Will an individual in Vietnam be issued a unique TIN to be used during his/her entire life?

What is the definition of tax identification number (TIN) in Vietnam?

According to Clause 5, Article 3 of the Law on Tax Administration 2019, terms are explained as follows:

Definitions

In this Law, the undermentioned terms shall be defined as follows:

1. “tax” means a compulsory amount payable to the state budget by organizations, households, household businesses, individuals as prescribed by tax laws.

...

5. “tax identification number” or “TIN” means a series of 10 or 13 digits and other characters assigned by tax authorities to taxpayers to serve tax administration.

6. “tax period” means a period of time used to determine tax liabilities that must be paid towards the state budget in accordance with provisions on taxation.

7. “tax return” means a document stipulated by the Minister of Finance and used by taxpayers to declare information for the purpose of determining tax liabilities.

...

A TIN means a series of 10 or 13 digits and other characters assigned by tax authorities to taxpayers to serve tax administration.

Will an individual in Vietnam be issued a unique TIN to be used during his/her entire life? (Image from the Internet)

Will an individual in Vietnam be issued a unique TIN to be used during his/her entire life?

According to Clause 1, Article 5 of Circular 95/2016/TT-BTC, the issuance of TINs is regulated as follows:

TIN issuance and usage

1. Issuing TINs

A taxpayer shall register for tax so as to be issued a TIN as prescribed in Article 21 of the Law on Tax administration. In particular:

a) Each of business entities and other entities shall be issued with a unique TIN for the whole operation as from the tax registration until the shutdown, except for the cases specified in Clause 3 of this Article.

b) An individual shall be issued a unique TIN being used in his/her entire life. A dependent of a personal income taxpayer shall be issued with a TIN for the purpose of exemption. The dependent’s TIN is also his/her TIN upon any of liability to government budget taken on by such person.

c) An assigned TIN may not be reissued to other taxpayers.

d) TINs of business entities and other entities shall, upon occurrence of conversion of business forms, sale, giving, or inheritance, remain valid.

dd) A TIN issued to a household business is the TIN issued to the individual acting as representative of such household business. When the representative of the household business dies, is missing, or lacks of legal capacity, the household business shall be issued with new TIN according to the tax code issued to the new household business’s representative. If the household business shuts down, the TIN of household business’s representative still remains valid as his/her TIN.

e) When a household business amendment its representative, it shall notify the tax authority of such amendment so as to be reissued another TIN. If the new household business’s representative has been issued with a TIN, such TIN shall be used.

g) 10-digit TINs shall be issued to enterprises, business entities, and other entities that have full legal status and take legal responsibility for their obligations (hereinafter referred to as “independent entities”; and household businesses’ representatives and other individuals prescribed in Clauses 1, 2, and 3 Article 2 of this Circular, except for the cases prescribed in Clause 3 of this Article.

h) 13-digit TINs shall be issued to:

- Branches and/or representative offices of an enterprise that are eligible for affiliated entities identification numbers of enterprises as prescribed in Law on enterprises; affiliated entities of business entities and other entities established under regulations of law and taking on tax liabilities.

hereinafter referred to as “affiliated entities”. An entity having “affiliated entity/entities” is called “managing entity” for the purpose of this Circular.

- Contractors, and investors entering into petroleum contracts or agreements, parent company – PetroVietnam that is the representative of host country receives profits distributed from petroleum contracts prescribed in Point a Clause 3 of this Article.

- Business locations of a household business in case where the business locations are in the same district but different communes.

...

Therefore, according to the above regulations, an individual shall be issued a unique TIN to be used in his/her entire life.

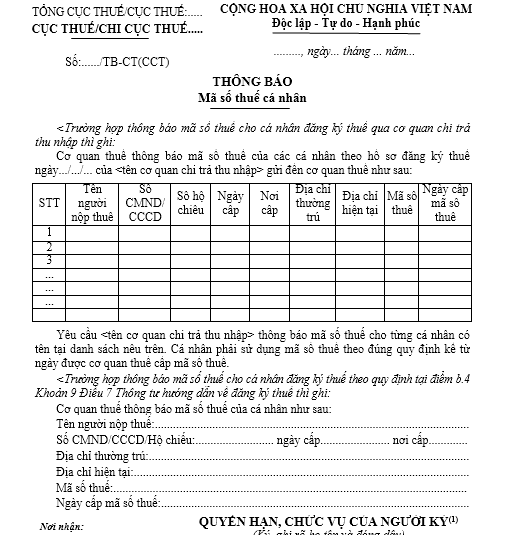

What is the latest TIN notification template in Vietnam?

The latest TIN notification template in Vietnam is Form 14-MST issued with Circular 105/2020/TT-BTC.

Latest TIN notification template in Vietnam: Download