Which tax authorities shall receive the Application for termination of tax identification numbers in Vietnam?

Which tax authorities shall receive the Application for termination of tax identification numbers in Vietnam?

Based on the Appendix issued together with Decision 2589/QD-BTC in 2021, the procedures to terminate the effectiveness of a tax identification number is carried out by the following authorities:

- Termination of the tax identification number for contractors and investors participating in oil and gas contracts, and foreign contractors: Tax Department.

- Termination of the tax identification number for economic organizations, other organizations - Excluding dependent units: Tax Department/ Tax Sub-department.

- Termination of the tax identification number of enterprises, cooperatives that are divided, merged, or consolidated; Termination of activity of dependent units of enterprises and cooperatives: Tax Department/ Tax Sub-department.

- Termination of the tax identification number in cases of division, merger, consolidation of organizations - For divided organizations, merged organizations, consolidated organizations: Tax Department/ Tax Sub-department.

- Termination of the tax identification number for cases of transformation of activities model of economic organizations and other organizations (Transforming dependent units into independent units or vice versa) - For the unit before transformation: Tax Department/ Tax Sub-department.

- Termination of the tax identification number for cases of transformation of activities model of economic organizations and other organizations (transforming independent units into dependent units of another managing unit) - For the unit before transformation: Tax Department/ Tax Sub-department.

- Termination of the tax identification number for cases of transformation of activities model of economic organizations and other organizations (Transforming dependent units of one managing unit into dependent units of another managing unit) - For the unit before transformation: Tax Department/ Tax Sub-department.

- Termination of the tax identification number for business households, individual businesses: Tax Sub-department.

Which tax authorities shall receive the Application for termination of tax identification numbers in Vietnam? (Image from the Internet)

What are regulations on documents and procedures to terminate a personal tax identification number at the tax authority in Vietnam?

(1) Documents for Termination of the Tax Identification Number

In cases where the electronic transaction account has not been registered and the digital signature is not available, the taxpayer shall carry out the procedures directly at the tax authority.

According to Article 14 of Circular 105/2020/TT-BTC, the documents for termination of the tax identification number for taxpayers directly registering with the tax authority include:

(1) Written request for the termination of the tax identification number as specified in form No. 24/DK-TCT issued together with Circular 105/2020/TT-BTC according to the provisions of Articles 38 and 39 of Tax Administration Law 2019.

(2) Other documents (if any):

- For business households; individual businesses; business locations of business households, individual businesses as specified at Point i Clause 2 Article 4 of Circular 105/2020/TT-BTC, the documents include:

A copy of the decision to revoke the Business Registration Certificate of the business household (if any).

(2) Procedure for Implementation:

According to Clause 6 Article 39, Clause 3 Article 41 of Tax Administration Law 2019 which regulates the termination of the tax identification number and the responsibility for handling the taxpayer registration documents as follows:

Step 1: The taxpayer shall directly register with the tax authority to submit the application for termination of the tax identification number to the directly managing tax authority within 10 working days from the date of the written termination of activities or business cessation or the termination date of the contract.

Step 2: The tax authority shall handle the taxpayer registration documents as follows:

- In case the documents are complete, notify the acceptance of the application and the deadline for resolving the taxpayer registration documents no later than 03 working days from the date of receiving the complete documents;

- In case the documents are incomplete, notify the taxpayer no later than 02 working days from the date of receiving the documents.

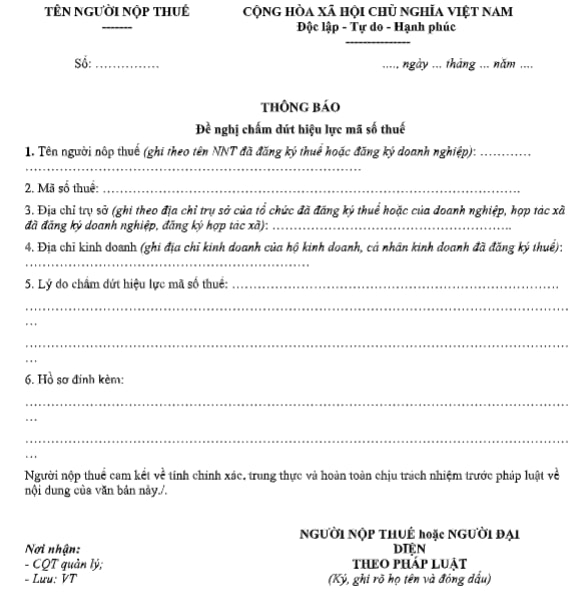

What contents are included in the Form 24/DK-TCT - Request for termination of the personal tax identification number in Vietnam?

The Request for termination of the personal tax identification number is specified in form No. 24/DK-TCT issued together with Circular 105/2020/TT-BTC according to the provisions of Articles 38 and 39 of Tax Administration Law 2019.

Download form 24/DK-TCT - Request for termination of the personal tax identification number here