Which form is used for the supplementary tax declaration in Vietnam?

Which form is used for the supplementary tax declaration in Vietnam? Where can the supplementary tax declaration form be downloaded?

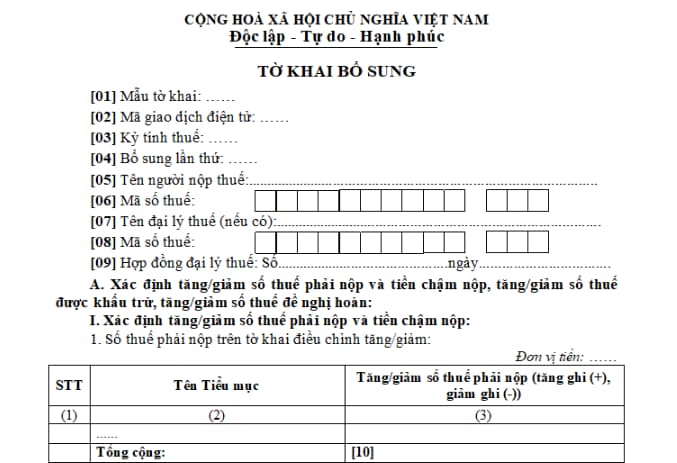

The latest form for the supplementary tax declaration is Form No. 01/KHBS in Appendix 2 issued with Circular 80/2021/TT-BTC:

>> Download the latest supplementary tax declaration form: Download

Which form is used for the supplementary tax declaration in Vietnam? (Image from the Internet)

How long can the tax declaration be supplemented when there are errors in Vietnam?

Based on Article 47 of the Law on Tax Administration 2019, the following is provided:

Supplementary Tax Declaration

1. If the taxpayer discovers errors in the tax declaration submitted to the tax authority, they can submit a supplementary tax declaration within 10 years from the deadline for submitting the tax declaration for the taxable period that contains the errors, but before the tax authority or a competent authority announces the decision on inspection or audit.

2. If the tax authority or a competent authority has announced the decision on tax inspection or audit at the taxpayer's office, the taxpayer can still submit a supplementary tax declaration; the tax authority will impose administrative penalties for tax management violations as stipulated in Articles 142 and 143 of this Law.

3. After the tax authority or a competent authority has issued conclusions and decisions on tax handling following the inspection or audit at the taxpayer's office, the supplementary tax declaration is regulated as follows:

a) The taxpayer can submit a supplementary tax declaration in cases where it increases the payable tax amount, reduces the deductible tax amount, or reduces the exempted, reduced, refundable tax amount and will be administratively penalized for tax management violations as stipulated in Articles 142 and 143 of this Law;

b) In cases where the taxpayer discovers errors in the tax declaration that, if supplemented, would reduce the payable tax amount or increase the deductible tax amount, or increase the exempted, reduced, refundable tax amount, they should follow the regulations on tax complaints.

4. The supplementary tax declaration dossier includes:

a) Supplementary declaration form;

b) Explanation of the supplementary declaration and related documents.

5. For exported and imported goods, the supplementary tax declaration must follow the legal provisions on customs.

The taxpayer can supplement the tax declaration within 10 years from the deadline for submitting the tax declaration for the taxable period that contains the errors, but it needs to be done before the tax authority or a competent authority announces the decision on inspection or audit.

When is the tax payable in case of a supplementary tax declaration in Vietnam?

Based on Article 55 of the Law on Tax Administration 2019, the following is provided:

Tax Payment Deadlines

1. In cases where the taxpayer calculates the tax, the tax payment deadline is the last day of the deadline for submitting the tax declaration. In the case of a supplementary tax declaration, the tax payment deadline is the deadline for submitting the tax declaration of the taxable period that contains the errors.

For corporate income tax, it is temporarily paid quarterly, with the tax payment deadline being the 30th day of the first month of the following quarter.

For crude oil, the tax payment deadline for resource tax and corporate income tax is 35 days from the date of sale for domestically sold crude oil or from the date of customs clearance, as prescribed by customs law, for exported crude oil.

For natural gas, the resource tax and corporate income tax are paid monthly.

2. In cases where the tax authority calculates the tax, the tax payment deadline is the deadline stated on the tax authority's notice.

3. For other state budget revenues from land, water resource exploitation rights, mineral resource exploitation rights, land use fee, and license fee payments, the payment deadlines are regulated by the Government of Vietnam.

4. For exported and imported goods subject to tax according to tax law, the tax payment deadlines follow the Law on Export and Import Taxes. If additional payable tax amounts arise after customs clearance or goods release, the tax payment deadlines are as follows:

...

In the case of a supplementary tax declaration, the tax payment deadline is the deadline for submitting the tax declaration of the taxable period that contains the errors.

In this context, if the taxpayer discovers errors in the tax declaration submitted to the tax authority, they can submit a supplementary tax declaration within 10 years from the deadline for submitting the tax declaration for the taxable period that contains the errors.