Which entities use the non-agricultural land use tax declaration form - Form 01/TK-SDDPNN in Vietnam?

What does the non-agricultural land use tax declaration dossier in Vietnam include?

According to Article 15 of Circular 153/2011/TT-BTC, the non-agricultural land use tax declaration dossier includes the following documents:

(1) For annual non-agricultural land use tax declaration, the dossier comprises:

- Non-agricultural land use tax declaration form for each taxable parcel according to Form 01/TK-SDDPNN applicable to households and individuals or Form 02/TK-SDDPNN applicable to organizations, issued together with Circular 153/2011/TT-BTC;

- Copies of documents related to the taxable parcel such as Certificate of land use rights, land allocation decision, land lease decision or land lease contract, Decision permitting change of land use purpose;

- Copies of documents proving eligibility for tax exemption or reduction (if any).

(2) For consolidated non-agricultural land use tax declaration, the dossier comprises:

- Consolidated non-agricultural land use tax declaration form 03/TKTH-SDDPNN issued together with Circular 153/2011/TT-BTC.

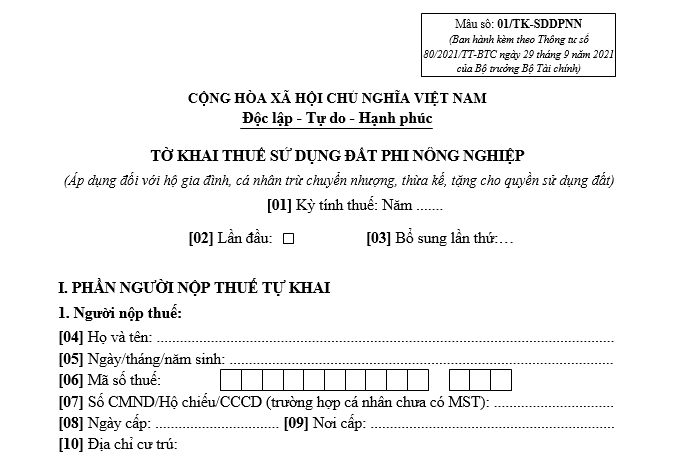

Which entities use the non-agricultural land use tax declaration form - Form 01/TK-SDDPNN in Vietnam? (Image from the Internet)

Which entities use the non-agricultural land use tax declaration form - Form 01/TK-SDDPNN in Vietnam?

The non-agricultural land use tax declaration form applicable to households and individuals except for land use right transfers, inheritances, or donations is form 01/TK-SDDPNN issued along with Circular 80/2021/TT-BTC:

Download the non-agricultural land use tax declaration form - Form 01/TK-SDDPNN: Here

What are the principles for non-agricultural land use tax declaration in Vietnam?

According to Clause 1, Article 16 of Circular 153/2011/TT-BTC, the declaration of non-agricultural land use tax must adhere to the following principles:

- The taxpayer is responsible for accurately filling out the tax declaration form with information related to the taxpayer, such as: name, ID card/Citizenship card number, tax code, address for tax notice; Information related to the taxable parcel, such as area, usage purpose. If the land has been issued with a Certificate, all details on the Certificate must be filled out, including number, issuance date, map sheet number, land area, and limit (if any).

For household-specific land tax declaration dossiers, the commune-level People's Committee identifies the criteria in the verification part of the functional agency on the form and forwards it to the Tax Sub-department as the basis for tax calculation.

For organizational tax declaration dossiers, if clarification is needed on certain criteria as a basis for tax calculation, the Tax and Environment Agency must confirm and send it to the Tax Agency.

- Annually, taxpayers do not need to re-declare if there is no change in the taxpayer or factors leading to a change in the payable tax amount.

In cases where changes arise affecting the taxpayer, the new taxpayer must declare and submit the tax declaration dossier as prescribed in Circular 153/2011/TT-BTC within 30 (thirty) days from the date of such changes;

In cases where factors arise leading to changes in the payable tax amount (except for changes in the taxable land price per square meter), the taxpayer must declare and submit the tax declaration dossier within 30 (thirty) days from the date of such changes.

- Consolidated non-agricultural land use tax declaration applies only to household land.

Taxpayers required to declare consolidated taxes per this Circular must prepare and submit the consolidated declaration at the Tax Sub-department where the taxpayer has selected and registered.

What are the instructions for paying the non-agricultural land use tax in Vietnam?

According to Article 17 Circular 153/2011/TT-BTC regulating the payment of non-agricultural land use tax:

(1) For households and individuals

- Tax authorities shall base themselves on taxpayers' declarations containing certifications of competent state authorities to calculate and make tax payment notices according to form No. 01/TB-SDDPNN attached to Circular 153/2011/TT-BTC (not printed herein).

Tax authorities shall send tax payment notices to taxpayers no later than September 30 every year.

Within 10 (ten) working days after receiving tax authorities' tax payment notices, taxpayers may give feedbacks on (modifications or additions) information indicated in such notices to lax officers receiving their tax declaration dossiers. Within 10 working days after receiving taxpayers' feedbacks, tax authorities shall give replies. In case taxpayers make no feedbacks, the tax amounts indicated in the notices are the payable tax amounts.

Taxpayers shall fully pay taxes into the state budget within the time limit prescribed in Clause 3 of Article 17 Circular 153/2011/TT-BTC.

- For cases subject to general declaration:

Based on general declarations, taxpayers shall immediately pay the positive difference into the state budget. Any overpaid tax amounts shall be handled according to the Law on Tax Administration and its guiding documents.

(2) For organizations

Taxpayers shall calculate and pay non-agricultural land use tax within the time limit prescribed in Article 3 of this Article.

(3) Tax payment deadlines

- The deadline for annual tax payment is December 31.

Taxpayers may select to pay tax once or twice a year and shall fulfill tax obligations by December 31 every year.

The deadline for payment of the difference as determined by taxpayers in the general declarations is March 31 of the subsequent year.

- During a 5-year stabilization period, if the taxpayer wishes to make a single tax payment for several years, the tax payment deadline is December 31 of the year of application.

- Upon occurrence of events that lead to a change in taxpayers, land use rights transferors shall pay tax into the state budget of the locality where exists the taxable land plot before carrying out other legal procedures. In case of inheritance, heirs shall pay tax into the state budget if tax has not been paid.