Which form is the current form of the distribution of value-added tax payable in Vietnam?

Which form is the current form of the distribution of value-added tax payable in Vietnam?

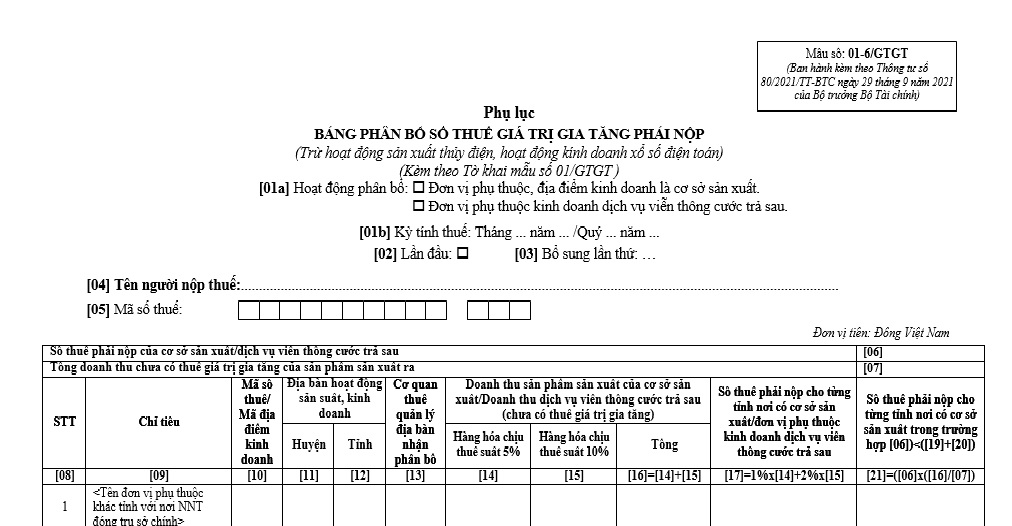

The current form of the distribution of value-added tax payable, excluding hydropower production and the lottery business, is Appendix 01-6 GTGT as stipulated in Appendix 2 issued together with Circular 80/2021/TT-BTC.

Appendix 01-6 GTGT according to Circular 80/2021/TT-BTC - The distribution of value-added tax payable is as follows:

The current form of the distribution of value-added tax payable... Download

Which form is the current form of the distribution of value-added tax payable in Vietnam? (Image from the Internet)

What are the cases where value-added tax is distributed in Vietnam?

According to Clause 1, Article 13 of Circular 80/2021/TT-BTC, the cases in which VAT is distributed include:

- Business activities in electronic lottery;

- Real estate transfer activities, except as regulated at point b, clause 1, Article 11 of Decree 126/2020/ND-CP;

- Construction activities as regulated by law on the national economic sector system and specialized legal provisions;

- Dependent units, business locations as production facilities (including processing and assembly facilities), except as regulated at point c, clause 1 of Article 11, Decree 126/2020/ND-CP;

- Hydropower plants located in multiple provinces.

What are methods of value-added tax distribution in Vietnam?

Based on Clause 2, Article 13 of Circular 80/2021/TT-BTC, the methods value-added tax distribution are as follows:

(1) Distribution of VAT payable for electronic lottery business activities

The VAT payable for each province where there is electronic lottery business activity equals (=) the VAT payable for the electronic lottery business activity multiplied (x) by the percentage (%) of actual ticket sales revenue from the electronic lottery business activity in each province over the total actual ticket sales revenue of the taxpayer.

Actual ticket sales revenue from electronic lottery business activity is determined as follows:

In the case of distributing electronic lottery tickets via terminal devices: Revenue from the electronic lottery business activity arises from terminal devices registered to sell electronic lottery tickets within the administrative boundaries of each province according to the lottery agency contract signed with the electronic lottery company or the stores, sales points established by the taxpayer in the area.

In the case of distributing electronic lottery tickets via telephone and internet: Revenue is determined in each province where customers register to participate in the lottery when opening a lottery account according to the law on electronic lottery business.

(2) Distribution of VAT payable for real estate transfer activities:

The VAT payable for each province from real estate transfer activities equals (=) revenue excluding value-added tax from real estate transfer activities in each province multiplied (x) by 1%.

(3) Distribution of VAT payable for construction activities:

The VAT payable for each province from construction activities equals (=) revenue excluding value-added tax from construction activities in each province multiplied (x) by 1%.

Revenue excluding value-added tax is determined according to contracts for construction works and construction items. In case construction works or items relate to multiple provinces and the revenue of the project in each province cannot be determined, after determining the 1% rate on the revenue of the construction project or item, taxpayers shall use the percentage (%) of investment value of the project in each province over the total investment value to determine the VAT payable for each province.

(4) Distribution of VAT payable to the province where the dependent unit, business location is a production facility:

- The VAT payable to the province where the production facility is located equals (=) revenue at pre-VAT prices multiplied (x) by 2% (for goods subject to 10% VAT rate) or 1% (for goods subject to 5% VAT rate), provided the total VAT payable to the provinces where the production facilities are located does not exceed the VAT payable by the taxpayer at the main headquarters. If the production facility transfers finished products or semi-finished products to other units in the system for sale, the revenue of the produced products is determined on the basis of the production cost of the product.

- If the taxpayer calculates to declare and pay according to the % rate prescribed at point d.1, clause of this section and the total VAT payable to the provinces with production facilities exceeds the total VAT payable by the taxpayer at the headquarters, the taxpayer distributes the VAT payable to the provinces with production facilities according to the formula: VAT payable to each province with a production facility equals (=) the VAT payable by the taxpayer at the headquarters multiplied (x) by the percentage (%) of revenue at pre-VAT prices of products produced in each province over the total revenue at pre-VAT prices of products produced by the taxpayer.

- The revenue used to determine the distribution rate according to points d.1 and d.2 of this section is the actual revenue arising in the tax period. If amendments are made that change the actual revenue, the taxpayer must determine and redistribute the tax payable for each tax period with errors that have been amended to identify the undistributed or overdistributed VAT difference for each locality.

(5) Distribution of VAT payable for each province where a hydropower plant is located across multiple provinces:

The VAT payable in each province where the hydropower plant is located within the administrative boundary equals (=) the VAT payable from the hydropower plant multiplied (x) by the percentage (%) of the investment value of the part of the hydropower plant located within the administrative boundary of each province over the total investment value of the hydropower plant.