What is the tax incentive consideration period in the Tax Incentive Program for automobile manufacturing and assembly in Vietnam?

What is the tax incentive consideration period in the Tax Incentive Program for automobile manufacturing and assembly in Vietnam?

The tax incentive consideration period in the Tax Incentive Program for automobile manufacturing and assembly is determined according to Clause 4, Article 8 of Decree 26/2023/ND-CP as follows:

Preferential import tax rates for imported automobile components under the Tax Incentive Program for automobile manufacturing and assembly (Tax Incentive Program)

...

4. Tax incentive consideration period

Enterprises can choose a 6-month or 12-month tax incentive consideration period as follows:

a) The 6-month tax incentive consideration period is calculated from January 1 to June 30 or from July 1 to December 31 annually.

In case an enterprise selects the 6-month tax incentive consideration period and has been handled for overpaid tax against the components used for manufacturing and assembling automobiles released during the first 6 months and the last 6 months of the year but not achieving the production conditions as stipulated by the Tax Incentive Program, if the total annual production meets the conditions for the 12-month tax incentive consideration period as stipulated by the Tax Incentive Program, they will still be eligible for tax incentives for the last 6 months, and at the same time, will be handled for overpaid tax against the components used if they meet the provisions of Clauses 2, 3, 6, 7, 8 of this Article.

b) The 12-month tax incentive consideration period is calculated from January 1 to December 31 annually.

Thus, according to the above regulations, enterprises can choose a 6-month or 12-month tax incentive consideration period. Specifically:

- For the 6-month tax incentive consideration period:

Calculated from January 1 to June 30 or from July 1 to December 31 annually.

- For the 12-month tax incentive consideration period:

Calculated from January 1 to December 31 annually.

What is the tax incentive consideration period in the Tax Incentive Program for automobile manufacturing and assembly in Vietnam? (Image from the Internet)

What is the new preferential import tax rate for imported automobile components under the Tax Incentive Program in Vietnam?

According to the provisions of Clause 1, Article 8 of Decree 26/2023/ND-CP as follows:

Preferential import tax rates for imported automobile components under the Tax Incentive Program for automobile manufacturing and assembly (Tax Incentive Program)

1. The preferential import tax rate of 0% is regulated for imported automobile components classified under group 98.49 in Clause 3, Section II, Appendix II issued together with this Decree as follows:

a) At the time of customs declaration, the declarant shall declare and calculate taxes for imported goods at the ordinary import tax rate, the preferential import tax rate, or the special preferential import tax rate as prescribed, without applying the 0% preferential import tax rate of group 98.49.

b) The application of the 0% preferential import tax rate for automobile components classified under group 98.49 follows the provisions of Clauses 2, 3, 4, 5, 6, 7, 8 of this Article.

Thus, the new preferential import tax rate for imported automobile components under the Tax Incentive Program is determined to be 0% for components classified under group 98.49 in Clause 3, Section II, Appendix II issued together with Decree 26/2023/ND-CP when certain conditions are met.

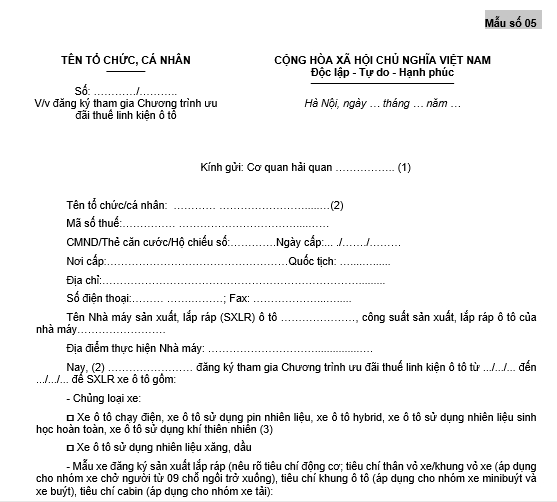

Where to download the Official Dispatch form to register for participation in the Tax Incentive Program for automobile manufacturing and assembly in Vietnam?

The Official Dispatch form to register for participation in the Tax Incentive Program for automobile manufacturing and assembly is Form No. 05, Appendix II issued together with Decree 26/2023/ND-CP.

>> Download the Official Dispatch form to register for participation in the Tax Incentive Program for automobile manufacturing and assembly

Additionally, the application dossier for participating in the Tax Incentive Program for automobile manufacturing and assembly includes:

- Official Dispatch for registering to participate in the automobile component tax incentive program: 01 original copy;

- Certificate of eligibility for automobile manufacturing and assembly: 01 certified copy.

Enterprises shall submit the registration dossier for participation in the Tax Incentive Program directly or via the electronic data system or by post to the customs authority where the enterprise is headquartered or where the manufacturing and assembly plant is located to register for participation in the Tax Incentive Program from the effective date of this Decree or at any time annually during the Tax Incentive Program period.

The participation period in the Tax Incentive Program begins from the date of the registration official dispatch onward.