When shall a household business order the printing of tax authority-ordered printed invoices in Vietnam?

When shall a household business order the printing of tax authority-ordered printed invoices in Vietnam?

Based on Clause 1, Article 23 of Decree 123/2020/ND-CP, it is stipulated as follows:

Application of tax authority-ordered printed invoices

The Tax Departments of provinces and centrally-affiliated cities (hereinafter referred to as the Tax Departments) print invoices for sale to the following subjects:

1. Enterprises, economic organizations, household businesses, and individuals specified in Clause 1, Article 14 of this Decree in cases where the enterprise, economic organization, household business, or individual does not conduct transactions with the tax authority by electronic means, lacks information technology infrastructure, does not have an accounting software system, and does not have invoicing software to use electronic invoices and to transmit electronic invoice data to the buyers and the tax authority.

Enterprises, economic organizations, household businesses, and individuals buy invoices from the tax authority for a maximum period of 12 months, during which the tax authority provides solutions to gradually transition to the application of electronic invoices. When switching to using electronic invoices, enterprises, economic organizations, household businesses, and individuals register to use electronic invoices with or without a tax authority code (if eligible) as per the regulations in Article 15 of this Decree.

....

And based on Clause 2, Article 11 of Circular 78/2021/TT-BTC, it is stipulated as follows:

Effective Date

1. This Circular takes effect from July 1, 2022, encouraging authorities, organizations, and individuals that meet information technology infrastructure conditions to apply electronic invoice and document regulations as guided in this Circular and Decree No. 123/2020/ND-CP before July 1, 2022.

2. Electronic invoices are applied to household businesses and individuals from July 1, 2022. In particular, for cases specified in Clause 1, Article 14 of Decree No. 123/2020/ND-CP where transactions are not conducted with the tax authority by electronic means, there is no information technology infrastructure, no accounting software system, and no invoicing software to use electronic invoices and transmit electronic data to the buyers and the tax authority, paper invoices from the tax authority can be used for a maximum period of 12 months, while gradually transitioning to electronic invoices. The maximum period of 12 months is counted once from July 1, 2022, for household businesses, individuals operating before July 1, 2022; or from the registration date to start using invoices for newly established household businesses, individuals from July 1, 2022.

...

According to the above provisions, household businesses in areas with difficult and especially difficult socio-economic conditions can order invoices from the tax authority for a maximum period of 12 months when:

- They do not conduct transactions with the tax authority by electronic means;

- They lack information technology infrastructure;

- They do not have an accounting software system;

- They do not have invoicing software to use electronic invoices and to transmit electronic invoice data to the buyer and the tax authority.

Here, the 12-month period is counted as follows:

- For household businesses operating before July 1, 2022: 12 months counted once from July 1, 2022.

- For newly established household businesses, individual businesses from July 1, 2022: 12 months from the time of registration to start using invoices.

When shall a household business order the printing of tax authority-ordered printed invoices in Vietnam? (Image from the internet)

What documents are included in the application for invoice purchase in Vietnam?

Based on Clause 1, Article 24 of Decree 123/2020/ND-CP, the documents included in application for invoice purchase from the tax authority are as follows:

Enterprises, economic organizations, household businesses, and individuals eligible to purchase invoices from the tax authority must submit a request form to buy invoices (according to Form No. 02/DN-HDG, Appendix IA issued with the Decree) to the tax authority when buying invoices, along with the following documents:

- The invoice purchaser (the named person in the form or the person authorized by the business, organization, or household business by a power of attorney under legal regulations) must present an identification card or citizenship card valid according to legal regulations;

- Enterprises, economic organizations, household businesses, and individuals buying invoices for the first time must provide a declaration of commitment (according to Form No. 02/CK-HDG, Appendix IA issued with this Decree) regarding the production and business location in line with the business registration certificate, operational license for branch activities, household business registration certificate, taxpayer registration certificate, tax code notification, investment registration certificate, cooperation certificate or the establishment decision of the competent authority;

- When purchasing invoices, enterprises, economic organizations, household businesses, and individuals buying tax authority issued invoices must take responsibility for recording or stamping: name, address, and tax code on page 2 of each set of invoices before removing them from the tax authority.

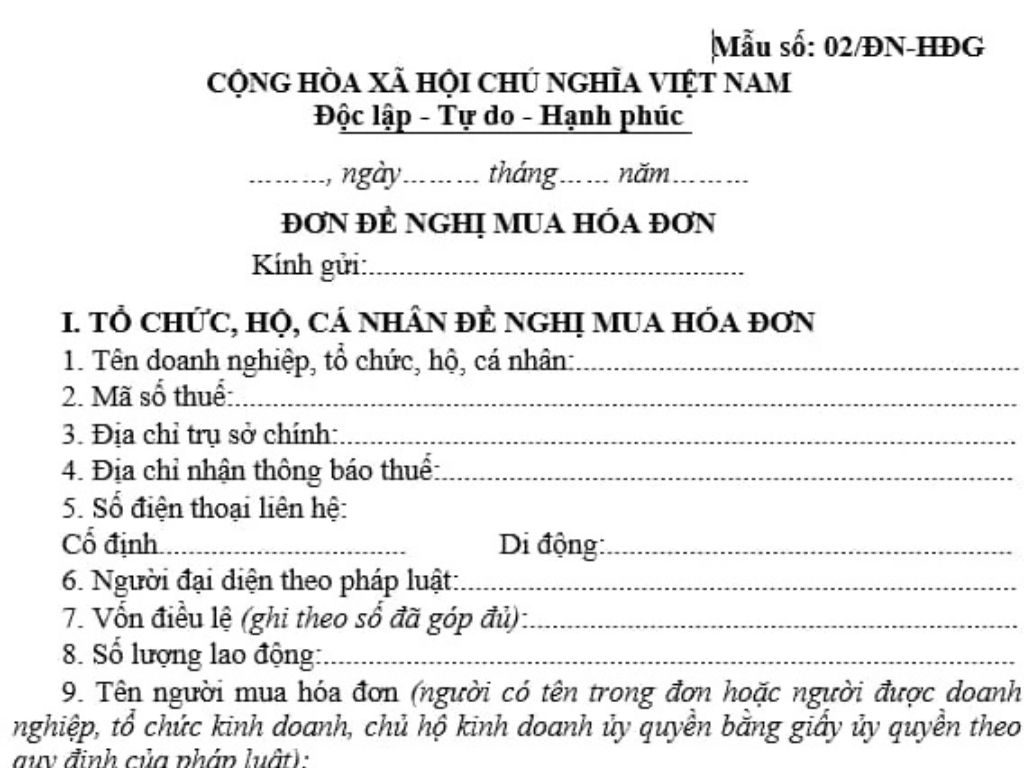

Which form is used for the purchase of tax authority-ordered printed invoices in Vietnam?

The request to purchase invoices is applied according to Form No. 02/DN-HDG in Appendix IA issued with Decree 123/2020/ND-CP dated October 19, 2020, of the Government of Vietnam, and it is formatted as follows:

>> Form No. 02/DN-HDG - Request to Purchase tax authority-ordered printed invoices Available Here DOWNLOAD