Which cases are exempt from submitting licensing fee in Vietnam in 2025?

Which cases are exempt from submitting licensing fee in Vietnam in 2025?

Based on Article 3 of Decree 139/2016/ND-CP (amended by point a, clause 1, Article 1 of Decree 22/2020/ND-CP, supplemented by point c, clause 1, Article 1 of Decree 22/2020/ND-CP), the cases exempt from submitting licensing fee in 2025 are as follows:

- Individuals, groups of individuals, and households engaged in production and business activities with an annual revenue of less than or equal to 100 million VND.

- Individuals, groups of individuals, and households engaged in production and business activities on an irregular basis; not having a fixed location as guided by the Ministry of Finance.

- Individuals, groups of individuals, and households engaged in salt production.

- Organizations, individuals, groups of individuals, and households engaged in aquaculture, fisheries, and fishery logistics services.

- Cultural postal points and press agencies (printed, spoken, visual, and electronic newspapers).

- Cooperatives, cooperative unions (including branches, representative offices, and business locations) operating in the agricultural sector as regulated by the law on agricultural cooperatives.

- People's credit funds; branches, representative offices, and business locations of cooperatives, cooperative unions, and private enterprises operating in mountainous areas. The mountainous areas are determined according to the regulations of the Committee for Ethnic Minority Affairs.

- Exemption from licensing fee in the first year of establishment or operating in production and business activities (from January 1 to December 31) for:

+ Newly established organizations (assigned new tax codes, new enterprise codes).

+ Households, individuals, groups of individuals initiating their production and business activities for the first time.

+ During the licensing fee exemption period, if the organization, household, individual, or group of individuals establishes a branch, representative office, or business location, such branch, representative office, or business location shall be exempted from licensing fee during the exemption period of the organization or individual.

- Small and medium enterprises transitioned from household businesses (per Article 16 of the Law on Support for Small and Medium Enterprises 2017) shall be exempted from licensing fee for a period of 3 years from the date of first issuance of the business registration certificate.

+ During the licensing fee exemption period, if small and medium enterprises establish branches, representative offices, or business locations, such locations shall be exempted from licensing fee during the exemption period of the enterprise.

+ Branches, representative offices, and business locations of small and medium enterprises (subject to licensing fee exemption as stipulated in Article 16 of the Law on Support for Small and Medium Enterprises 2017) established before this Decree becomes effective shall have their exemption period calculated from the effective date of this Decree until the end of the exemption period of the enterprises.

+ Small and medium enterprises transformed from household businesses before this Decree becomes effective shall implement licensing fee exemptions in accordance with Articles 16 and 35 of the Law on Support for Small and Medium Enterprises 2017.

- Public educational institutions and public preschool institutions.

Which cases are exempt from submitting licensing fee in Vietnam in 2025? (Image from Internet)

What are responsibilities of licensing fee collectors in Vietnam?

Pursuant to Article 14 of the Law on Fees and Charges 2015, the responsibilities of fee and charge collectors are as follows:

(1) Publicly post at the collection points and disclose on the electronic information site of the fee and charge collector about the name of the fees, charges, collection rates, collection methods, payers, exemptions, reductions, and documents regulating fees and charges.

(2) Prepare and issue receipt documents to the payer according to the provisions of the law.

(3) Implement accounting policies; periodically report the settlement of collection, remittance, and use of fees and charges; enforce financial disclosure policies according to the provisions of the law.

(4) Account each type of fee and charge separately.

(5) Report on the situation of collection, remittance, management, and use of fees and charges.

What is the licensing fee declaration for 2025? What are the detailed instructions for completing the licensing fee declaration for 2025?

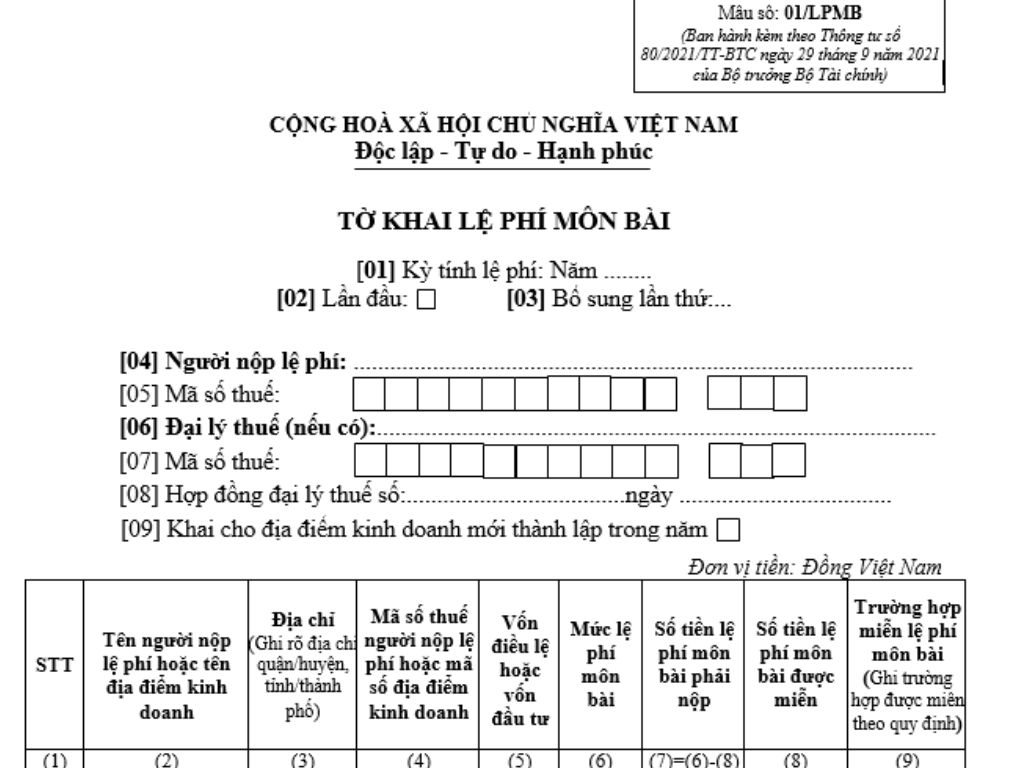

The licensing fee Declaration for 2025 is form 01/LPMB stipulated in Appendix 2 issued together with Circular 80/2021/TT-BTC.

To be specific, the 2025 licensing fee declaration is as follows:

2025 licensing fee Declaration Download

Instructions for completing the licensing fee declaration for 2025 are as follows:

- Indicator [01]: Declare the year of licensing fee calculation.

- Indicator [02]: Mark for the first-time declaration.

- Indicator [03]: Mark in case the taxpayer (referred to as NNT hereafter) has submitted a declaration but later discovers changes in required declaration information, re-declaring the information for the already declared fee period. Note, NNT should only check one of the two indicators [02] and [03], not both.

- Indicators [04] to [05]: Declare information according to the taxpayer registration of the NNT.

- Indicators [06] to [08]: Declare information about tax agents (if any).

- Indicator [09]: Check in case the NNT has declared the LPMB, and subsequently establishes new business locations.