What operation does the environmental protection tax finalization declaration made in Form 02/PBVMT in Vietnam apply to?

Which objects are subject to environmental protection tax in Vietnam?

According to Article 3 of the Law on Environmental Protection Tax 2010, the following objects are subject to environmental protection tax:

- Gasoline, oil, grease, including:

+ Gasoline, except ethanol;

+ aircraft fuel;

+ diesel oil;

+ Petroleum;

+ Fuel oil;

+ lubricants;

+ Grease.

- Coal, including:

+ Lignite;

+ Anthracite Coal (anthracite);

+ Fat coal;

+ Other coal.

- Hydrogen-chlorofluorocarbon liquid (HCFC).

- Taxable-plastic bag.

- Herbicide which is restricted from use.

- Pesticide which is restricted from use.

- Forest product preservative which is restricted from use.

- Warehouse disinfectant which is restricted from use.

Note: When it is necessary to supplement other taxable objects as per period, the National Assembly Standing Committee shall consider and regulate.

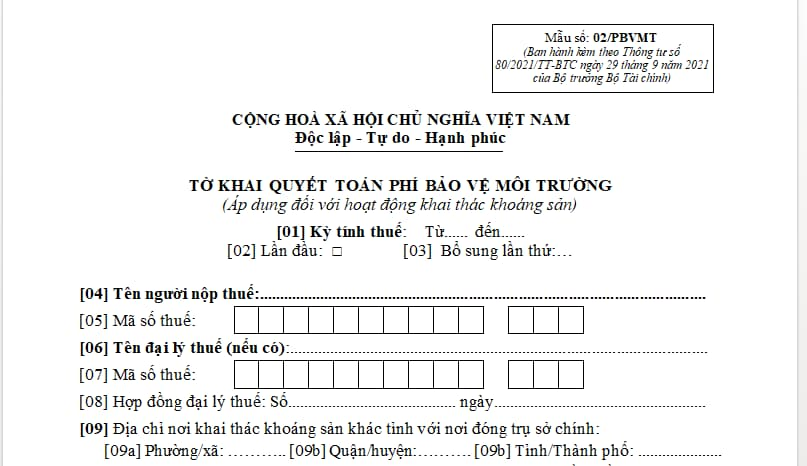

What operation does the environmental protection tax finalization declaration made in Form 02/PBVMT in Vietnam apply to? (Image from the Internet)

What operation does the environmental protection tax finalization declaration made in Form 02/PBVMT in Vietnam apply to?

The environmental protection tax finalization declaration made in Form 02/PBVMT in Vietnam applies to mineral extraction as stipulated in Appendix 2 issued together with Circular 80/2021/TT-BTC:

Download the environmental protection tax finalization declaration made in Form 02/PBVMT: Here

What is the tariff table for environmental protection tax in 2024?

According to Article 8 of the Environmental Protection Tax Law 2010, the tariff table is as follows:

- Absolute rates are specified in the tariff table below:

|

No. |

Goods |

Calculation unit |

Tax rate |

|

I |

Gasoline, oil, grease |

|

|

|

1 |

Gasoline, except ethanol |

lit |

1.000-4.000 |

|

2 |

aircraft fuel |

lit |

1.000-3.000 |

|

3 |

diesel oil; |

lit |

500-2.000 |

|

4 |

Petroleum |

lit |

300-2.000 |

|

5 |

Fuel oil |

lit |

300-2.000 |

|

6 |

lubricants |

lit |

300-2.000 |

|

7 |

Grease |

kg |

300-2.000 |

|

II |

Coal |

|

|

|

1 |

Lignite |

Tấn |

10.000-30.000 |

|

2 |

Anthracite Coal (anthracite) |

Tấn |

20.000-30.000 |

|

3 |

Fat coal |

Tấn |

10.000-30.000 |

|

4 |

Other coal |

Tấn |

10.000-30.000 |

|

III |

Hydrogen-chlorofluorocarbon liquid (HCFC). |

kg |

1.000-5.000 |

|

IV |

Taxable-plastic bag |

kg |

30.000-50.000 |

|

V |

Herbicide which is restricted from use |

kg |

500-2.000 |

|

VI |

Pesticide which is restricted from use |

kg |

1.000-3.000 |

|

VII |

Forest product preservative which is restricted from use |

kg |

1.000-3.000 |

|

VIII |

Warehouse disinfectant which is restricted from use |

kg |

1.000-3.000 |

- On the basis of the tax bracket prescribed in Clause 1 of this Article, the National Assembly Standing Committee provide for specific tax rate to each type of dutiable goods ensuring the following principles:

+ The tax rate on taxable goods in line with socio-economic development policy – social in each period;

+ The tax rate on taxable goods shall be determined under the extent of causing negative environmental impacts of the goods.

What are the procedures for declaring the environmental protection tax in Vietnam?

According to sub-item 21, Section 2 of the Administrative Procedures issued along with Decision 1462/QD-BTC of 2022, the procedures for declaring environmental protection tax are as follows:

Step 1: The taxpayer prepares data, fills out the declaration form, and submits it to the tax authority no later than the 20th of the month following the month in which the tax liability arises. To be specific:

- Taxpayers submit the environmental protection tax declaration dossier at the place of production of taxable goods, the place of production or business of coal, except for the environmental protection tax on petroleum business activities (stipulated at Point a, Clause 4, Article 11 of Decree 126/2020/ND-CP), environmental protection tax on coal extracted and consumed domestically (stipulated at Point b, Clause 4, Article 11 of Decree 126/2020/ND-CP).

- For petroleum business activities:

+ Main traders directly importing, producing, and blending petroleum submit tax declaration dossiers to the direct managing tax authority for the quantity of petroleum directly exported and sold by the main traders, including for internal consumption, for exchange of other products, for returning entrusted import goods, and for selling to other organizations and individuals that are not subsidiaries or dependent units under the Enterprise Law; except for the quantity of petroleum exported and imported for other main traders under entrustment.

+ Subsidiaries under the Enterprise Law of main traders or dependent units of subsidiaries, dependent units of main traders submit tax declaration dossiers to the direct managing tax authority for the quantity of petroleum exported and sold to other organizations and individuals that are not subsidiaries under the Enterprise Law of main traders and dependent units of subsidiaries.

+ Main traders or subsidiaries under the Enterprise Law of main traders having dependent units operating in different provinces or cities directly under the central government from the main trader's or subsidiary's headquarters, and the dependent units not being able to separately account for the tax, shall submit the environmental protection tax declaration to the direct managing tax authority; calculate the tax, and allocate the tax obligation to be payable to each locality where the dependent units are headquartered according to the regulations of the Minister of Finance.

- For coal extracted and consumed domestically:

Enterprises involved in coal extraction and domestic consumption, through management and assignment to subsidiaries or dependent units for extraction, processing, and consumption, the unit responsible for coal consumption shall declare taxes for the entire environmental protection tax arising on coal subject to tax and submit the tax declaration dossier to the direct managing tax authority, accompanied by the tax amount determination table for each locality where the coal extraction companies are headquartered, according to the regulations of the Minister of Finance.

Step 2: The tax authority receives:

- The tax management authority receives the tax declaration dossier, issues a receipt notice for the tax declaration dossier; if the dossier is not legal, complete, or correct in form, notify the taxpayer within 03 working days from the date of receipt of the dossier.

- In the case of receiving the dossier via the General Department of Taxation's electronic portal, the tax authority shall receive, review, and process the dossier through the electronic data processing system of the tax authority:

+ The electronic portal of the General Department of Taxation sends a receipt notice to the taxpayer (NNT) for the submitted dossier or notifies the reason for rejecting the dossier to the NNT via the electronic portal chosen by the taxpayer to prepare and submit the dossier (General Department of Taxation's electronic portal/state authority's electronic portal or T-VAN service provider) within 15 minutes from receiving the taxpayer's electronic tax declaration dossier.

+ The tax authority reviews and processes the taxpayer's tax declaration dossier according to the provisions of the Tax Administration Law and guiding documents, and sends an acceptance/rejection notice for the dossier to the electronic portal chosen by the taxpayer to prepare and submit the dossier within 01 working day from the date on the notice of receipt of the electronic tax declaration dossier.