Which form is used for personal income tax commitment in Vietnam? What are cases where individuals are exempt from submitting personal income tax commitment in Vietnam?

Which form is used for personal income tax commitment in Vietnam?

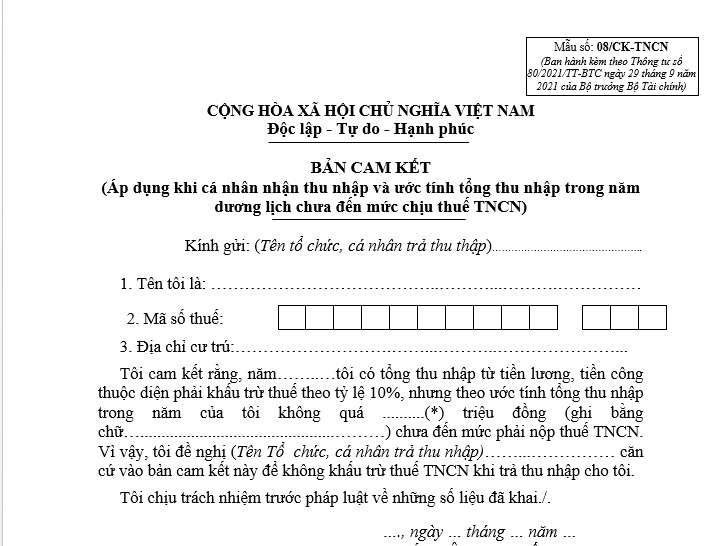

The latest Personal Income Tax Commitment Form is Form 08/CK-TNCN, issued with Appendix 2 of Circular 80/2021/TT-BTC.

The latest Personal Income Tax Commitment Form...Download

Which form is used for personal income tax commitment in Vietnam? (Image from the Internet)

What are cases where individuals are exempt from submitting personal income tax commitment in Vietnam?

According to point i, clause 1, Article 25 of Circular 111/2013/TT-BTC, the regulations are as follows:

Tax Deduction and Tax Deduction Receipts

...

i) Tax Deduction in Some Specific Cases

Organizations and individuals paying wages, remunerations, or other payments to resident individuals without a labor contract (as guided at points c, d, clause 2, Article 2 of this Circular) or with a labor contract of less than three (03) months must deduct tax at a rate of 10% on income before paying to the individual if the total income is from two million (2,000,000) VND per time or more.

In cases where individuals have only one source of income subject to tax deduction at the above rate, but estimate their total taxable income, after family deductions, does not reach the taxable amount, they can make a commitment (using the form issued along with guidance documents on tax management) and send it to the income-paying organization. This serves as a basis for the income-paying organization not to temporarily deduct personal income tax.

Based on the commitment of the income recipient, the income-paying organization does not deduct tax. At the end of the tax year, the organization must still compile and submit a list of individuals not reaching the tax deduction threshold (using the form issued along with guidance documents on tax management) to the tax authority. Individuals making the commitment are responsible for its accuracy, and any discovered fraud will be handled according to tax management laws.

Individuals making commitments under this guidance must have taxpayer registration and a tax identification number at the time of commitment.

...

As such, the subjects eligible to use Form 08/CK-TNCN to temporarily avoid personal income tax deduction must meet all the following conditions:

- Resident individuals with a labor contract of less than 03 months or without a labor contract.

- Individuals with a total income from two million VND per time or more.

- Only have unique income subject to tax deduction. If employed at two or more places, the commitment is not permissible.

- Must be registered and have a tax identification number at the time of writing the commitment.

- Estimate their total taxable income, after family deductions, does not reach the taxable amount (less than 132 million VND for individuals without dependents).

- Individuals with income from two places are not eligible to make the commitment to avoid personal income tax deduction.

When is personal income tax reduction applicable in Vietnam?

Article 5 of the Personal Income Tax Law 2007 stipulates on personal income tax reduction as follows:

Tax Reduction

Taxpayers facing difficulties due to natural disasters, fires, accidents, or severe illnesses affecting their tax payment capability are eligible for a tax reduction corresponding to the extent of damage but not exceeding the payable tax amount.

Therefore, taxpayers are eligible for personal income tax reduction when facing difficulties due to natural disasters, fires, accidents, or severe illness affecting their tax payment capability.

Note: The tax reduction amount corresponds to the extent of the damage but does not exceed the payable tax amount.

Additionally, according to Article 4 of Circular 111/2013/TT-BTC, the personal income tax reduction assessment is conducted per tax year.

- The tax amount used as a basis for tax reduction assessment is the total personal income tax that the taxpayer has to pay during the tax year, including:

+ Personal income tax already paid or deducted for income from capital investment, capital transfer, real estate transfer, winning income, royalty income, franchising income, inheritance income, and gift income.

+ Personal income tax payable for business income and income from wages and salaries.

- The degree of damage eligible for tax reduction = Total actual cost for damage recovery - Compensation received from an insurance organization (if any) or from the party causing the accident (if any).

- The reduced tax amount is determined as follows:

+ If the tax amount payable during the tax year exceeds the degree of damage, the tax reduction equals the degree of damage.

+ If the tax amount payable during the tax year is less than the degree of damage, the tax reduction equals the payable tax amount.

What are regulations on personal income tax period in Vietnam?

According to Article 7 of the Personal Income Tax Law 2007 (amended by clause 3, Article 1 of the Amended Personal Income Tax Law 2012), the personal income tax period is stipulated as follows:

(1) For Resident Individuals:

- The tax period on an annual basis applies to income from business activities; income from wages and salaries.

- The tax period per occurrence of income applies to income including:

+ Income from capital investment.

+ Income from capital transfer, except from securities transfer.

+ Income from real estate transfer.

+ Income from winnings.

+ Income from royalties.

+ Income from franchising.

+ Income from inheritance; income from gifts.

- The tax period either per transfer occurrence or annually for income from securities transfer.

(2) For Non-Resident Individuals:

Income is calculated per occurrence for all taxable income.