Which entities use the VAT declaration form - Form 02/GTGT in Vietnam?

Which entities use the VAT declaration form - Form 02/GTGT in Vietnam?

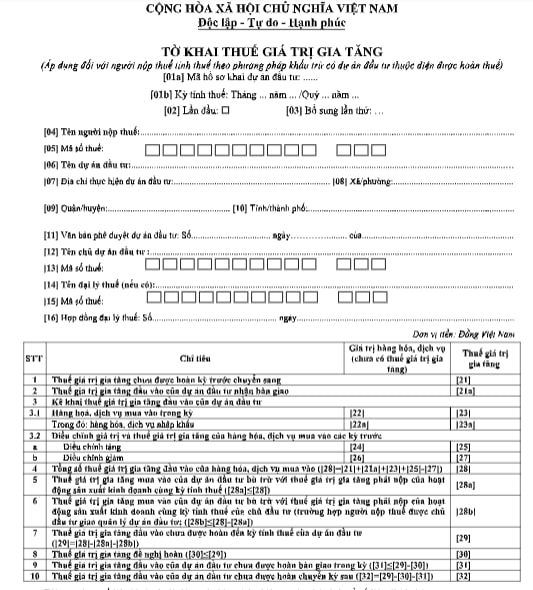

Under Form 02/GTGT specified in Appendix 2 issued together with Circular 80/2021/TT-BTC, Form 02/GTGT applies to taxpayers who declare value-added tax under the deduction method and have investment projects subject to tax refund. The Form 02/GTGT is specified as follows:

Download the VAT declaration form - Form 02/GTGT: Here

Which entities use the VAT declaration form - Form 02/GTGT in Vietnam? (Image from the Internet)

What is the place to pay VAT in Vietnam?

Under the regulations of Article 56 of Law on Tax Administration 2019 regarding the place to pay VAT:

Receiving authorities

1. Taxpayers shall pay tax:

a) at State Treasuries;

b) At the tax authorities that receive the tax declaration dossiers;

c) via a organization authorized by the tax authority to collect tax; or

d) via a commercial bank or credit institution or service provider as prescribed by law.

2. State Treasuries, commercial banks, credit institutions and service providers shall prepare their premises, equipment and personnel to collect tax.

3. Every organization that collects or deduct tax shall provide tax payment documents to taxpayers.

4. Within 08 working hours from the tax collection, the collecting organization shall transfer the collected tax to state budget. The Minister of Finance shall specify the time limit for transfer of tax collected in cash in remote and isolated areas, islands, areas where travel is difficult or collection time is limited.

Simultaneously, according to the guidance in Article 20 Circular 219/2013/TT-BTC:

Places to pay tax

1. Taxpayer shall declare and pay VAT in the locality where the business is situated.

2. If the taxpayer that pays VAT using credit-invoice method has a financially dependent manufacturing facility in a province other than the province where the headquarter is situated, VAT shall be paid in both provinces.

...

5. VAT shall be declared and paid in accordance with the Law on Tax administration and its guiding documents.

Thus, the taxpayer shall declare and pay VAT in the locality where the business is situated:

- at State Treasuries;

- At the tax authorities that receive the tax declaration dossiers;

- via an organization authorized by the tax authority to collect tax; or

- via a commercial bank or credit institution or service provider as prescribed by law.

The appropriate place to pay value-added tax shall be determined based on actual operational situations as per the above regulations.

What are the rules for tax declaration in Vietnam?

According to the provisions of Article 42 of Law on Tax Administration 2019 on tax declaration and tax calculation rules:

- Taxpayers shall fully and accurately provide information on the tax return provided by the Minister of Finance and submit adequate documents to the tax authority.

- Taxpayers shall calculate the tax payable themselves, except for the cases in which tax has to be calculated by the tax authority as specified by the Government.

-Taxpayers shall declare tax at the local tax authority in charge of the area in which their headquarters are based. A taxpayer that does accounting mainly at the headquarters and has dependant units in other provinces shall declare tax in the province in which the headquarters are based and distribute tax incurred in each province. The Minister of Finance shall elaborate this Clause.

- Regarding electronic commerce, digital business and other services provided by overseas providers without permanent establishments in Vietnam, the overseas providers shall directly or authorize representatives to apply for taxpayer registration, declare and pay tax in Vietnam in accordance with regulations of the Minister of Finance.

- Rules for declaring and calculating taxable prices in related-party transactions:

+ Values of related-party transactions shall be determined and declared by analyzing and comparing with independent transactions, the nature of operation and nature of the transaction, in order to determine tax liability in the same manner as that of transactions between independent parties;

+ Values of related-party transactions shall be adjusted according to independent transactions to declare tax in order that in taxable income is not decreased;

+ Taxpayers whose businesses are small in scale and pose low tax risk are exempt from compliance to provisions of Point a and Point b Clause 5 Article 42 of Law on Tax Administration 2019 and may apply simplified related-party transaction declaration procedures.

- Rules for declaring tax with predetermined taxable price calculation method:

+ Predetermined taxable price calculation methods shall be applied on the basis of request of the taxpayers, consensus between the tax authorities and the taxpayer under unilateral, bilateral and multilateral agreements between tax authorities, taxpayers and tax authorities of relevant countries or territories;

+ Predetermined taxable price calculation methods shall be applied according to information provided by the taxpayers and legally verified commercial database;

+ Application of predetermined taxable price calculation methods is subject to approval by the Minister of Finance. Regulations of law on international treaties and international agreements shall apply to bilateral and multilateral agreements participated in by foreign tax authorities.