Which is the form for the declaration of environmental protection fees for exhaust emissions in Vietnam in 2025?

Which is the form for the declaration of environmental protection fees for exhaust emissions in Vietnam in 2025?

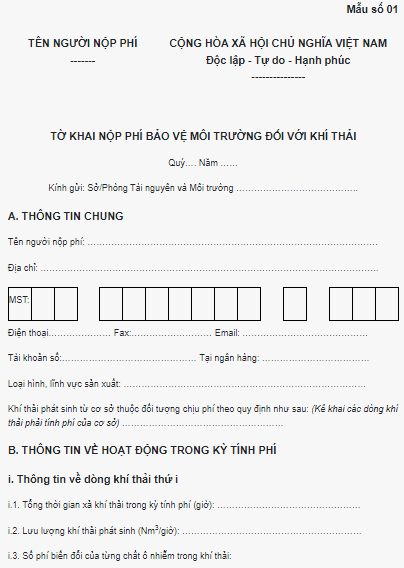

According to the Appendix issued together with Decree 153/2024/ND-CP, the form for the declaration of environmental protection fees for exhaust emissions is Form No. 01 as follows:

Download Form No. 01: Declaration of environmental protection fees for exhaust emissions as Form No. 01.

What is the method for calculating environmental protection fees for exhaust emissions in Vietnam in 2025?

According to Article 5 of Decree 153/2024/ND-CP regulating the method for calculating environmental protection fees for exhaust emissions from January 5, 2025, as follows:

- The environmental protection fee for exhaust emissions payable during the fee payment period is calculated using the following formula: F = f + C.

Where:

+ F is the total fee payable during the fee payment period (quarter or year).

+ f is the fixed fee stipulated in paragraph 1 of Article 6 of Decree 153/2024/ND-CP (quarter or year).

+ C is the variable fee, calculated quarterly.

The variable fee for the exhaust gas source (C) is the total variable fee at each exhaust gas stream (Ci) determined using the following formula: C = ΣCi.

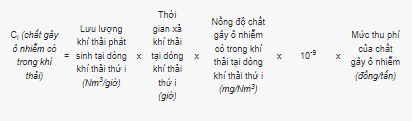

The variable fee for each exhaust gas stream (Ci) is the total variable fee of pollutants stipulated in paragraph 2 of Article 6 of Decree 153/2024/ND-CP present in the exhaust gas at each exhaust stream (i) and is determined using the following formula:

Ci = Ci (Dust) + Ci (SOx) + Ci (NOx) + Ci (CO)

The variable fee of each pollutant present in the exhaust gas at each exhaust stream (i) is determined as follows:

Where:

+ The exhaust time at the exhaust stream (i) is the total exhaust time during the fee calculation period at the exhaust stream (i) as declared by the fee payer.

+ The exhaust gas flow and the concentration of each pollutant present in the exhaust gas at each exhaust stream during the fee payment period are determined as follows:

+ For establishments discharging exhaust emissions that conduct periodic monitoring: The exhaust gas flow is determined according to the flow recorded in the environmental permit; the concentration of each pollutant present in the exhaust gas is determined based on monitoring data conducted once every three months as stipulated in Article 98 of Decree 08/2022/ND-CP.

In cases where the establishment discharges exhaust emissions with a periodic monitoring frequency of once every six months as stipulated in Article 98 of Decree 08/2022/ND-CP, the declaration and calculation of fees for the quarter without monitoring is based on the monitoring data of the preceding monitoring period.

For establishments discharging exhaust emissions that conduct automatic continuous monitoring: The exhaust gas flow and the concentration of each pollutant present in the exhaust gas are determined according to the average value of the measurement results (according to the technical characteristics of each type of equipment).

- For establishments discharging exhaust emissions required to conduct automatic, continuous, or periodic exhaust gas monitoring according to the environmental permit (hereinafter referred to as the subject required to monitor exhaust gas): The environmental protection fee for exhaust emissions payable is the total fee payable (F) determined according to the formula stipulated in paragraph 1 of Article 5 of Decree 153/2024/ND-CP.

- For establishments discharging exhaust emissions that are not required to monitor exhaust gas: The environmental protection fee for exhaust emission payable is the fixed fee rate (f) stipulated in paragraph 1 of Article 6 of Decree 153/2024/ND-CP.

What is the rate of environmental protection fees for exhaust emissions in Vietnam in 2025?

According to Article 6 of Decree 153/2024/ND-CP regulating the rate of environmental protection fees for exhaust emissions from 2025 as follows:

- For establishments discharging exhaust emissions that are not required to monitor exhaust gas

The fixed fee rate (f): 3,000,000 VND/year. In case the fee payer pays quarterly, the fee rate for one quarter is f/4.

In case an establishment discharging exhaust emissions begins operations from the effective date of this Decree or an establishment discharging exhaust emissions operates before the effective date of this Decree: The payable fee = (f/12) x the fee calculation period (month).

Where the fee calculation period is the period from the month following the month this Decree becomes effective (applied to establishments discharging exhaust emissions that are operating) or the month when operations begin (applied to new establishments discharging exhaust emissions from the effective date of this Decree) until the end of the quarter or year.

- For establishments discharging exhaust emissions required to monitor exhaust gas

+ The fixed fee rate (f) is implemented according to the provisions in paragraph 1 of Article 6 of Decree 153/2024/ND-CP.

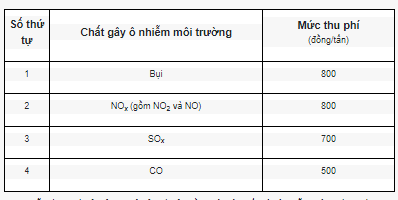

+ The variable fee rate for pollutants present in exhaust gas as follows:

+ At each exhaust stream of an establishment discharging exhaust gas, the concentration of a pollutant present in the exhaust gas with an average value (calculated during the fee payment period) is lower by 30% than the concentration of that substance stipulated in the environmental technical standard for exhaust gas or regulations of the local government (if any): The variable fee rate for that pollutant is 75% of the fee calculated using the formula to determine the variable fee of each pollutant present in the exhaust gas stream stipulated in point c paragraph 1 Article 5 of Decree 153/2024/ND-CP.

+ At each exhaust stream of an establishment discharging exhaust gas, the concentration of a pollutant present in the exhaust gas with an average value (calculated during the fee payment period) is lower by 30% or more than the concentration of that substance stipulated in the environmental technical standard for exhaust gas or regulations of the local government (if any): The variable fee rate for that pollutant is 50% of the fee calculated using the formula to determine the variable fee of each pollutant present in the exhaust gas stream stipulated in point c paragraph 1 Article 5 of Decree 153/2024/ND-CP.

The basis for determining the fee rates stipulated in point c, point d paragraph 2 Article 5 of Decree 153/2024/ND-CP is the result of exhaust gas monitoring (automatic, continuous, or periodic) and the environmental technical standards for exhaust gas or regulations of the local government on pollutant concentration in exhaust gas (if any).