Which form is used for value-added tax invoices in foreign currency for special enterprises in Vietnam according to Circular 78?

Which form is used for value-added tax invoices in foreign currency for special enterprises in Vietnam according to Circular 78?

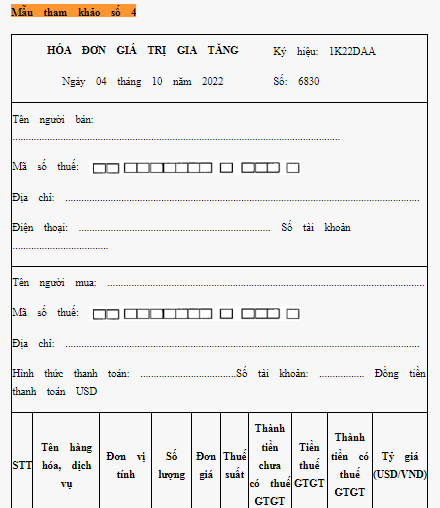

Based on Appendix 2 of electronic invoice/receipt forms displayed for reference issued together with Circular 78/2021/TT-BTC, the form in question is reference number 4 as follows:

>>> Download the value-added tax invoice form for enterprises collecting foreign currency.

Which form is used for value-added tax invoices in foreign currency for special enterprises in Vietnam according to Circular 78? (Image from Internet)

What is the code 1C22TAA of the value-added tax invoice in Vietnam?

According to Clause 1, Article 4 of Circular 78/2021/TT-BTC, the regulations are as follows:

Model number, invoice symbol, carbon copy name

1. Electronic invoices

a) The model number symbol of the electronic invoice is a character consisting of a single natural digit, which are natural numbers 1, 2, 3, 4, 5, 6 to reflect the type of electronic invoice as follows:

- Number 1: Reflects the type of value-added electronic invoice;

- Number 2: Reflects the type of sales electronic invoice;

- Number 3: Reflects the type of electronic invoice for selling public assets;

- Number 4: Reflects the type of electronic invoice for selling national reserve goods;

- Number 5: Reflects other types of electronic invoices including electronic stamps, electronic tickets, electronic cards, electronic receipts, or other electronic documents with the content of an electronic invoice according to Decree No. 123/2020/ND-CP;

- Number 6: Reflects electronic documents used and managed like invoices including electronic internal transportation vouchers, electronic consignment vouchers for agents.

b) The electronic invoice symbol is a group of 6 characters consisting of both letters and numbers representing the electronic invoice symbol to reflect the information on the type of electronic invoice with tax authority code or without tax authority code, year of invoice creation, type of electronic invoice used. These six (06) characters are specified as follows:

- The first character is a letter (C or K), where C represents an electronic invoice with a tax authority code, K represents an electronic invoice without a code;

- The following two characters are two Arabic numerals denoting the year of electronic invoice creation, identified by the last 2 digits of the calendar year. For example, for the year 2022, it is represented as number 22; for the year 2023, it is number 23;

- The next character is a letter defined as T, D, L, M, N, B, G, H representing the type of electronic invoice used, specifically:

+ Letter T: Applied for electronic invoices used by enterprises, organizations, households, individuals registered with the tax authority;

+ Letter D: Applied for invoices for selling public assets, national reserve sales invoices, or special electronic invoices not necessarily having some criteria registered by enterprises, organizations;

+ Letter L: Applied for electronic invoices issued by tax authorities on a per-case basis;

+ Letter M: Applied for electronic invoices generated from cash registers;

+ Letter N: Applied for electronic internal transportation vouchers;

+ Letter B: Applied for electronic consignment vouchers for agents;

+ Letter G: Applied for electronic stamps, tickets, cards that are value-added invoices;

+ Letter H: Applied for electronic stamps, tickets, cards that are sales invoices.

- The last two characters are letters determined by the seller based on their management needs. If the seller uses multiple electronic invoice forms within the same type, these characters distinguish different invoice forms within the same type. If there is no management need, they are YY;

- In the presentation form, both the electronic invoice symbol and model number are shown at the top right of the invoice (or in an easily recognizable position);

- Examples of the electronic invoice model number and symbol characters:

+ “1C22TAA” – is a value-added invoice with a tax authority code created in 2022, an electronic invoice used by enterprises, organizations registered with the tax authority;

+ “2C22TBB” – is a sales invoice with a tax authority code created in 2022, an electronic invoice used by business entities registered with the tax authority;

+ “1C23LBB” – is a value-added invoice with a tax authority code created in 2023, an electronic invoice issued by tax authorities on a per-case basis;

+ “1K23TYY” – is a type of value-added invoice without a code created in 2023, an electronic invoice registered by enterprises, organizations with the tax authority;

+ “1K22DAA” – is a type of value-added invoice without a code created in 2022, a special electronic invoice not necessarily having some mandatory criteria registered by enterprises, organizations;

+ “6K22NAB” – is a type of internal transportation voucher without a code created in 2022, a voucher registered with the tax authority;

+ “6K22BAB” – is a type of agent consignment voucher without a code created in 2022, a voucher registered with the tax authority.

c) Name, address, and tax code of the authorized recipient for authorized electronic invoices.

...

Therefore, according to the above regulation, the code 1C22TAA of the value-added tax invoice is a value-added tax invoice with a tax authority code created in 2022 and is an electronic invoice used by enterprises, organizations registered with the tax authority.

When is the deadline for submitting value-added tax for months and quarters in 2024 in Vietnam?

According to Clause 1, Article 4 of Decree 64/2024/ND-CP on the extension of the deadline for submitting value-added tax (excluding import stage value-added tax) for enterprises and organizations as follows:

- The extension applies to the value-added tax amount arising in tax periods from May to September 2024 (for monthly value-added tax declarations) and tax periods of the second quarter of 2024, third quarter of 2024 (for quarterly value-added tax declarations) for enterprises and organizations specified in Article 3 of this Decree.

The extension period is 05 months for value-added tax in May 2024, June 2024, and the second quarter of 2024; the extension period is 04 months for the tax in July 2024; 03 months for the tax in August 2024; and 02 months for the tax in September 2024 and the third quarter of 2024.

The extension period is calculated from the deadline for submitting value-added tax as prescribed by law on tax administration.

Enterprises and organizations eligible for the extension must declare, and submit monthly and quarterly value-added tax declarations in accordance with current laws, but they do not have to pay the value-added tax arising on these declarations.

The deadlines for extended value-added tax submissions are as follows:

The deadline for submitting value-added tax for the tax period of May 2024 is no later than November 20, 2024.

The deadline for submitting value-added tax for the tax period of June 2024 is no later than December 20, 2024.

The deadline for submitting value-added tax for the tax period of July 2024 is no later than December 20, 2024.

The deadline for submitting value-added tax for the tax period of August 2024 is no later than December 20, 2024.

The deadline for submitting value-added tax for the tax period of September 2024 is no later than December 20, 2024.

The deadline for submitting value-added tax for the tax period of the second quarter of 2024 is no later than December 31, 2024.

The deadline for submitting value-added tax for the tax period of the third quarter of 2024 is no later than December 31, 2024.

*Note: Decree 64/2024/ND-CP is effective until December 31, 2024.