Which entities use the 10-digit tax identification numbers in Vietnam?

Who uses 10-digit tax identification numbers?

First of all, the tax identification number structure must comply with Clause 1 Article 5 of Circular 105/2020/TT-BTC where the structure of the tax identification number is stipulated as follows:

| N1N2N3N4N5N6N7N8N9N10 - N11N12N13 |

Additionally, the classification structure of the tax identification number as regulated in Clause 3 Article 5 of Circular 105/2020/TT-BTC is as follows:

- The 10-digit tax identification number is used for enterprises, cooperatives, organizations with legal status or organizations without legal status but directly incurring tax obligations; household representatives, business households, and other individuals (hereinafter referred to as independent units).

- The 13-digit tax identification number with a hyphen (-) used to separate the first 10 numbers and the last 3 numbers is used for dependent units and other entities.

- Taxpayers are economic organizations, and other organizations specified at Points a, b, c, d, n Clause 2 Article 4 of Circular 105/2020/TT-BTC with full legal status or without legal status but directly incurring tax obligations and taking responsibility for all tax liabilities before the law are granted a 10-digit tax identification number;

Dependent units established in accordance with the law of the above-mentioned taxpayers, if they incur tax obligations and directly declare tax, and pay tax, are granted a 13-digit tax identification number.

- Foreign contractors, subcontractors as specified at Point đ Clause 2 Article 4 of Circular 105/2020/TT-BTC who register to pay contractor tax directly with the tax authorities will be issued a 10-digit tax identification number for each contract.

In cases where foreign contractors partner with Vietnamese economic organizations to conduct business in Vietnam based on a contractor agreement and the parties to the partnership establish a Joint Operation Unit, the Joint Operation Unit carrying out accounting independently, having a bank account, and being responsible for issuing invoices;

Or the participating Vietnamese economic organization in the partnership is responsible for joint accounting and profit-sharing among the participants in the partnership, will be issued a 10-digit tax identification number to declare and pay tax for the contractor agreement.

In cases where foreign contractors, subcontractors have an office in Vietnam and have been declared for withholding and paying contractor tax by the Vietnamese side, they will be issued a 10-digit tax identification number to declare all other tax obligations (excluding contractor tax) in Vietnam and provide the tax identification number to the Vietnamese side.

- Foreign suppliers specified at Point e Clause 2 Article 4 of Circular 105/2020/TT-BTC who do not yet have a tax identification number in Vietnam when registering directly with the tax authorities will be issued a 10-digit tax identification number.

Foreign suppliers will use the issued tax identification number to declare and pay taxes directly or provide the tax identification number to organizations or individuals in Vietnam authorized by the foreign supplier, or provide it to commercial banks, or intermediary payment service providers to perform withholding and paying obligations and declare in the Schedule of Tax Withholding of Foreign Suppliers in Vietnam.

- Organizations and individuals responsible for withholding and paying in accordance with Point g Clause 2 Article 4 of Circular 105/2020/TT-BTC will be issued a 10-digit tax identification number (hereinafter referred to as the withholding number) to declare and pay taxes on behalf of foreign contractors, subcontractors, foreign suppliers, organizations, and individuals with business or cooperation contracts.

Foreign contractors, subcontractors as specified at Point đ Clause 2 Article 4 of Circular 105/2020/TT-BTC who have been declared and paid contractor tax by the Vietnamese side will be issued a 13-digit tax identification number according to the withholding tax identification number of the Vietnamese side to confirm the completion of contractor tax obligations in Vietnam.

When taxpayers change their taxpayer registration information, temporarily suspend operations, resume operations before the scheduled time, terminate the validity of their tax identification number, or restore the tax identification number as per regulations applicable to the taxpayer's tax identification number, the withholding tax identification number will be updated by the tax authorities according to the taxpayer's tax identification number information and status.

Taxpayers are not required to submit documents stipulated in Chapter 2 of Circular 105/2020/TT-BTC regarding withholding tax identification numbers.

- Operators, joint operating companies, joint venture enterprises, and organizations assigned by the Government of Vietnam to receive and distribute shares of oil and gas profits from overlapping oilfields as specified at Point h Clause 2 Article 4 of Circular 105/2020/TT-BTC are issued a 10-digit tax identification number for each oil and gas contract or other agreement or equivalent document.

Contractors and investors participating in oil and gas contracts are issued a 13-digit tax identification number according to the 10-digit tax identification number of each oil and gas contract to fulfill separate tax obligations under the oil and gas contract (including corporate income tax on income from transferring participation rights in oil and gas contracts).

The parent company - Vietnam Oil and Gas Group represents the host country to receive profit shares from oil and gas contracts and is issued a 13-digit tax identification number according to the 10-digit tax identification number of each oil and gas contract to declare and pay taxes on the shares of profit received according to each oil and gas contract.

- Taxpayers are households, business households, individual businesses, and other individuals as specified at Points i, k, l, n Clause 2 Article 4 of Circular 105/2020/TT-BTC who are issued a 10-digit tax identification number for the household representative, business household representative, individual, and a 13-digit tax identification number for business locations of business households and individuals.

- Organizations and individuals according to Point m Clause 2 Article 4 of Circular 105/2020/TT-BTC who have one or multiple collection authorization contracts with a tax authority will be issued a withholding tax identification number to deposit collected amounts from taxpayers into the state budget.

Thus, according to the above regulations, a 10-digit tax identification number is used for:

- Enterprises;

- Cooperatives;

- Organizations with legal status;

- Organizations without legal status but directly incurring tax obligations;

- Household representatives, business households, and other individuals.

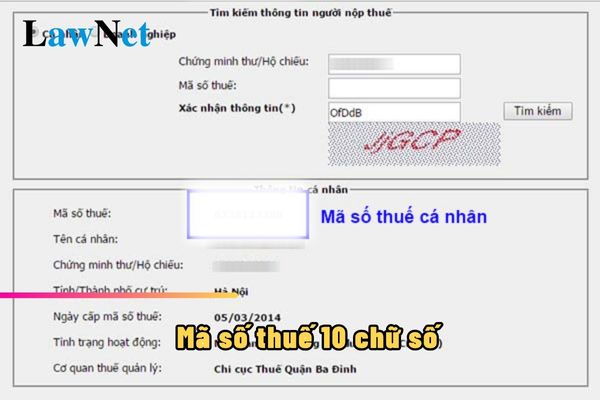

Which entities use the 10-digit tax identification numbers in Vietnam? (Image from the Internet)

How to use the 10-digit tax identification number in Vietnam?

The use of tax identification numbers in general and 10-digit tax identification numbers, in particular, is regulated in Article 35 of The Tax Administration Law 2019. To be specific:

- Taxpayers must insert the issued tax identification number into invoices, documents, and materials when:

+ Conducting business transactions;

+ Opening deposit accounts at commercial banks or other credit institutions;

+ Declaring and paying taxes, tax exemptions, tax reductions, tax refunds, non-collection of taxes, customs declaration registration;

+ Performing other tax-related transactions for all obligations payable to the state budget, including cases where the taxpayer produces or conducts business in various regions.

- Taxpayers must provide their tax identification number to related agencies, organizations, or insert it into applications when performing administrative procedures through the one-stop-shop mechanism with tax authorities.

- Tax management agencies, the State Treasury, commercial banks coordinating in state budget collection, tax-collecting organizations authorized by the tax authorities must use the taxpayer's tax identification number in tax management and tax collection into the state budget.

- Commercial banks and other credit institutions must record the tax identification number in their account opening documents and transaction vouchers through the taxpayer's account.

- Other organizations and individuals engaged in tax management must use the issued tax identification number of the taxpayer when providing information related to tax liability determination.

- When the Vietnamese side pays foreign organizations and individuals conducting cross-border business activities based on a digital intermediary platform without presence in Vietnam, the issued tax identification number must be used to withhold and pay on behalf.

- When the personal identification number is granted to all residents, it replaces the tax identification number.

What is the significance of the 10-digit tax identification number in Vietnam?

Primarily, according to Clause 1 Article 5 of Circular 105/2020/TT-BTC, the structure of the tax identification number is as follows:

N1N2N3N4N5N6N7N8N9N10 - N11N12N13

The significance of the 10-digit tax identification number is as follows:

- The first two digits N1N2 represent the tax identification number's regional code.

- The seven digits N3N4N5N6N7N8N9 are defined in a determined structure, sequentially increasing from 0000001 to 9999999.

- The N10 digit is a check digit.

- Furthermore, the three digits N11N12N13 are sequential numbers from 001 to 999.

- The hyphen (-) is a character used to separate the group of the first 10 digits and the last 3 digits.