What type of land does the agricultural land use tax declaration form (Form 03/SDDNN) in Vietnam apply to?

What type of land does the agricultural land use tax declaration form (Form 03/SDDNN) in Vietnam apply to?

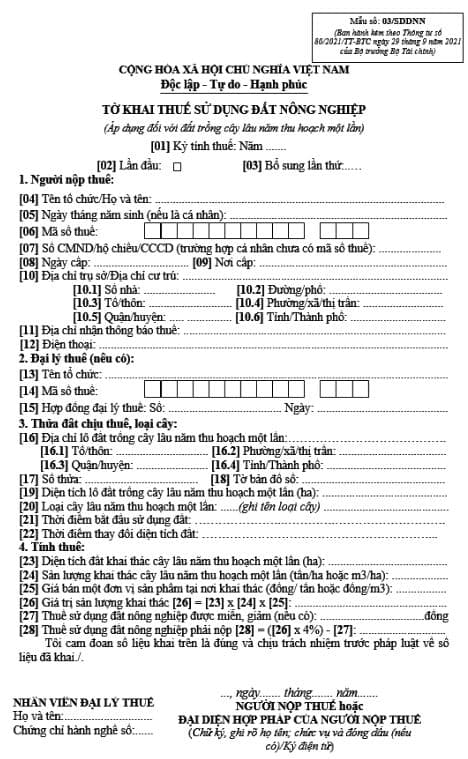

The agricultural land use tax declaration form (Form 03/SDDNN) applies to land for one-time harvest perennial crops stipulated in Appendix 2 issued together with Circular 80/2021/TT-BTC:

Download the agricultural land use tax declaration form (Form 03/SDDNN): Here

What type of land does the agricultural land use tax declaration form (Form 03/SDDNN) in Vietnam apply to? (Image from the Internet)

What are the current agricultural land use tax rates in Vietnam?

Under Article 9 of the Agricultural Land Use Tax Law 1993, the agricultural land use tax rate is calculated in kilograms of rice per unit area for each land grade.

For land for annual crops and land with water surface for aquaculture:

| Land grade | Tax Rate |

| 1 | 550 |

| 2 | 460 |

| 3 | 370 |

| 4 | 280 |

| 5 | 180 |

| 6 | 50 |

- For land for perennial crops:

| Land grade | Tax Rate |

| 1 | 650 |

| 2 | 550 |

| 3 | 400 |

| 4 | 200 |

| 5 | 80 |

For perennial fruit trees planted on land for annual crops:

- 1.3 times the land for annual crops tax rate for land grades 1, 2, and 3.

- The same land for annual crops tax rate for land grades 4, 5, and 6.

For land for one-time harvest perennial crops:

- A tax rate of 4% of the production value.

Note: Households using agricultural land exceeding the area limit set by the Land Law must pay an additional tax as prescribed by the Standing Committee of the National Assembly for the excess area.

What types of land are subject to agricultural land use tax in Vietnam?

According to Article 2 of the Agricultural Land Use Tax Law 1993 and Article 2 of Decree 74-CP of 1993, the types of land subject to agricultural land use tax include:

- Croplands: lands for annual crops, perennial crops, and grasslands.

- Land for annual crops: land for crops with a growth period (from planting to harvest) not exceeding 365 days such as rice, corn, vegetables, peanuts, or crops harvested multiple times without undergoing a basic construction period like sugarcane, banana, reed, sisal, lemongrass, pineapple.

- Land for perennial crops: land for crops with a growth cycle exceeding 365 days, planted once but harvested over many years and requiring a basic construction period like rubber, tea, coffee, oranges, tangerines, longans, oil palms, coconuts.

- Grassland: lands already utilized for growing grass to raise livestock.

- Aquaculture areas: lands specifically used for aquaculture or both aquaculture and cropping, but not used for any other purposes.

- Plantation land: lands that have been forested and assigned to organizations or individuals for management, care, and exploitation, excluding bare hills and mountains.

Owners of tax-liable lands under this provision are required to pay taxes even if the land is not currently in use.

What are the cases of exemption and reduction of agricultural land use tax in Vietnam?

According to Chapter 5 of the Agricultural Land Use Tax Law 1993, the cases of exemption and reduction of agricultural land use tax in Vietnam include:

- Exemption for barren hills and mountains used for agricultural, forestry production, protective forests, and special-use forests.

- Exemption for reclaimed land not included in the above categories used for production:

+ Annual crops: 5 years; for mountainous, swamp, and reclaimed marine lands: 7 years.

+ Perennial crops: exempt during the basic construction period plus 3 years from the start of harvesting. For mountainous, swamp, and reclaimed marine lands, an additional 6 years are exempted.

- Timber and one-time harvest perennial crops are taxed only upon harvesting.

- Exemption for land for perennial crops undergoing replantation or transformation from annual to perennial crops, or fruit trees: during the basic construction period plus 3 years from the start of harvesting.

- Exemption for households relocating to new economic zones for agricultural production within the stipulated time plus an additional 2 years.

- For land currently under agricultural production, an exemption for 3 years from the date of receiving the land.

- In cases of natural disasters or enemy attacks causing crop failure, agricultural land use tax is reduced or exempted for each production season as follows:

+ Damage from 10% to less than 20%, tax is reduced proportionately to the damage level.

+ Damage from 20% to less than 30%, tax is reduced by 60%.

+ Damage from 30% to less than 40%, tax is reduced by 80%.

+ Damage from 40% or more, tax is fully exempted.

- Exemption or reduction for households in highland, mountainous, border, and island areas where production and living conditions are difficult.

- Exemption or reduction for ethnic minority households facing production and living difficulties.

- Exemption for households with disabled, elderly members with no means of support.

- Exemption for households with Category 1/4 and 2/4 wounded soldiers and Category 1/3 and 2/3 sick soldiers.- Exemption or reduction for households of fallen soldiers.

- Reduction for households with wounded or sick soldiers not eligible for exemption.