When does an income payer apply for taxpayer registration on behalf of an employee’s dependants in Vietnam?

When does an income payer apply for taxpayer registration on behalf of an employee’s dependants in Vietnam?

Based on Article 33 of the Law on Tax Administration 2019, the regulation is as follows:

Initial taxpayer registration deadline

- Taxpayers who register for taxpayer identification simultaneously with enterprise registration, cooperative registration, or business registration must follow the deadlines prescribed by law for these registrations.

- Taxpayers who register directly with the tax authority must do so within 10 business days from the following events:

a) Issuance of the business household registration certificate, establishment and operation license, investment registration certificate, or decision of establishment;

b) Commencement of business activities for organizations not subject to business registration, or for business households or individuals required to register but not yet issued a business registration certificate;

c) Occurrence of the responsibility to withhold and pay taxes on behalf of others; organizations paying tax on behalf of individuals under collaboration or business cooperation agreements;

d) Signing of contractor agreements for foreign contractors and subcontractors who declare and pay taxes directly to the tax authority; signing of petroleum agreements;

dd) Occurrence of personal income tax obligations;

e) Occurrence of a tax refund request;

g) Occurrence of other obligations to the state budget.

- Organizations and individuals paying income are responsible for registering taxpayers on behalf of individuals earning income within 10 business days from the date of tax obligation arising if the individuals do not have a tax code; registering dependants of taxpayers within 10 business days from the date the taxpayer registers for the personal exemption according to legal provisions if the dependants do not have a tax code.

If the dependants do not have a tax code, the income payer must register taxpayers on behalf of the dependants of the taxpayer within 10 business days from the date the taxpayer registers for the personal exemption according to legal provisions.

When does an income payer apply for taxpayer registration on behalf of an employee’s dependants in Vietnam? (Image from the Internet)

Vietnam: How many taxpayers may a person be registered as a dependent of?

Based on Article 19 of the Law on Personal Income Tax 2007 (amended by Clause 4, Article 1 of the Law on amendments to the Law on Personal Income Tax 2012), the regulation is as follows:

Personal exemption

...

- The determination of personal exemption level for dependants follows the principle that each dependent is only considered for exemption once for one taxpayer.

- dependants include those whom the taxpayer is responsible for supporting, comprising:

a) Minor children; children with disabilities who are unable to work;

b) Individuals without income or with income not exceeding the prescribed level, including adult children studying at universities, colleges, professional secondary schools, or vocational schools; spouses unable to work; parents who are beyond working age or unable to work; other individuals without means of support that the taxpayer must directly support.

The Government of Vietnam stipulates income levels and declarations for determining dependants eligible for personal exemptions.

Based on point c, clause 1, Article 9 of Circular 111/2013/TT-BTC (amended by Clause 6, Article 25 of Circular 92/2015/TT-BTC), the regulation is as follows:

Deductions

The deductions provided for in this Article are subtracted from an individual’s taxable income before determining taxable income from wages, salaries, or business income. Specifically as follows:

- Personal exemption

According to Article 19 of the Law on Personal Income Tax; Clause 4, Article 1 of the Law amending and supplementing several articles of the Law on Personal Income Tax; Article 12 of ND 65/2013/ND-CP, personal exemption is implemented as follows:

...

c) Principles of personal exemption calculation

...

c.2.4) Each dependent can only be considered for exemption once for one taxpayer in the tax year. In cases where multiple taxpayers jointly support a dependent, they must agree to register the personal exemption for one taxpayer.

...

Each individual can only be registered as a dependent of one taxpayer when calculating personal income tax.

What is the level of personal exemption for dependants in Vietnam?

According to Article 1 of the Resolution issued with Resolution 954/2020/UBTVQH14, the regulation is as follows:

Personal exemption level

Adjust the personal exemption level stipulated in Clause 1, Article 19 of the Law on Personal Income Tax No. 04/2007/QH12 as amended and supplemented by Law No. 26/2012/QH13 as follows:

- The exemption level for the taxpayer is VND 11 million/month (VND 132 million/year);

- The exemption level for each dependent is VND 4.4 million/month.

Each employee is entitled to a personal exemption of VND 4.4 million/month per dependent.

What is the current detailed dependent registration form for personal exemption in Vietnam?

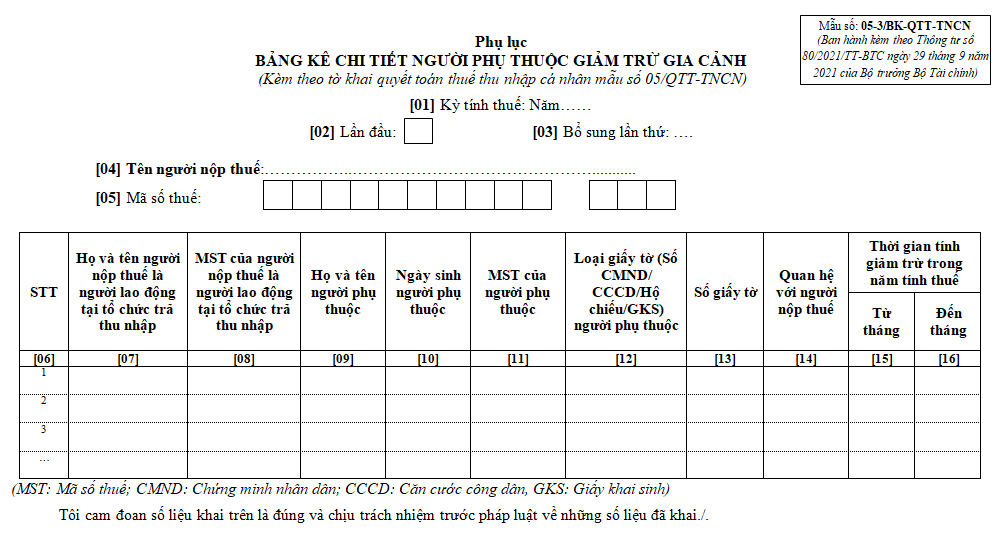

The current detailed dependent registration form for personal exemption is Form No. 05-3/BK-QTT-TNCN issued with Appendix II of Circular 80/2021/TT-BTC as follows:

Download the current detailed dependent registration form for personal exemption: Here