When is the taxpayer not required to submit a tax declaration dossier in Vietnam? What types of taxes must be declared monthly?

When is the taxpayer not required to submit a tax declaration dossier in Vietnam?

According to the provisions of Clause 3, Article 7 of Decree 126/2020/ND-CP, the taxpayer is not required to submit a tax declaration dossier in the following cases:

- The taxpayer only engages in activities or businesses that are not subject to tax according to the laws on each type of tax.

- Individuals with income exempt from tax according to the laws on personal income tax and the provisions at point b, clause 2, Article 79 of the Tax Management Law 2019, except for individuals receiving inheritances, gifts as real estate; or transferring real estate.

- Export processing enterprises solely engaged in export activities are not required to submit VAT declaration files.

- Taxpayers temporarily suspend business activities according to the provisions of Article 4 of Decree 126/2020/ND-CP.

- Taxpayers submitting the dossier for terminating the tax code effect, except in cases of terminating operations, terminating contracts, or reorganizing the enterprise according to the provisions of clause 4, Article 44 of the Tax Management Law 2019.

How are monthly declared taxes regulated?

According to the provisions of Clause 1, Article 8 of Decree 126/2020/ND-CP, the taxes declared monthly include:

- Value Added Tax and Personal Income Tax. If a taxpayer satisfies the criteria stipulated in Article 9 of Decree 126/2020/ND-CP, they can opt to declare quarterly.

- Special Consumption Tax.

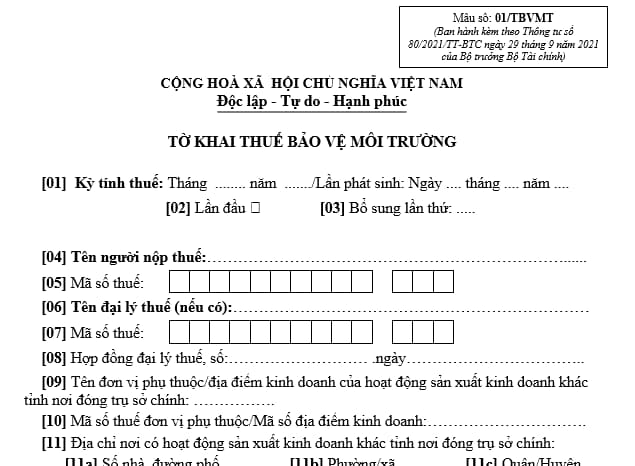

- Environmental Protection Tax.

- Resource Tax, except for Resource Tax as stipulated at point e, clause 1, Article 8 of Decree 126/2020/ND-CP.

When is the taxpayer not required to submit a tax declaration dossier in Vietnam? What types of taxes must be declared monthly? (Image from the Internet)

Where to submit the environmental protection tax declaration dossier for gasoline, extracted coal, and domestic coal consumption in Vietnam?

According to Clause 4, Article 11 of Decree 126/2020/ND-CP, revised by Clause 6, Article 1 of Decree 91/2022/ND-CP, the location to submit the environmental protection tax declaration dossier for gasoline, extracted coal, and domestic coal consumption is regulated as follows:

- For gasoline:

+ The direct import, production, and blending trader submits the tax declaration dossier to the tax authority directly managing the volume of gasoline exported, sold, including exports for internal use, exports for commodity exchange, exports for commission import, sales to other organizations or individuals not dependent units, and subsidiaries according to the Enterprise Law of the said traders; excluding the exported sale and commission import for other main traders.

+ Main traders or subsidiaries according to the Enterprise Law of the main traders having dependent units operating in different provinces or centrally-run cities from where the main traders or their subsidiaries are headquartered, and where the dependent units do not account separately for environmental protection tax, shall submit the environmental protection tax declaration to the directly managing tax authority; calculate tax, allocate tax obligations for each locality where the dependent units are headquartered as regulated by the Minister of Finance.

- For extracted and domestic coal consumption:

Enterprises engaging in coal extraction and domestic coal consumption through management and entrustment to subsidiaries or dependent units for extraction, processing, and consumption shall have the consumption unit submit the tax declaration for the total environmental protection tax incurred for taxable extracted coal and submit the tax declaration dossier to the managing tax authority, accompanied by a Table determining taxes payable for each locality where the coal extraction company is headquartered as regulated by the Minister of Finance.

Form 01/TBVMT for the environmental protection tax declaration for gasoline, extracted coal, and domestic coal consumption:

Download: Form for environmental protection tax declaration for extracted and consumed domestic coal here