Which enterprises will use the PIT deduction declaration form - Form 01/XSBHDC in Vietnam?

Which enterprises will use the PIT deduction declaration form - Form 01/XSBHDC in Vietnam?

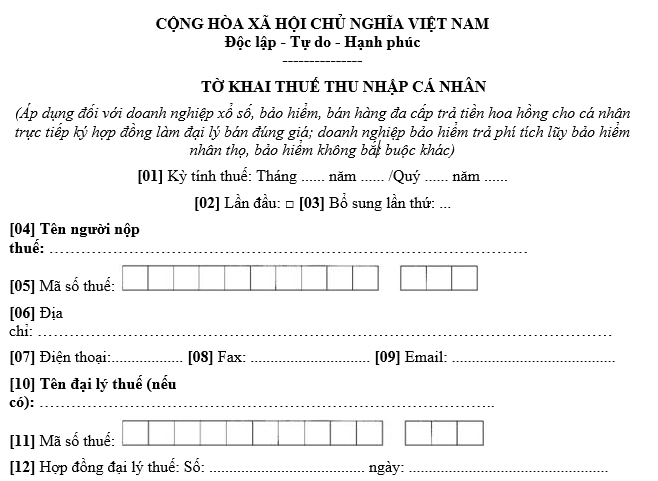

PIT deduction declaration form - Form 01/XSBHDC applies to the lottery enterprises, insurers, and MLM enterprises paying commissions to individuals who sign contracts to work as commission agents; insurers paying life insurance payouts and other non-compulsory insurance payouts as regulated in Appendix 2 issued together with Circular 80/2021/TT-BTC:

Download PIT deduction declaration form - Form 01/XSBHDC: Here

Which enterprises will use the PIT deduction declaration form - Form 01/XSBHDC in Vietnam? (Image from the Internet)

What are the deadlines for submitting PIT declarations for lottery enterprises and insurers in Vietnam?

Under clause 3, Article 15 of Circular 40/2021/TT-BTC, the regulation is as follows:

Tax administration of individuals who directly sign contracts to work as lottery agents, insurance agents, MLM agents, other business activities

...

3. Deadlines for submission of tax declaration dossiers

a) Lottery enterprises, insurers, MLM enterprises shall submit tax declaration dossiers by the deadlines specified in Clause 1 Article 44 of the Law on Tax Administration. To be specific:

a.1) Lottery enterprises, insurers, MLM enterprises shall submit monthly tax declaration dossiers by the 20th of the month succeeding the month in which tax is incurred.

a.2) Lottery enterprises, insurers, MLM enterprises shall submit quarterly tax declaration dossiers by the last day of the first month of the quarter succeeding the quarter in which tax is incurred.

b) Individuals who directly sign contracts to work as lottery agents, insurance agents, MLM agents, other business activities prescribed in Point a Clause 2 Article 44 of the Law on Tax Administration shall submit annual tax declaration dossier by the last day of the first month of the succeeding calendar year.

...

Thus, the deadlines for submitting PIT declarations for lottery enterprises and insurers in Vietnam are as follows:

- The deadline for submitting monthly tax declarations is no later than the 20th of the month succeeding the month in which tax is incurred.

- The deadline for submitting quarterly tax declarations is no later than the last day of the first month of the quarter succeeding the quarter in which tax is incurred.

What are the responsibilities of taxpayers in Vietnam?

According to Article 17 of the Law on Tax Administration 2019, taxpayers have the following responsibilities:

- Apply for taxpayer registration and use TINs as prescribed by law.

- Declare tax accurately, honestly and adequately and submitting tax dossiers on time; take legal responsibility for the accuracy, honesty and adequacy of tax dossiers.

- Pay tax, late payment interest and/or penalties fully, on schedule and at the right location.

- Conform to regulations on accounting, statistics and management, use of invoices and records as prescribed by law.

- Truthfully and fully record the taxable activities and transactions.

- Issue and deliver invoices and records to buyers with the correct quantity, type and actual payment amount when selling goods and/or providing services as prescribed by law.

- Provide information and/or materials related to the determination of tax liabilities accurately, fully and promptly, including information on investment value; transaction IDs and contents of accounts opened at commercial banks and/or other credit institutions; explain declared tax and/or tax payment as requested by tax authorities.

- Comply with decisions, notifications and requests of tax authorities, tax officials as prescribed by law.

- Take responsibility for the fulfillment of tax liabilities as prescribed by law in case the taxpayer’s legal representative or authorized representative fails to follow tax procedures.

- Taxpayers operating businesses in areas with available information technology infrastructure must declare and pay tax and carry out transactions with tax authorities electronically as prescribed by law.

- Based on the availability of information technology equipment, the Government shall specify the documents that regulatory authorities already have and thus can be excluded from tax declarations, applications for tax refund and other tax dossiers.

- Develop, manage and operate systems of technical infrastructure so as to ensure e-transactions with tax authorities; sharing information related to the fulfillment of tax liabilities with tax authorities

- Taxpayers who have entered into related-party transactions have the responsibility to create, retain, declare and provide documents on taxpayers and their related parties, including information on related parties residing in foreign countries or territories according to the Government's regulations.