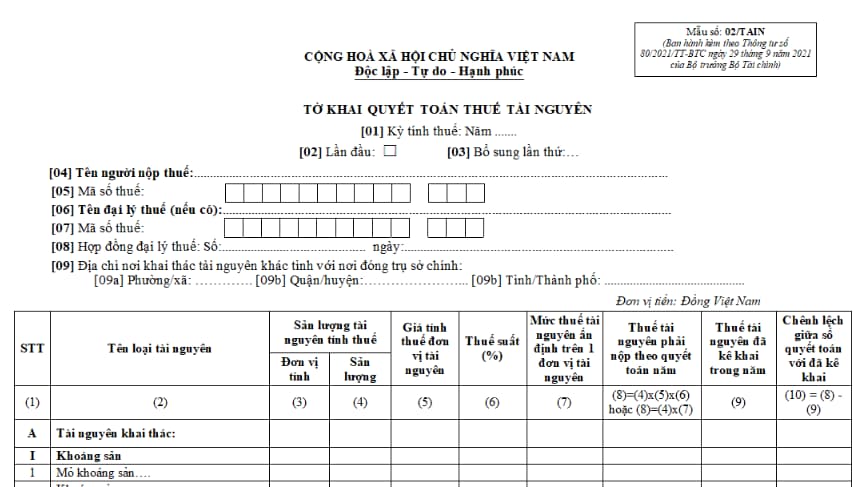

- Resource royalty finalization declaration form No. 02/TAIN (download) in Appendix 2 issued together with Circular 80/2021/TT-BTC

- Appendix for the distribution of resource royalty payable to the localities benefiting from the hydropower production - form No. 01-1/TAIN (Download) issued together with Circular 80/2021/TT-BTC

What is the latest resource royalty finalization declaration form in Vietnam?

Currently, the latest resource royalty finalization declaration form is Form No. 02/TAIN in Appendix 2 issued together with Circular 80/2021/TT-BTC:

Download the latest resource royalty finalization declaration form

What are the criteria for calculating environmental resource royalty in Vietnam?

According to Article 4 of the Resource Royalty Law 2009, the regulation is as follows:

Basis for tax calculation:

The basis for resource royalty calculation is the taxable resource output, tax price, and tax rate.

Referencing Article 4 of Circular 152/2015/TT-BTC for specific guidelines:

- The basis for calculating resource royalty is the taxable resource output, taxable resource price, and resource royalty rate.

- Determining the payable resource royalty in the period:

Payable resource royalty in the period = Taxable resource output x Unit price for taxable resource x resource royalty rate

In the case where the state authority determines the payable resource royalty rate per unit of exploited resource, the payable resource royalty is determined as follows:

Payable resource royalty in the period = Taxable resource output x Determined resource royalty rate per unit of exploited resource

The tax determination is based on the tax authority's database, in accordance with tax determination regulations under tax management law.