When is VAT declared quarterly in Vietnam?

When is VAT declared quarterly in Vietnam?

Based on Point a, Clause 1, Article 9 of Decree 126/2020/ND-CP, the quarterly VAT tax declaration is applicable for:

- Taxpayers subject to monthly value-added tax declaration as stipulated in Point a, Clause 1, Article 8 of Decree 126/2020/ND-CP, if their total revenue from sales of goods and provision of services of the previous year is 50 billion VND or less, they are entitled to declare VAT on a quarterly basis. Revenue from sales of goods and provision of services is determined as the total revenue on VAT declarations of the tax periods in the calendar year.

In cases where the taxpayer performs centralized tax declaration at the head office for the dependent unit, business location, the revenue from sales of goods and provision of services includes the revenue of the dependent unit and business location.

- In the case of taxpayers who have just started their operations and business, they are entitled to select quarterly VAT tax declaration. After engaging in business for a full 12 months, from the subsequent calendar year adjacent to the year that has completed 12 months, the level of revenue of the adjacent previous calendar year (complete 12 months) is used to implement VAT tax declaration on a monthly or quarterly basis.

Currently, taxpayers on a quarterly basis must belong to the category of monthly taxpayers and meet the following conditions: total revenue from sales of goods and provision of services in the previous year is 50 billion VND or less, or they have just started operations and business, then they can choose to declare VAT on a quarterly basis.

Thus, according to the regulations, taxpayers with a total revenue from sales of goods and provision of services in the previous year of 50 billion VND or less are permitted to declare VAT quarterly.

In the case of taxpayers who have just started their production and business activities, VAT declaration is performed quarterly.

When is VAT declared quarterly in Vietnam? (Image from Internet)

Vietnam: When is the deadline for VAT declaration for Quarter 3, 2024?

According to Article 44 of the Law on Tax Administration 2019, the deadline for submitting tax declaration dossiers is as follows:

- The deadline for submitting tax declaration dossiers for taxes declared monthly or quarterly is stipulated as follows:

+ No later than the 20th of the following month after the month in which the tax obligation arises for cases of monthly declaration and payment.

+ No later than the last day of the first month of the following quarter for cases of quarterly declaration and payment.

- The deadline for submitting tax declaration dossiers for taxes with an annual tax period is stipulated as follows:

+ No later than the last day of the third month from the end of the calendar year or fiscal year for annual tax finalization dossiers; no later than the last day of the first month of the calendar year or fiscal year for annual tax declaration dossiers;

+ No later than the last day of the fourth month from the end of the calendar year for individual income tax finalization dossiers of individuals directly settling tax;

+ No later than December 15 of the previous year for presumptive tax declaration dossiers of household businesses, individual businesses paying tax by the presumptive method; in the case of new household businesses, individuals starting business, the deadline for submitting the presumptive tax declaration dossier is no later than 10 days from the starting date of business.

Thus, according to the above regulation, it can be seen that the deadline for submitting the VAT quarterly declaration dossier for Quarter 3 of 2024 is October 31, 2024.

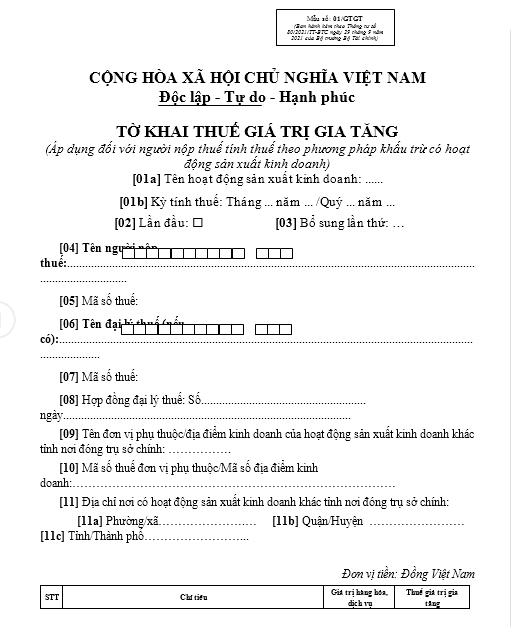

Vietnam: What is the VAT declaration form for Quarter 3 of 2024?

Accordingly, the VAT quarterly declaration for Quarter 3 of 2024 is to be made according to the form in the Appendix issued with Circular 80/2021/TT-BTC as follows:

Download VAT Quarterly Declaration Form for Quarter 3 of 2024.

What are the cases in which enterprises, household businesses must declare VAT in Vietnam?

Pursuant to the provisions of Article 3 of Circular 219/2013/TT-BTC, enterprises and household businesses must declare and pay value-added tax (VAT) which includes enterprises and household businesses producing, trading goods, and services subject to VAT in Vietnam, regardless of industry, form, business organization, and enterprises, household businesses importing goods, purchasing services from abroad which are subject to VAT, specifically:

- Enterprises and household businesses established and registered in accordance with the Law on Enterprises 2020 and other specialized business laws.

- Enterprises with foreign investment and foreign parties participating in business cooperation contracts according to the Investment Law 2020.

- Enterprises and household businesses engaging in production and business in Vietnam purchasing services (including in cases of purchasing services associated with goods) from foreign organizations that do not have permanent establishments in Vietnam, or individuals from abroad who are non-residents in Vietnam, then the purchasing enterprises, household businesses are the VAT payers, except for cases not required to declare and pay VAT stipulated in Section 2 below.

- Branches of export processing enterprises established to operate in the purchase and sale of goods and activities directly related to the purchase and sale of goods in Vietnam according to the provisions of the law on industrial zones, export processing zones, and economic zones.