What is the time limit for tax refund procedure under the Double Taxation Agreement in Vietnam?

What is the procedure for tax refund under the Double Taxation Agreement in Vietnam?

Based on sub-section 86, Section 2, Administrative Procedures issued together with Decision 1462/QD-BTC in 2022, the procedure for tax refund under the Double Taxation Agreement is guided as follows:

Step 1. Organizations or individuals eligible for tax refund under the Double Taxation Agreement prepare a tax refund dossier and send it to the Tax Department managing the place where the organization’s head office is located, where the individual has a permanent establishment, or the Tax Department where the organization or individual has paid the tax amount requested for refund.

Step 2. The tax authority receives:

- If the dossier is submitted directly to the tax authority or sent via postal service: the tax authority shall receive and process the dossier and return the result as regulated.

- If the dossier is submitted to the tax authority via electronic transactions, the reception, inspection, acceptance, and processing of the dossier shall be through the tax authority's electronic data processing system.

What is the time limit for tax refund procedure under the Double Taxation Agreement in Vietnam? (Image from the Internet)

Vietnam: What does the dossier for tax refund under the Double Taxation Agreement include?

Based on sub-section 86, Section 2, Administrative Procedures issued together with Decision 1462/QD-BTC in 2022, the dossier for tax refund under the Double Taxation Agreement includes:

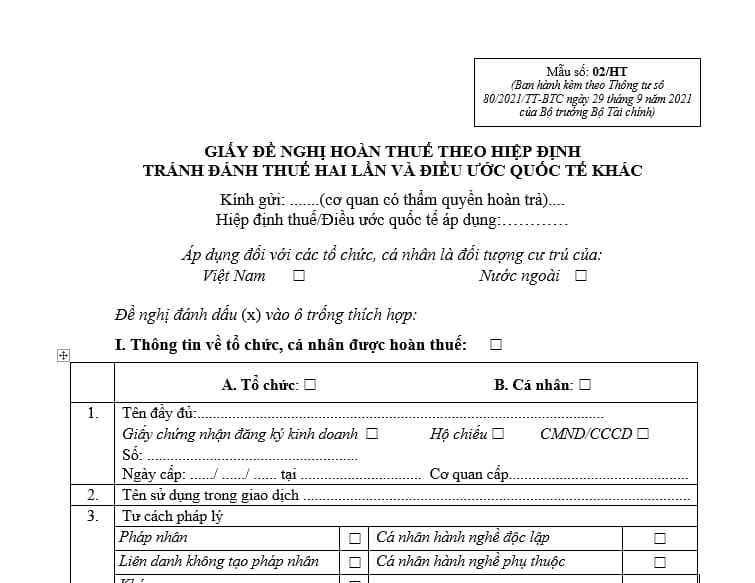

- Application for tax refund form according to the Double Taxation Agreement and other international treaties, Form 02/HT issued together with Circular 80/2021/TT-BTC.

- Certificate of residence issued by the tax authority of the country of residence, legally notarized, indicating the subject of residence for the specific tax year;

- A copy of the economic contract, service provision contract, agency contract, entrusted contract, technology transfer contract, or labor contract signed with Vietnamese organizations or individuals, certificate of deposit in Vietnam, certificate of capital contribution to a company in Vietnam (depending on the type of income in each specific case) certified by the taxpayer;

- Written confirmation from the Vietnamese organization or individual signing the contract regarding the time and actual activities according to the contract (except for tax refund for foreign transport companies);

- Power of attorney in case the organization or individual authorizes a legal representative to carry out the tax treaty procedures. If the organization or individual makes a power of attorney to authorize a legal representative to carry out the tax refund procedures into another subject’s account, the legalization procedure must be carried out (if the authorization is made abroad) or notarized (if the authorization is made in Vietnam) according to regulations;

- List of tax payment documents, Form 02-1/HT issued together with Circular 80/2021/TT-BTC.

What is the time limit for tax refund procedure under the Double Taxation Agreement?

Based on sub-section 86, Section 2, Administrative Procedures issued together with Decision 1462/QD-BTC in 2022, the time limit for tax refund procedure under the Double Taxation Agreement is as follows:

- First-time tax refund for each contract or agreement signed with organizations or individuals in Vietnam according to the Double Taxation Agreement and other international treaties of which the Socialist Republic of Vietnam is a member, subject to pre-inspection, post-refund.

- For dossiers subject to pre-inspection, post-refund: no later than 40 (forty) days from the date of receipt of a complete tax refund dossier.

What is Form 02/HT - Application for tax refund under the Double Taxation Agreement?

Form 02/HT, Application for tax refund under the Double Taxation Agreement, or other international treaties is regulated in Appendix 1 issued together with Circular 80/2021/TT-BTC.

Download the Form 02/HT, Application for tax refund under the Double Taxation Agreement, or other international treaties here: Here