Which form is used for declaring information on related parties and related-party transactions in corporate income tax calcualtion in Vietnam?

Which form is used for declaring information on related parties and related-party transactions in corporate income tax calcualtion in Vietnam?

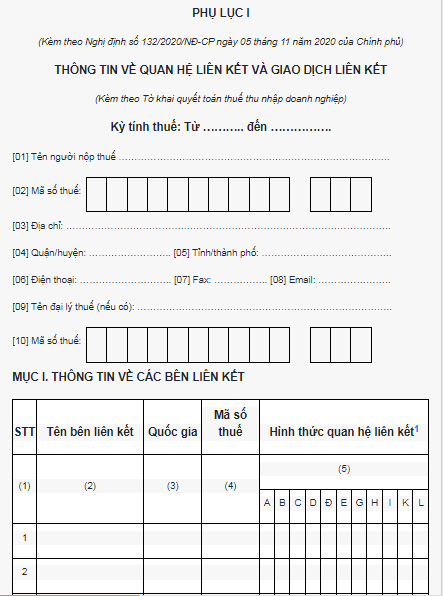

According to Appendix I issued together with Decree 132/2020/ND-CP, in corporate income tax, the form for providing information on related parties and related-party transactions is as follows:

Download the latest form for providing information on related parties and related-party transactions.

Which form is used for declaring information on related parties and related-party transactions in corporate income tax calcualtion in Vietnam? (Image from the Internet)

What are instructions on how to fill out the form for providing information on related parties and related-party transactions in Vietnam?

According to Appendix I issued together with Decree 132/2020/ND-CP, the instructions on how to fill out the form for providing information on related parties and related-party transactions are as follows:

INSTRUCTIONS FOR DECLARING CERTAIN INDICATORS

A. Tax period: Record information corresponding to the tax period of the corporate income tax finalization declaration. The tax period is determined according to the provisions of the Corporate Income Tax Law.

B. General information of the taxpayer: From item [01] to item [10], record information corresponding to the information already recorded in the corporate income tax finalization declaration.

C. Section I. Information on affiliated parties:

- Column (2): Fully record the names of each affiliated party:

+ If the affiliated party in Vietnam is an organization, record according to the information on the business registration certificate; if an individual, record according to the information on the identity card, citizen identification card, or passport.

+ If the affiliated party is an organization or individual outside Vietnam, record according to the information on the document identifying the associated relationship such as the business registration certificate, contract, or transaction agreement with the taxpayer.

- Column (3): Record the name of the country, territory where the affiliated party is a resident.

- Column (4): Record the tax codes of the affiliated parties:

+ If the affiliated party is an organization or individual in Vietnam, record the full tax code.

+ If the affiliated party is an organization or individual outside Vietnam, record the full tax code, taxpayer identification number, if unavailable, clear reasons must be stated.

- Column (5): Based on the provisions at Clause 2, Article 5 of Decree No. …../2020/ND-CP, the taxpayer with related-party transactions declares the form of the associated relationship corresponding to each affiliated party by marking “x” in the appropriate box. In cases where the affiliated party falls into more than one form of associated relationship, the taxpayer marks “x” in the corresponding boxes.

D. Section II. Cases of exemption from declaration and exemption from documentation for determining associated transaction pricing:

If the taxpayer falls into a case of exemption from declaration and exemption from preparing documentation for determining associated transaction pricing as stipulated in Article 19 of Decree No. …../2020/ND-CP, mark “x” in the box corresponding to the exemption in Column (3).

If the taxpayer is exempt from declaration and documentation for determining associated transaction pricing under Clause 1, Article 19 of Decree No. …../2020/ND-CP, the taxpayer only needs to mark the appropriate box in Column (3) and is not required to declare in Sections III and IV of Appendix I attached to Decree No. …../2020/ND-CP.

If the taxpayer is exempt from preparing documentation for determining associated transaction pricing under point a or point c, Clause 2, Article 19 of Decree No. …../2020/ND-CP, the taxpayer declares Sections III and IV according to corresponding instructions in parts Đ.1 and E.

If the taxpayer is exempt from preparing documentation for determining associated transaction pricing under point b, Clause 2, Article 19 of Decree No. …../2020/ND-CP, the taxpayer declares according to corresponding instructions in parts Đ.2 and E.

Đ. Section III. Information on determining associated transaction pricing:

Đ.1. If the taxpayer is exempt from preparing documentation for determining associated transaction pricing under point a or point c, Clause 2, Article 19 of Decree No. …../2020/ND-CP and has marked (x) in column 3 at row a or row c of the exemption indicator for preparing documentation in Section II of Appendix I attached to Decree No. …../2020/ND-CP, declare this section as follows:

- Columns (3), (7), and (12): Declare according to instructions in part Đ.2 of this Appendix.

- Columns (4), (5), (6), (8), (9), (10), and (11): Leave blank, no declaration required.

For cases where the taxpayer is exempt from preparing documentation for determining associated transaction pricing under point a, Clause 2, Article 19 of Decree No. …../2020/ND-CP, the total value of all related-party transactions incurred in the tax period is the basis for determining the exemption condition, calculated as (=) the total value at Column (3) plus (+) Column (7) of the indicator “Total transaction value arising from associated activities”.

Đ.2. Taxpayers not exempted from preparing documentation under point a or point c, Clause 2, Article 19 of Decree No. …../2020/ND-CP declare as follows:

- Indicator “Total transaction value arising from business activities”:

+ Column (3): Record the total revenue value from sales to affiliated and independent parties, including: sales and service provision revenue, financial operation revenue, and other income (excluding collection on behalf).

+ Column (7): Record the total cost value incurred from affiliated and independent parties, including: cost of goods and services purchased, financial costs, sales expenses, administrative expenses of the enterprise, and other expenses (excluding expenditure on behalf).

+ Columns (4), (5), (6), (8), (9), (10), (11), (12), and (13): Leave blank, no declaration required.

- Indicator “Total transaction value arising from associated activities”:

+ Columns (3), (4), (7), and (8): Record the total value in the corresponding boxes for each of the indicators Goods plus (+) Services.

- Indicator “Goods”:

+ Columns (3), (4), (7), and (8): Record the total value in the corresponding boxes for the indicators Goods forming fixed assets plus (+) Goods not forming fixed assets.

- Indicator “Goods forming fixed assets” and detailed lines “Affiliated party A”, “Affiliated party B”,...:

+ Columns (3) and (7): Record the total value arising from the purchase or sale of fixed assets of the taxpayer with affiliated parties according to the value on the accounting books.

+ Columns (4) and (8): Record the total value arising from the purchase or sale of fixed assets with affiliated parties determined according to the method for determining the associated transaction price corresponding in Column (6) and (10).

...

Download to see details on Instructions on how to fill out the form for providing information on related parties and related-party transactions.

What are related-party transactions in Vietnam under the Decree 132?

Based on Article 1 of Decree 132/2020/ND-CP as follows:

Scope of regulation

1. This Decree stipulates the principles, methods, and procedures for determining the elements forming associated transaction prices; the rights and obligations of taxpayers in determining associated transaction prices, declaration procedures; the responsibilities of state agencies in tax administration for taxpayers with related-party transactions.

2. The related-party transactions under the regulation of this Decree include related-party transactions of buying, selling, exchanging, leasing, lending, transferring, assigning goods, providing services; borrowing, lending, financial services, financial guarantees, and other financial instruments; buying, selling, exchanging, leasing, lending, transferring, assigning tangible and intangible assets, and agreements for buying, selling, and sharing the use of resources such as assets, capital, labor, and cost-sharing between parties with related parties, except for business related-party transactions involving goods and services that are under state-regulated pricing implemented according to the provisions of the law on prices.

Thus, the related-party transactions regulated by Decree 132 include:

- related-party transactions of buying, selling, exchanging, leasing, lending, transferring, assigning goods, providing services; borrowing, lending, financial services, financial guarantees, and other financial instruments;

- Buying, selling, exchanging, leasing, lending, transferring, assigning tangible assets, intangible assets, and agreements for buying, selling, and sharing the use of resources such as assets, capital, labor, cost-sharing between parties with related parties, except for business related-party transactions involving goods and services under state-regulated pricing implemented according to the provisions of the law on prices.