When must individuals in Vietnam self-finalize PIT on income from salaries and remunerations?

What is the definition of tax finalization in Vietnam?

According to Clause 10, Article 3 of the Law on Tax Administration 2019, tax finalization means the calculation of tax accrued in a tax year or over the period from the beginning of a tax year to the termination of taxable activities, or over the period during which taxable activities occur as prescribed by law.

When must individuals in Vietnam self-finalize PIT on income from salaries and remunerations? (Image from the Internet)

When must individuals in Vietnam self-finalize PIT on income from salaries and remunerations?

According to Point d, Clause 6, Article 8 of Decree 126/2020/ND-CP:

Taxes declared monthly, quarterly, annually, separately; tax finalization

...

6. The following taxes and amounts shall be declared annually and finalized when an enterprise is dissolved, shuts down, terminates a contract or undergoes rearrangement. In case of conversion (except equitized state-owned enterprises) where the enterprise after conversion inherits all tax obligations of the enterprise before conversion, tax shall be finalized at the end of the year instead of the issuance date of the decision on conversion. Tax shall be finalized at the end of the year):

...

d) PIT for salary payers; salary earners that authorize salary payers to finalize tax on their behalf; salary earners that finalize tax themselves. To be specific:

...

d.3) A resident salary earner shall directly submit the PIT finalization dossier to the tax authority in the following cases:

Tax is underpaid or overpaid and the individual claims a refund or has it carried forward to the next period, unless: the tax arrears is not exceeding 50.000 VND; the amount of tax payable is smaller than the amount provisionally paid but the individual does not claim a refund or does not have it carried forward to the next period; the individual has an employment contract with a duration of at least 03 months and earns an average monthly irregular income not exceeding 10 million VND which on which PIT has been deducted at 10% and does not wish to have this income included in the tax finalization dossier; the individual’s life insurance (except voluntary retirement insurance) or any other voluntary insurance with insurance premium accumulation is purchased by the individual’s employee and 10% PIT on the part purchased or contributed by the taxpayer.

The individual has been present in Vietnam for fewer than 183 days in the first calendar year but more than 183 days in 12 consecutive months from the arrival date.

An individual that is a foreigner whose employment contract in Vietnam has ended shall submit a tax finalization dossier to the tax authority before exit or authorize the income payer or another organization or individual to prepare and submit the tax finalization dossier as per regulations. The income payer or the authorized organization/individual must pay tax arrears if tax is underpaid or will receive a refund in case tax is overpaid.

Resident salary earners who are eligible for tax reduction due to a natural disaster, fire, accident or serious illness shall finalize tax themselves instead of authorizing income payers to perform this task.

Thus, residents earning income from salaries and remunerations shall directly submit the PIT finalization dossier to the tax authority in the following cases:

- Tax is underpaid or overpaid and the individual claims a refund or has it carried forward to the next period, unless cases specified by law.

- The individual has been present in Vietnam for fewer than 183 days in the first calendar year but more than 183 days in 12 consecutive months from the arrival date.

- An individual that is a foreigner whose employment contract in Vietnam has ended shall submit a tax finalization dossier to the tax authority before exit.

- Resident salary earners who are eligible for tax reduction due to a natural disaster, fire, accident or serious illness shall finalize tax themselves instead of authorizing income payers to perform this task.

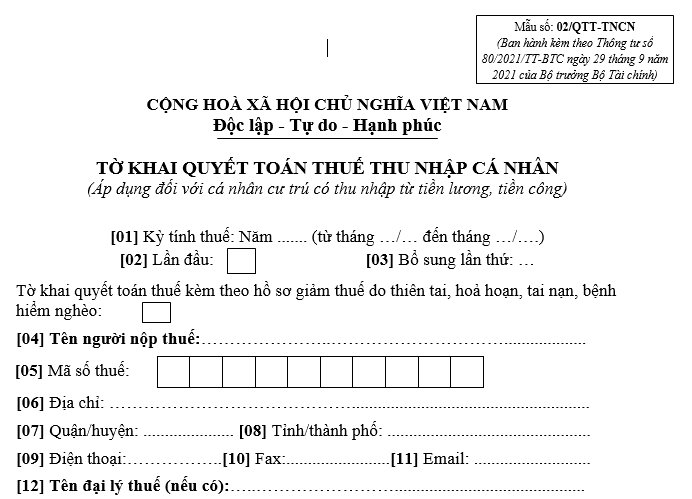

What is the PIT finalization declaration form for income from salaries and remunerations in Vietnam?

The PIT finalization declaration form for income from salaries and remunerations is Form 02/QTT-TNCN issued together with Circular 80/2021/TT-BTC:

>> Download the PIT finalization declaration form for income from salaries and remunerations.