Who are applicable subjects of Form 04/DTV-TNCN for personal income tax returns in Vietnam?

Who are applicable subjects of Form 04/DTV-TNCN for personal income tax returns in Vietnam?

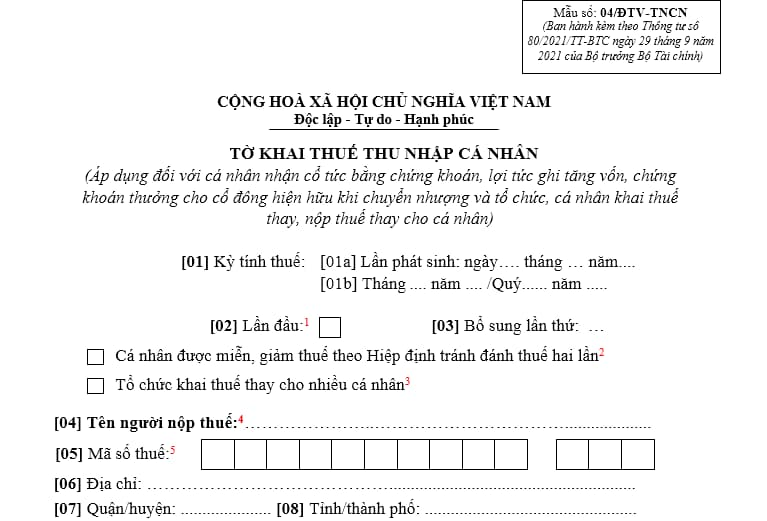

Form 04/DTV-TNCN for personal income tax returns applies to individuals with income from capital transfers, individuals transferring shares who file directly with tax authorities, and organizations or individuals who file and pay taxes on behalf of others as stipulated in Appendix 2 issued together with Circular 80/2021/TT-BTC, as follows:

Download Form 04/CNV-TNCN for personal income tax returns: Here

Who are applicable subjects of Form 04/DTV-TNCN for personal income tax returns in Vietnam? (Image from the Internet)

What is the deadline for submitting personal income tax in Vietnam?

According to Clause 1, Article 55 of the Law on Tax Administration 2019, the regulations are as follows:

Tax Payment Deadline

1. In the case where the taxpayer calculates the tax, the tax payment deadline is no later than the last day of the deadline for submitting the tax return. In the case of amending the tax return, the tax payment deadline is the deadline for submitting the tax return of the tax period having errors or omissions.

For corporate income tax, it is temporarily paid on a quarterly basis, with the tax payment deadline being no later than the 30th of the first month of the following quarter.

For crude oil, the deadline for paying resource tax and corporate income tax per export sale of crude oil is 35 days from the date of sale for domestically sold crude oil or from the date of customs clearance for exported crude oil as per customs regulations.

For natural gas, the deadline to pay resource tax and corporate income tax is monthly.

...

According to Clause 1, Article 44 of the Law on Tax Administration 2019, the regulations are as follows:

Deadline for Submitting Tax Returns

1. The deadline for submitting tax returns for taxes filed monthly or quarterly is as follows:

a) No later than the 20th day of the month following the month in which the tax obligation arises for monthly filings;

b) No later than the last day of the first month of the following quarter in which the tax obligation arises for quarterly filings.

...

Thus, the deadlines for filing and paying taxes monthly and quarterly are determined as follows:

- For personal income tax paid monthly: No later than the 20th day of the month following the month in which the tax obligation arises.

- For personal income tax paid quarterly: No later than the last day of the first month of the following quarter in which the tax obligation arises.

What are the penalties for failing to submit personal income tax returns in Vietnam?

Based on the provisions of Article 13 of Decree 125/2020/ND-CP, acts of late submission or non-submission of personal income tax returns are subject to warnings or fines ranging from VND 2 million to VND 25 million, depending on the level of violation. Specifically:

| No. | Violation | Fine Range | Remedial Measures |

|---|---|---|---|

| 1 | Late submission from 1-5 days with mitigating circumstances | Warning | Must pay the outstanding tax amount in case the late submission leads to late payment of tax |

| 2 | Late submission from 1-30 days, except case (1) | VND 2-5 million | Must pay the outstanding tax amount in case the late submission leads to late payment of tax |

| 3 | Late submission from 31-60 days | VND 5-8 million | Must pay the outstanding tax amount in case the late submission leads to late payment of tax |

| 4 | Late submission from 61-90 days | VND 8-15 million | - Must pay the outstanding tax amount in case the late submission leads to late payment of tax |

| 5 | Late submission from 91 days or more without incurring tax payable | VND 8-15 million | - Must pay the outstanding tax amount in case the late submission leads to late payment of tax |

| 6 | Non-submission of tax return without incurring tax payable | VND 8-15 million | - Must pay the outstanding tax amount in case the late submission leads to late payment of tax - Must submit the tax return in case of non-submission |

| 7 | - Late submission of more than 90 days - Tax payable arises, and the taxpayer has paid the tax and late payment fine before the tax authority issues a decision on tax inspection, tax audit, or records the act of late submission |

- VND 15-25 million - If the fine exceeds the tax payable on the tax return, the maximum fine is equal to the tax payable but not less than VND 11.5 million |

Must pay the outstanding tax amount in case the late submission leads to late payment of tax |