When is a change in the currency in accounting allowed in Vietnam?

When is a change in the currency in accounting allowed in Vietnam?

Based on Article 7 of Circular 200/2014/TT-BTC, the conditions for changing the currency in accounting are as follows:

Change in currency in accounting

A business can change the currency used in accounting when significant changes in management and business activities occur, causing the current currency in accounting to no longer meet the criteria stated in Clauses 2 and 3 of Article 4 of this Circular. Such a change is only allowed at the beginning of a new fiscal year. The business must notify the direct tax management authority of the currency change within 10 working days from the end of the fiscal year.

Therefore, changing from one currency in accounting to another is only allowed at the start of a new fiscal year.

As such, in compliance with the above regulations, when accountants implement a change from one currency in accounting, it is only permissible at the beginning of a new fiscal year.

When is a change in the currency in accounting allowed in Vietnam? (Image from the Internet)

What are principles of preparation of financial statements upon change of currency in accounting in Vietnam?

According to Article 108 of Circular 200/2014/TT-BTC, tax accountants must adhere to the following three principles when preparing financial statements upon changing the currency in accounting:

Principle 1. When changing the currency in accounting, at the first period post-change, accountants must convert accounting ledger balances into the new currency in accounting using the transfer rate of a commercial bank where the enterprise frequently transacts on the date of the currency change.

Principle 2. The exchange rate for comparative information (previous period column) on the Income Statement and the Cash Flow Statement:

When presenting comparative information on the Income Statement and Cash Flow Statement for the period in which the currency in accounting is changed, the entity must apply the average transfer rate of the preceding period adjacent to the change period (if the average rate approximates the actual rate).

Principle 3. Upon changing the currency in accounting, the enterprise must disclose in the Notes to Financial Statements the reason for the currency change and any impacts (if any) on the financial statements due to such change.

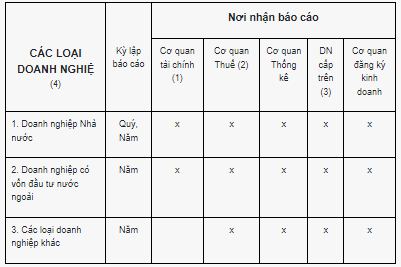

What are deadlines for submission of financial statements in Vietnam?

Based on Article 109 of Circular 200/2014/TT-BTC, tax accountants must observe the following deadlines for financial statement submission:

- For state-owned enterprises

+ Filing deadline for quarterly financial statements:

++ The accounting unit must submit the quarterly financial statements no later than 20 days from the end of the quarter; for parent companies, state-owned corporations no later than 45 days;

++ Subsidiary accounting units must submit quarterly financial statements to the parent company and corporation by the timeframe set by the parent company and corporation.

+ Filing deadline for annual financial statements:

++ The accounting unit must submit the annual financial statements no later than 30 days from the end of the fiscal year; for parent companies, state-owned corporations no later than 90 days;

++ Subsidiaries of state-owned corporations must submit annual financial statements to the parent company and corporation by the timeframe prescribed by the parent company and corporation.

- For other types of enterprises

+ Private enterprises and partnerships must submit annual financial statements no later than 30 days from the end of the fiscal year; other accounting units have a submission deadline of no later than 90 days;

+ Subsidiary accounting units must submit annual financial statements to the superior accounting unit by the deadline set by the superior accounting unit.

Furthermore, the recipients of financial statements follow Article 110 of Circular 200/2014/TT-BTC.

- State-owned enterprises located in provinces and centrally-administered cities must prepare and submit financial statements to the provincial/municipal Department of Finance. Central state-owned enterprises must also submit financial statements to the Ministry of Finance (Department of Corporate Finance).

- State-owned enterprises such as commercial banks, lottery companies, credit institutions, insurers, and securities companies must submit financial statements to the Ministry of Finance (Department of Banking Finance or Department of Insurance Supervision).

- Securities trading companies and public companies must submit financial statements to the State Securities Commission and the Stock Exchange.

- Enterprises must send financial statements to the tax authorities directly managing their taxes locally. State-owned corporations must additionally submit financial statements to the Ministry of Finance (General Department of Taxation).

- Enterprises with a superior accounting unit must submit financial statements to the superior accounting unit according to the superior accounting unit's regulations.

- Enterprises required by law to audit their financial statements must have them audited before submission, as regulated. Businesses that have already undergone an audit must attach the audit report with their financial statements when submitting to state management agencies and higher-level enterprises.

- Financial statements required to be submitted by foreign direct investment (FDI) enterprises must go to the provincial/municipal Department of Finance where the business registers its main business location.

- 100% state-owned enterprises, in addition to the agencies where they must submit financial statements as stated above, must also submit them to agencies and organizations designated and decentralized to exercise ownership rights according to Decree 99/2012/ND-CP and its amendments, additions, replacements.

- Enterprises (including domestic and foreign-invested enterprises) located in export processing zones, industrial parks, and high-tech zones must file annual financial statements to the management board of such zones if required.