What is the VAT rate for food and beverage services in Vietnam?

What is the tax rate for food and beverage services in Vietnam?

Based on Article 11 of Circular 219/2013/TT-BTC which stipulates a 10% tax rate applicable to goods and services not subject to VAT exemption, 0% VAT, or 5% VAT.

- The VAT rates mentioned in Article 10 and Article 11 of Circular 219/2013/TT-BTC are uniformly applied to each type of goods and services at the stages of importation, production, processing, or commercial business.

- Scrap and defective products recovered for recycling and reuse when sold are subject to VAT according to the tax rate of the sold scrap and defective products.

- Business establishments dealing with multiple types of goods and services with different VAT rates must declare VAT according to each prescribed tax rate for each type of goods and services; if the establishment does not determine according to each tax rate, it must calculate and pay tax according to the highest tax rate of the goods and services produced or traded by the establishment.

- During implementation, if there are cases where the VAT rate in the VAT rate tariff according to the Preferential Import Tariff List does not match the guidance in this Circular, it is implemented according to the guidance in Circular 219/2013/TT-BTC.

*Note: In the case where the VAT rate is not consistent for the same type of imported and domestically produced goods, the local tax authorities and local customs authorities report to the Ministry of Finance for prompt guidance to ensure consistent implementation.

From July 1, 2024, when Decree 72/2024/ND-CP officially takes effect, the groups of goods and services currently subject to a 10% tax rate will be reduced to 8%. However, except for the following groups of goods and services: based on Clause 1, Article 1 of Decree 72/2024/ND-CP

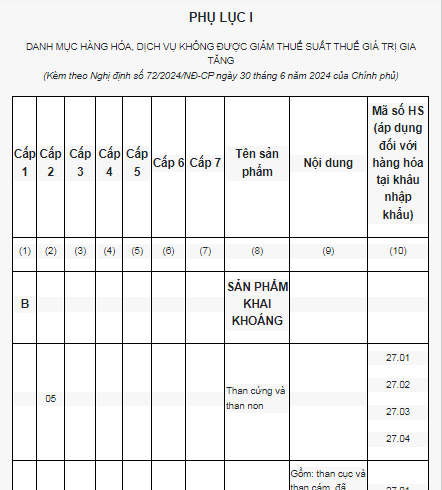

[1] Telecommunications, financial activities, banking, securities, insurance, real estate trading, metals and products from manufactured metals, mining products (excluding coal mining), coke, refined petroleum, chemical products. Details in Appendix 1 issued together with this Decree. (Download Appendix 1)

[2] Products and services subject to excise tax. Details in Appendix 2 issued together with this Decree. (Download Appendix 2)

[3] Information technology according to the law on information technology. Details in Appendix 3 issued together with this Decree. (Download Appendix 3)

[4] The reduction of VAT for each type of goods and services specified in Clause 1, Article 1 of Decree 72/2024/ND-CP is applied uniformly at the importation, production, processing, and commercial business stages.

For exported coal items (including the case where coal is processed through screening and classification according to a closed process before being sold), VAT reduction is applicable.

Coal items are listed in Appendix 1 issued together with this Decree (Download Appendix 1), at stages other than the stage of coal mining, VAT reduction is not applicable.

Corporations and economic groups implementing closed processes before selling are also subject to VAT reduction for coal mining.

If goods and services listed in Appendices 1, 2, and 3 issued with this Decree are not subject to VAT or subject to 5% VAT as prescribed by the VAT Law, they shall follow the VAT Law provisions and are not eligible for VAT reduction.

Food and beverage services are not among goods and services subject to 0% VAT, 5% VAT; therefore, they are subject to 10% VAT.

Thus, from July 1, 2024, to December 31, 2024, VAT on food and beverage services will be 8%, and from January 1, 2025, it will revert to the 10% rate.

What is the VAT rate for food and beverage services in Vietnam? (Image from the Internet)

Where to declare VAT in Vietnam?

Based on Article 20 of Circular 219/2013/TT-BTC which dictates the place of tax submission as follows:

Place of tax submission

1. Taxpayers declare and pay VAT at the location where production and business activities take place.

2. Taxpayers that declare and pay VAT by deduction method with production facilities accounting independently located in different provinces or cities from where the headquarters is situated must pay VAT at the location of the production facility and the location where the headquarters is located.

3. In case a business or cooperative applying the direct method has a production facility in a province or city different from where the headquarters is or has sales activities interprovincially, the business or cooperative declares and pays VAT based on a percentage (%) on the revenue generated outside the province at the location of the production facility or where the mobile sales take place. The business or cooperative does not have to pay VAT by the percentage (%) on revenue at the headquarters for the revenue generated outside the province that has been declared and paid.

4. For telecom service businesses providing post-paid services at provincial or city levels different from the headquarters and have dependent branches declaring VAT by deduction also participating in the provision of post-paid telecom services at those locations, the telecom service businesses must declare and pay VAT on post-paid telecom services as follows:

- Declare VAT on the revenue of post-paid telecom services of the entire business to the tax authority directly managing the headquarters.

- Pay VAT at the location where the headquarters is and at the location where the dependent branch is situated.

The VAT amount payable at the location of the dependent accounting branch is determined as 2% (for post-paid telecom services subject to VAT at 10%) of the revenue (excluding VAT) of post-paid telecom services at the location of the dependent accounting branch.

5. VAT declaration and payment are carried out according to the Tax Management Law and the accompanying legal guidance documents.

Thus, it can be seen that VAT is declared at the local tax office where the production and business activities occur, meaning the local tax office.

What is the list of goods and services not eligible for VAT rate reduction in Vietnam in 2024?

According to Appendices 1, 2, and 3 of the List of goods and services not eligible for VAT rate reduction issued with Decree 72/2024/ND-CP, the list of goods and services not eligible for VAT rate reduction in 2024 is as follows:

>>>Download the latest list of goods and services not eligible for VAT rate reduction in 2024.

Note:

- The above list contains goods and services not eligible for VAT reduction from 10% to 8%, hence maintaining a VAT rate of 10% for these items. Other goods not in the list will have VAT reduced from 10% to 8%.

- The Appendix of goods and services not eligible for VAT reduction is a part of the Appendix on the System of Vietnam Product Industries issued with Decision 43/2018/QD-TTg on November 1, 2018, by the Prime Minister of Vietnam regarding the System of Vietnam Product Industries.

- The HS code in column (10) is for reference only. Determination of HS codes for actual imported goods is performed according to the classification rules in the Customs Law and accompanying legal documents guiding the implementation of the Customs Law.

- Items marked (*) in column (10) have to declare HS codes according to the actual imported goods.