What is the taxable value for natural aquatic products in Quang Nam province for 2025?

What is the taxable value for natural aquatic products in Quang Nam province for the year 2025?

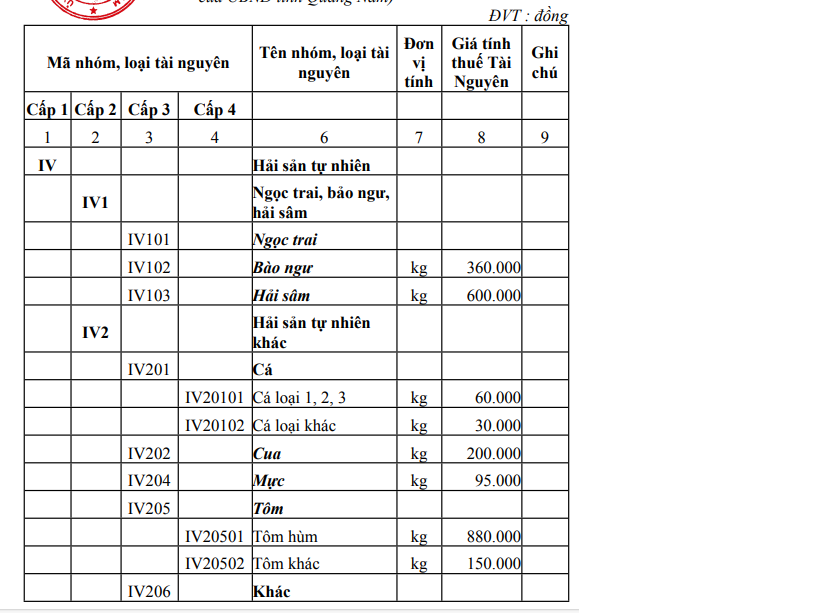

Pursuant to Appendix IV issued with Decision 3332/QD-UBND in 2024 by Quang Nam province on issuing the Price List for resource royalty in 2025 in Quang Nam province, the taxable value for natural aquatic products is specifically stipulated as follows:

Note: The unit of measurement is kg, the currency unit is dong.

Download Decision 3332/QD-UBND in 2024 of Quang Nam province

Download Price List for resource royalty for natural aquatic products: Appendix IV

What is the taxable value for natural aquatic products in Quang Nam province for 2025? (Image from the Internet)

Which entities are resource royalty payers in Vietnam according to current regulations?

Pursuant to Article 3 Circular 152/2015/TT-BTC, those responsible for paying resource royalty are organizations and individuals exploiting resources subject to resource royalty as specified in Article 2 Circular 152/2015/TT-BTC. The taxpayers (hereinafter referred to as tax payers - NNT) in certain cases are specified as follows:

- For mineral resource exploitation activities, the taxpayer is the organization or business household licensed by the competent state agency to exploit minerals.

+ If an organization licensed by the competent state agency to exploit minerals is allowed to cooperate with other organizations or individuals to exploit resources and there are specific rules regarding the taxpayer, the resource royaltypayer is determined according to such documentation.

+ If the organization is licensed by the competent state agency to exploit minerals and subsequently delegates authority to affiliated units to exploit resources, each exploiting unit is the resource royaltypayer.

- Enterprises engaged in resource extraction formed on a joint venture basis are considered tax payers;

+ In cases where both Vietnamese and foreign parties participate in a joint business contract to exploit resources, the responsibility for tax payment of the parties should be clearly defined in the joint business contract. If the contract does not specify which party is responsible for paying the resource royalty, all parties involved in the contract must declare and pay the resource tax or appoint a representative to do so on behalf of the joint business contract.

- Organizations or individuals contracted for construction projects that, during implementation, generate quantities of resources that, with permission from state management agencies or adhering to legal regulations on resource management and exploitation, are utilized or consumed, must declare and pay resource tax to the local tax authority where the resource exploitation occurs.

- Organizations or individuals using water from irrigation facilities for hydroelectric power generation are subject to resource royalty as stipulated in this Circular, regardless of the funding source for the irrigation facility.

If an organization managing the irrigation facility supplies water to other organizations or individuals for domestic water production or other purposes (except for hydroelectric power generation), the organization managing the irrigation facility is the taxpayer.

- For prohibited or illegally extracted natural resources that are seized and confiscated but allowed to be sold, the organization in charge of the sale must declare and pay resource royalty on each occurrence at the tax agency managing the organization handling the sale before deducting related costs of capture, auction, and bonus allocation according to specified policies.

What are regulations on the resource royalty in Vietnam?

According to Clause 2, Article 4 Circular 152/2015/TT-BTC, the resource royalty is determined using the following formula:

resource royalty payable in the period = Taxable resource yield x Unit taxable price of the resource x Resource tax rate

In cases where the state agency determines the resource tax amount payable per unit of resource exploited, the tax amount is determined as follows:

resource royalty payable in the period = Taxable resource yield x Stipulated resource tax level per unit of resource extracted

Tax imposition is conducted based on the Tax Authority’s database and in accordance with regulations on tax imposition under the law governing tax management.

How is the taxable resource output determined?

Pursuant to Article 5 Resource Tax Law 2009, the determination of taxable resource output is as follows:

- For resources whose quantity, weight, or volume can be determined, the taxable output is the actual quantity, weight, or volume of resources extracted in the tax period.

- For resources whose quantity, weight, or volume cannot be determined due to the presence of various substances, the taxable output is determined by the quantity, weight, or volume of each substance obtained after screening and classification.

- For resources not sold but used in manufacturing other products, if the actual quantity, weight, or volume cannot be directly determined, the taxable output is based on the production volume in the tax period and the resource utilization standard per product unit.

- For natural water used for hydroelectric production, the taxable output is the volume of electricity sold or delivered by the hydroelectric facility to the buyer as per the power purchasing contract or determined per system measurements meeting Vietnamese metrological quality standards, verified by the seller, buyer, or either party involved.

- For natural mineral water, hot water, or water used for industrial purposes, the taxable output is measured in cubic meters (m³) or liters (l) as per measurement systems adhering to Vietnamese metrological quality standards.

- For resources extracted manually, dispersedly or via mobile, non-regular means, where the estimated annual extraction value is under 200,000,000 dong, resource extraction is allocated seasonally or periodically for tax calculation. The tax authorities in collaboration with relevant local agencies determine the allocated resource output for tax assessment.