Where to download the latest Appendix 03-2/TNDN for loss carryforward in Vietnam? How to fill in the loss carryforward form?

Where to download the latest Appendix 03-2/TNDN for loss carryforward in Vietnam?

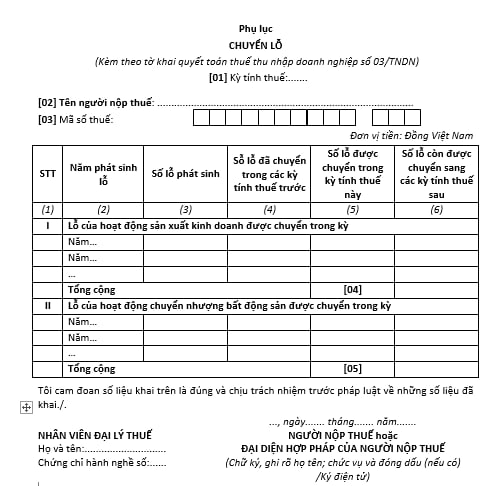

Appendix form number 03-2/TNDN accompanies the corporate income tax return form number 03/TNDN, as stipulated in Appendix II issued alongside Circular 80/2021/TT-BTC and is used when a company carries forward a loss, as follows:

Download form 03-2/TNDN: Here

Where to download the latest Appendix 03-2/TNDN for loss carryforward in Vietnam? How to fill in the loss carryforward form? (Image from the Internet)

How to fill in the loss carryforward form in Vietnam according to Form 03-2/TNDN?

Below are the instructions for filling in the loss carryforward form according to form number 03-2/TNDN:

Item [01]: The taxpayer specifies the tax calculation period corresponding to the tax period on the 03/TNDN return.

Items [02], [03]: The taxpayer states their name and tax identification number as per the information on the 03/TNDN return. If the taxpayer is using electronic tax filing, the Etax system will automatically display this information from the details declared on the 03/TNDN return.

Column (1): The taxpayer enters sequential numbers for each line in each section I, II.

Column (2): The taxpayer records the year the loss occurred, with each year entered on a separate line in each section I, II.

Column (3): The taxpayer enters the total amount of loss corresponding to each year declared in column (1).

Column (4): The taxpayer notes the amount of loss that was transferred in previous tax periods of each year declared in column (1).

Column (5): The taxpayer states the amount of loss to be transferred in this tax period of each year declared in column (1).

Column (6): The taxpayer indicates the amount of loss that remains to be carried forward to subsequent tax periods for each year declared in column (1). The figures in this column for each year are calculated as follows: (6) = (3) - (4) - (5).

Item [04]: The taxpayer records the total amount of loss from business activities to be carried forward in this tax period, not exceeding the taxable income (before loss carryforward) of the company after subtracting exempt income within the period. This item is recorded in item C3a of the 03/TNDN return.

Item [05]: The taxpayer records the total amount of loss from real estate transfer activities to be carried forward in this tax period, not exceeding the taxable income from real estate transfer activities within the period. This item is recorded in item D2 of the 03/TNDN return.

What if there Is a continued loss during the loss carryforward period in Vietnam?

According to Clause 2, Article 9 of Circular 78/2014/TT-BTC, the regulation on loss carryforward is as follows:

Determination of Loss and Loss Carryforward

...

2. If a company reports a loss after tax finalization, it must transfer the entire and continuous amount of loss to the taxable income (after exempt income) of subsequent years. The loss carryforward period is continuous and not more than 5 years from the year following the loss occurrence.

Companies may temporarily transfer losses into the income of the quarters of the following year after filing the provisional quarterly tax declaration and officially into the following year upon filing the annual tax finalization declaration.

Example 12: In 2013, Company A incurred a loss of VND 10 billion, in 2014 Company A earned an income of VND 12 billion; therefore, the entire loss of VND 10 billion incurred in 2013 must be transferred into the 2014 income.

Example 13: In 2013, Company B incurred a loss of VND 20 billion, in 2014 Company B earned an income of VND 15 billion; thus:

+ Company B must transfer the entire loss of VND 15 billion into the 2014 income;

+ The remaining loss of VND 5 billion must be tracked and transferred completely and continuously in accordance with the loss carryforward principle of the 2013 loss to the following years, but not exceeding 5 years from the year after the loss occurrence.

- Companies with quarterly losses within the same fiscal year may offset these losses between quarters within that fiscal year. Upon finalizing corporate income tax, the company determines the yearly loss and transfers the entire and continuous loss into taxable income of the years following the loss occurrence as stated above.

- The company itself determines the deductible loss from income based on the principles stated above. Should another loss occur during the loss carryforward period, this newly incurred loss (excluding the loss carried forward from previous periods) will be transferred entirely and continuously for no more than 5 years from the year following the loss occurrence.

In cases where the competent authority investigates and audits the corporate income tax finalization and identifies a different amount of loss eligible for carryforward than determined by the company itself, the loss amount shall be determined according to the authority's conclusion but must ensure the continuous and total loss carryforward is not more than 5 years from the year following the loss occurrence as stipulated.

After the 5-year period from the year following the loss occurrence, if the incurred loss has not been fully transferred, it will not be transferable to the income of the subsequent years.

...

Therefore, if during the period of loss carryforward by a company, a new loss is incurred, this newly incurred loss (excluding the loss from a previous period carried forward) will be entirely and continuously carried forward for no more than 5 years from the year following the loss occurrence.