When shall individual bussinesses be eligible for an extension of tax payment deadline in Vietnam in 2024?

When shall individual bussinesses be eligible for an extension of tax payment deadline in Vietnam in 2024?

According to Article 3 of Decree 64/2024/ND-CP, individual bussinesses in the following economic sectors are granted an extension of tax payment deadline for 2024:

- Transportation and warehousing; accommodation and food services; education and training; health care and social assistance activities; real estate business activities;

- Labor and employment service activities; activities of travel agencies, tour operators, and related services, including tour promotion and organization;

- Creative, arts, and entertainment activities; activities of libraries, archives, museums, and other cultural activities; sports, entertainment, and recreation activities; movie screening activities;

- Broadcasting and television activities; computer programming, consulting, and other computer-related activities; information service activities;

- Mining support service activities.

The list of economic sectors mentioned in Clauses 1 and 2 of Article 3 of Decree 64/2024/ND-CP is determined according to Decision 27/2018/QD-TTg issued in 2018.

Economic sectors are categorized in Annex 1 issued with Decision 27/2018/QD-TTg into 5 levels, and the determination of the economic sector is applied based on the following principles: If the economic sector name mentioned in Clauses 1 and 2 of Article 3 of Decree 64/2024/ND-CP is within level 1, the sector eligible for the extension includes all sectors within levels 2, 3, 4, and 5 of level 1;

If within level 2, the sector eligible for the extension includes all sectors within levels 3, 4, and 5 of level 2;

If within level 3, the sector eligible for the extension includes all sectors within levels 4 and 5 of level 3;

If within level 4, the sector eligible for the extension includes all sectors within level 5 of level 4.

When shall individual bussinesses be eligible for an extension of tax payment deadline in Vietnam in 2024? (Image from the Internet)

What is the deadline for extension of tax payment deadline in 2024?

As stipulated in Article 4 of Decree 64/2024/ND-CP:

Extension of tax and land rent payment deadlines

- For value-added tax (excluding VAT on imports)

...

- For value-added tax and personal income tax of business households and individuals

The extension of the value-added tax and personal income tax payment is applicable to the tax amounts arising in 2024 for business households and individual bussinesses in the economic sectors and fields mentioned in Clauses 1, 2, and 3 of Article 3 of this Decree. Business households and individuals must make the tax payment, which has been extended, by December 30, 2024 at the latest.

- For land rent

Extension of land rent payment for 50% of the land rent due to be paid in 2024 (second period of 2024) for enterprises, organizations, households, and individuals specified in Article 3 of this Decree that are being directly leased land by the State according to a Decision or Contract by a competent state agency, under an annual rent payment method. The extension period is 2 months from October 31, 2024.

This provision applies even if an enterprise, organization, household, or individual has multiple Decisions, Contracts for direct land leases by the state, and engages in various production and business activities including those in the economic sectors and fields specified in Clauses 1, 2, and 3 of Article 3 of this Decree.

- In cases where enterprises, organizations, business households, or individuals engage in various economic sectors including those specified in Clauses 1, 2, and 3 of Article 3 of this Decree:Business enterprises and organizations are extended for the entire amount of VAT and corporate income tax payable. Business households and individuals are extended for the entire amount of VAT and personal income tax payable as guided in this Decree.

...

The deadline for extending the personal income tax payment in 2024 is December 30, 2024.

Note: The extension is only for the personal income tax amounts arising in 2024.

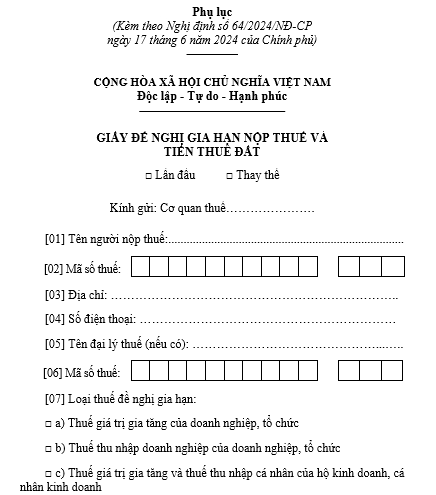

What is the 2024 form for extension of tax payment deadline?

The 2024 form for extension of tax payment deadline is the form in the Annex issued with Decree 64/2024/ND-CP:

>> Download the 2024 form for extension of tax payment deadline: Download