Are CER Certificates Subject to Corporate Income Tax in Vietnam?

Are CER Certificates Subject to Corporate Income Tax in Vietnam?

Firstly, CERs are not merely greenhouse gas emission reduction certificates used to prevent carbon dioxide emissions.

CERs are also a special type of commodity. These CERs can be "bought" and "sold" as credits to developed countries, with 1 CER defined as one ton of CO2.

Simultaneously, based on Clause 8, Article 4 of the 2008 Law on Corporate Income Tax (supplemented by Clause 3, Article 1 of the 2013 Law on Amendments to the Law on Corporate Income Tax; amended by Clause 2, Article 1 of Law No. 71/2014/QH13 on 2014 Amended Tax Law), it is stipulated as follows regarding the subjects exempt from corporate income tax:

Income Exempt from Tax

1. Income from activities of cultivation, husbandry, breeding, processing of agricultural, aquaculture products, or salt production by cooperatives; income of cooperatives active in the fields of agriculture, forestry, aquaculture, and salt production in areas with difficult socio-economic conditions or in areas with exceptionally difficult socio-economic conditions; income of enterprises from cultivation, husbandry, breeding, processing of agricultural, aquaculture products in areas with exceptionally difficult socio-economic conditions; income from offshore fishing activities.

2. Income from direct technical services serving agriculture.

3. Income from the performance of scientific research and technology development contracts, products in the trial production stage, products made from new technology applied for the first time in Vietnam.

4. Income from production and business activities of enterprises employing 30% or more of the average number of employees in the year are people with disabilities, rehabilitated addicts, HIV/AIDS sufferers, and the average number of employees in the year is twenty or more, excluding enterprises operating in the financial sector, real estate business.

5. Income from vocational training activities exclusively for ethnic minorities, people with disabilities, children with special difficult circumstances, and social problem subjects.

6. Income generated from capital contribution activities, joint ventures, or associations with domestic enterprises after corporate income tax has been paid in accordance with this Law.

7. Donations received for educational, scientific research, cultural, artistic, charitable, humanitarian, and other social activities in Vietnam.

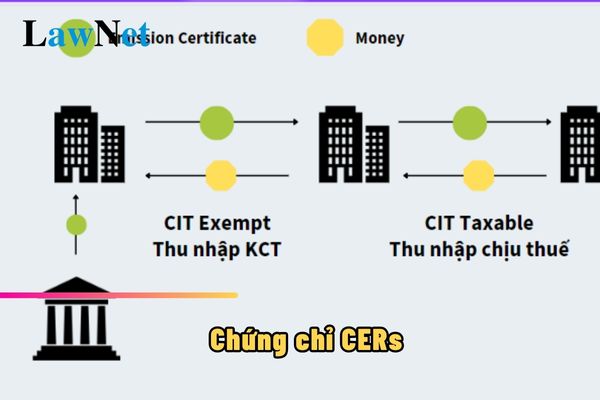

8. Income from the transfer of emission reduction certificates (CERs) by businesses granted emission reduction certificates.

9. Income from performing tasks assigned by the State of the Vietnam Development Bank in investment credit activities, export credit; income from credit activities for the poor and other policy subjects of the Social Policy Bank; income of state financial funds and other state funds operating not for profit as prescribed by law; income of organizations wholly owned by the State established by the Government of Vietnam to handle bad debts of Vietnamese credit institutions.

10. Undivided income of socialization undertakings in the field of education - training, healthcare, and other socialization fields to invest in developing such establishments as prescribed by specialized laws on education - training, healthcare, and other socialization fields; undivided income forming assets of cooperatives established and operating under the Law on Cooperatives.

11. Income from technology transfer in the prioritized transfer field to organizations and individuals in areas with exceptionally difficult socio-economic conditions.

Thus, according to the above regulations, if a business has CER certificates, also known fully as emission reduction certificates (CERs) and earns income from transferring these certificates, it will be exempt from corporate income tax.

Are CER Certificates Subject to Corporate Income Tax in Vietnam? (Image from Internet)

Is the Second Transfer of CER Certificates Subject to Corporate Income Tax in Vietnam?

Corporate income tax exemption for income is stipulated in Clause 8, Article 8 of Decree 218/2013/ND-CP as follows:

Income Exempt from Tax

...

Income exempt from tax is implemented according to the provisions of Article 4 of the Law on Corporate Income Tax and Clause 3, Article 1 of the Law on Amendments and Supplements to several articles of the Law on Corporate Income Tax.

...

8. Income from the first transfer of emission reduction certificates (CERs) by businesses granted emission reduction certificates; subsequent transfers subject to corporate income tax according to regulations.

...

Thus, according to the above regulations, from the second transfer of CER certificates onwards, businesses will be subject to corporate income tax as prescribed.

What is the Basis for Determining Taxable Income in Vietnam?

According to the provisions of Article 7 of the 2008 Law on Corporate Income Tax, the basis for determining taxable income is as follows:

- Taxable income in a tax period is determined by taxable income less exempt income and losses carried forward from previous years.

- Taxable income equals revenue minus deductible expenses of production and business activities, plus other income, including income earned outside of Vietnam.