What is the VAT declaration form for October 2024? What is the deadline for submitting the VAT declaration in Vietnam for October 2024?

Vietnam: What is the VAT declaration form for October 2024?

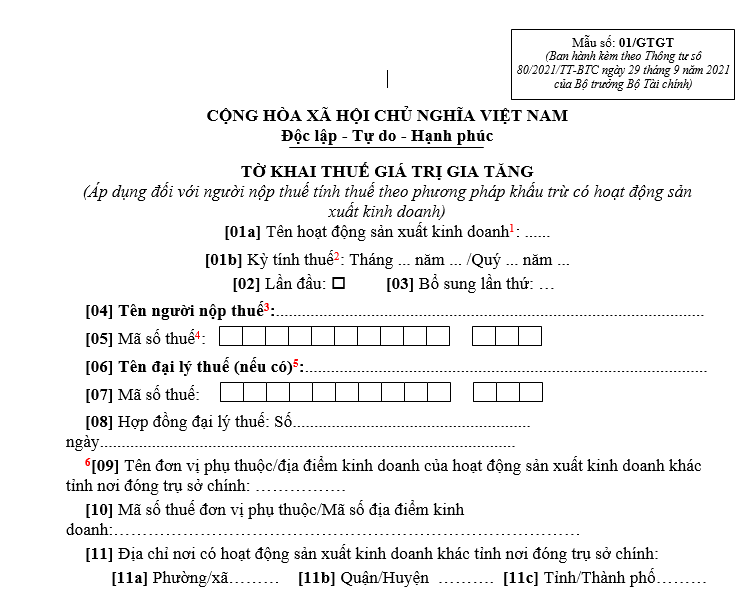

Based on the provisions in Appendix 2 issued together with Circular 80/2021/TT-BTC, the template of the VAT declaration is regulated as follows:

VAT declaration template for October 2024....download here

Note: VAT declaration Template No. 01/GTGT according to Circular 80/2021/TT-BTC is the VAT declaration (applicable to taxpayers calculating tax by the credit method with business operations)

What is the deadline for submitting the VAT declaration in Vietnam for October 2024?

According to Clause 1, Article 44 of the Law on Tax Administration 2019, specific regulations on the tax declaration submission deadline are as follows:

Deadline for submitting the tax declaration dossier

- The deadline for submitting the tax declaration dossier for taxes declared monthly and quarterly is regulated as follows:

a) No later than the 20th day of the following month for monthly tax declaration and payment;

b) No later than the last day of the first month of the next quarter for quarterly tax declaration and payment.

- The deadline for submitting the tax declaration dossier for taxes calculated annually is regulated as follows:

a) No later than the last day of the third month following the end of the calendar year or fiscal year for annual tax finalization dossiers; no later than the last day of the first month of the calendar year or fiscal year for annual tax declaration dossiers;

b) No later than the last day of the fourth month following the end of the calendar year for individual income tax finalization dossiers for individuals directly finalizing tax;

c) No later than December 15 of the preceding year for fixed tax declaration dossiers for business households and individuals paying tax by the fixed method; in the case of newly operating business households and individuals, the deadline is no later than 10 days from the start of business operations.

...

Hence, according to the above regulations, the exact deadline for submitting the VAT declaration for October 2024 is November 20, 2024.

What are penalties for late submission of the VAT declaration in Vietnam for October 2024?

According to Article 13 of Decree 125/2020/ND-CP, regulations on penalties for violations regarding the tax declaration submission deadline are as follows:

- Warning for late submission of the tax declaration from 01 day to 05 days with mitigating circumstances.

- Fine from VND 2,000,000 to VND 5,000,000 for late submission of the tax declaration from 01 day to 30 days, except as stipulated in Clause 1 of this Article.

- Fine from VND 5,000,000 to VND 8,000,000 for submitting the tax declaration from 31 days to 60 days late.

- Fine from VND 8,000,000 to VND 15,000,000 for any of the following acts:

- Submitting the tax declaration from 61 days to 90 days late;

- Submitting the tax declaration from 91 days onwards but no tax due arises;

- Not submitting the tax declaration but no tax due arises;

- Not submitting appendices according to tax management regulations for enterprises with affiliated transactions attached to the corporate income tax finalization dossier.

- Fine from VND 15,000,000 to VND 25,000,000 for submitting the tax declaration over 90 days late from the deadline with incurred tax liability, provided the taxpayer has fully paid the tax and late payment amount to the state budget before the tax authority announces the tax inspection, audit decision, or before the tax authority makes a report on the late submission of the tax declaration file as specified in Clause 11, Article 143 of the Law on Tax Administration.

Note: For the same administrative violation regarding taxes or invoices, the fine for organizations is twice the amount imposed on individuals.

Where to submit the VAT declaration in Vietnam?

According to Article 45 of the Law on Tax Administration 2019, specific regulations on the location for submitting the VAT declaration dossier are as follows:

- Taxpayers submit the tax declaration dossier to the directly managing tax authority.

- In case of submitting the tax declaration dossier under the one-stop-shop mechanism, the submission location is according to the regulations of that mechanism.

- The submission location for tax declaration dossiers of exported or imported goods is in accordance with the Law on Customs.

- The Government of Vietnam shall regulate submission locations for tax declaration dossiers for the following cases:

+ Taxpayers with multiple production and business operations;

+ Taxpayers operating production and business in various localities; taxpayers with tax obligations arising from types of taxes declared and paid per occurrence;

+ Taxpayers with tax obligations arising from land-related revenue; issuance of water resource exploitation rights, mineral resources;

+ Taxpayers with personal income tax finalization obligations;

+ Taxpayers declaring taxes through electronic transactions and other necessary cases.