Will organizations with taxable land in Vietnam use the agricultural land use tax declaration form - Form 01/SDDNN?

Will organizations with taxable land in Vietnam use the agricultural land use tax declaration form - Form 01/SDDNN?

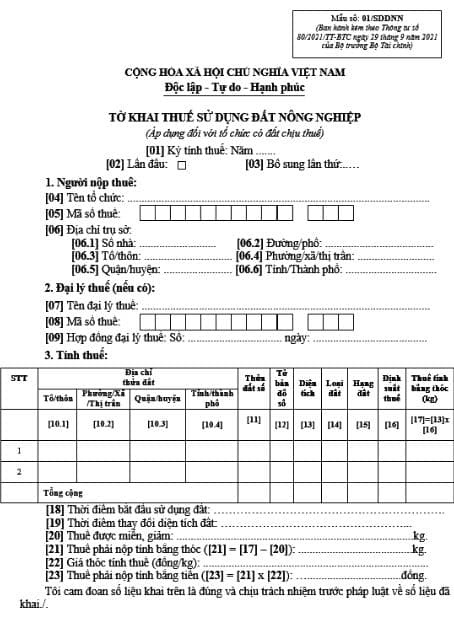

The agricultural land use tax declaration form - Form 01/SDDNN applies to organizations with taxable land issued along with Circular 80/2021/TT-BTC:

Download the agricultural land use tax declaration form - Form 01/SDDNN: Here

Will organizations with taxable land in Vietnam use the agricultural land use tax declaration form - Form 01/SDDNN? (Image from the Internet)

Which entities are the agricultural land use taxpayers in Vietnam?

According to Article 1 of the Agricultural Land Use Tax Law 1993 and Article 1 of Decree 74-CP of 1993, the entities required to pay agricultural land use tax include:

- Organizations and individuals using land for agricultural production are required to pay agricultural land use tax, including:

+ Farmer households, private households, and individuals;

+ Organizations and individuals using agricultural land from the land fund dedicated to the public utility needs of the commune;

+ Agricultural, forestry, and aquaculture enterprises, including farms, forestry stations, enterprises, stations, and other enterprises, state agencies, public service providers, armed forces units, social organizations, and other units using land for agricultural, forestry, and aquaculture production.

- Households allocated agricultural land use rights, even if not used, must still pay agricultural land use tax.

What types of land are subject to agricultural land use tax in Vietnam?

According to Article 2 of the Agricultural Land Use Tax Law 1993 and Article 2 of Decree 74-CP of 1993, the types of land subject to agricultural land use tax include:

- Croplands: lands for annual crops, perennial crops, and grasslands.

- Land for annual crops: land for crops with a growth period (from planting to harvest) not exceeding 365 days such as rice, corn, vegetables, peanuts, or crops harvested multiple times without undergoing a basic construction period like sugarcane, banana, reed, sisal, lemongrass, pineapple.

- Land for perennial crops: land for crops with a growth cycle exceeding 365 days, planted once but harvested over many years and requiring a basic construction period like rubber, tea, coffee, oranges, tangerines, longans, oil palms, coconuts.

- Grassland: lands already utilized for growing grass to raise livestock.

- Aquaculture areas: lands specifically used for aquaculture or both aquaculture and cropping, but not used for any other purposes.

- Plantation land: lands that have been forested and assigned to organizations or individuals for management, care, and exploitation, excluding bare hills and mountains.

Owners of tax-liable lands under this provision are required to pay taxes even if the land is not currently in use.

What types of land are not subject to agricultural land use tax in Vietnam?

According to Articles 3 and 4 of the Agricultural Land Use Tax Law 1993 and Articles 3 and 4 of Decree 74-CP of 1993, the types of land not subject to agricultural land use tax include:

- Natural forest land;

- Natural grassland not allocated to any organization or individual for use;

- Residential land or land for constructing buildings subject to house and land tax;

- Land for common traffic and irrigation for fields;

- Specialized land as prescribed by the Land Law, identified for purposes other than agricultural or forestry production and housing;

- Land leased by the Government of Vietnam or People's Committees at all levels to organizations, households, or individuals according to the Land Law.

Note: Foreign organizations and individuals investing in Vietnam using agricultural land must pay land rent as prescribed by the Foreign Investment Law in Vietnam and are not required to pay agricultural land use tax.

What are the regulations on agricultural land use tax collection and payment in Vietnam?

According to Chapter 4 of the Agricultural Land Use Tax Law 1993, the collection and payment of agricultural land use tax are as follows:

- The approved tax register is the basis for tax collection. Tax is paid yearly from 1 to 2 times, according to the main harvest season of each type of crop in each locality. The tax payment deadline is determined by the Provincial People's Committee or Centrally Administered City. At least 10 days before the tax payment deadline, the direct tax collection agency must send a notice specifying the location, time, and tax amount to be paid by each taxpayer.

- Agricultural land use tax is calculated in paddy and collected in cash. The price of paddy for tax collection is decided by the Provincial People's Committee or Centrally Administered City, not exceeding 10% below the local market price during the tax collection season.

In special cases, tax may be collected in paddy as decided by the Chairman of the Provincial People's Committee or Centrally Administered City.

- At the end of the tax year, the direct tax collection agency must settle the tax collection results for each household and report the tax settlement in writing to the superior tax authority and the People's Committee at the same level, and simultaneously publicly announce it to the public.