Which form is the personal income tax statement in Vietnam?

What is tax statement in Vietnam?

According to Clause 10, Article 3 of the Law on Tax Administration 2019, tax statement is the determination of the tax amount to be paid for the tax year or the period from the beginning of the tax year until the termination of activities giving rise to tax obligations or the period from the time of incurrence to the termination of activities giving rise to tax obligations in accordance with the law.

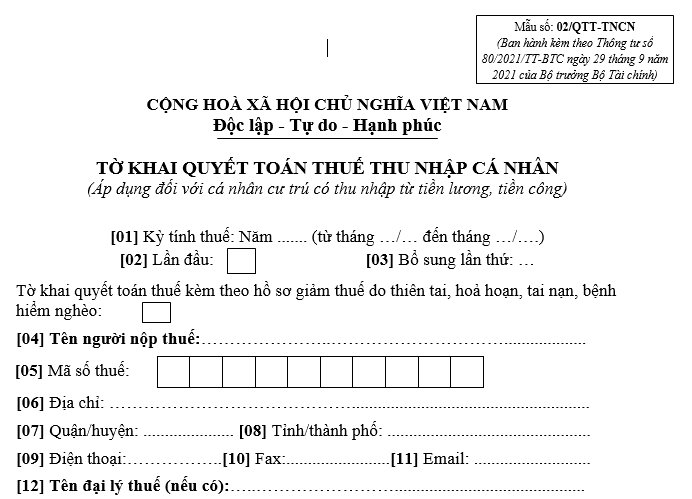

Which form is the personal income tax statement in Vietnam? (Image from the Internet)

Which form is the personal income tax statement in Vietnam?

The form of the personal income tax statement applicable to individuals with income from wages and salaries is form 02/QTT-TNCN issued together with Circular 80/2021/TT-BTC, specifically:

>> Download Download the personal income tax statement form applicable to individuals with income from wages and salaries

How to fill out the personal income tax statement form applicable to individuals with income from wages and salaries is as follows:

[01] Income from wages and salaries for resident individuals applying for personal income tax calculation by year.

[02] The taxpayer checks this box if it is the first time declaring personal income tax finalization in the tax period (without additional declarations).

[03] The taxpayer checks this box if eligible for tax reduction due to natural disasters, fires, accidents, or serious illnesses affecting tax payment ability.

[04] Fill in the full name of the taxpayer.

[05] Fill in the taxpayer identification number issued by the tax authority.

[06] Fill in the address of the taxpayer (house number, street name, village, commune, ward), do not fill in the district and city/province names (as these will be filled in sections [07] and [08]).

[07] Fill in the full name of the tax agent in case the taxpayer has signed a contract with a tax agent to carry out tax procedures on their behalf.

[08] Fill in the tax identification number of the tax agent (if any).

[09] Fill in the full name of the organization paying the personal income subject to tax.

[10] Fill in the tax identification number of the organization paying the personal income subject to tax.

[11] In this column, the taxpayer specifically fills in the amount of money or the number of people according to the instructions in the Criteria column.

When is the time to determine taxable income from wages and salaries of employees in Vietnam?

According to Clause 2, Article 11 of Decree 65/2013/ND-CP, amended by Clause 8, Article 2 of Decree 12/2015/ND-CP stipulates as follows:

Tax on income from wages and salaries

1. Taxable income from wages and salaries is determined as specified in Clause 2, Article 3 of this Decree.

2. The time to determine taxable income from wages and salaries is the time the employer pays wages and salaries to the taxpayer or the time the taxpayer receives the income.

In case the employer purchases life insurance (except for voluntary pension insurance), other non-mandatory insurance with cumulative premiums from insurers established and operating in compliance with Vietnamese law for employees, the employee does not have to calculate into taxable income at the time of insurance purchase. At the contract maturity, the insurer is responsible for withholding 10% tax on the cumulative premiums corresponding to the portion purchased by the employer for the employee from July 1, 2013.

In case the employer purchases life insurance (except for voluntary pension insurance), other non-mandatory insurance with cumulative premiums from insurers not established and not operating under Vietnamese law but allowed to sell insurance in Vietnam, the employer is responsible for withholding 10% tax on the insurance premiums paid or contributed before paying income to the employee.

3. Taxable income from wages and salaries is determined by subtracting (-) the following deductions from taxable income:

a) Compulsory social insurance contributions, health insurance, unemployment insurance, professional liability insurance for certain professions, voluntary pension fund contributions, and purchases of voluntary pension insurance.

The maximum amount contributed to voluntary pension funds, or purchases of voluntary pension insurance deducted from income when determining taxable income as prescribed in this Clause is not more than 1 million VND/month, including the contribution from the employer and what the employee themselves contribute (if any).

...

The time to determine taxable income from wages and salaries of employees is the time the employer pays wages and salaries to the taxpayer or the time the taxpayer receives the income.