What is the tax declaration form for property leasing activities in Vietnam?

What is the tax declaration form for property leasing activities in Vietnam?

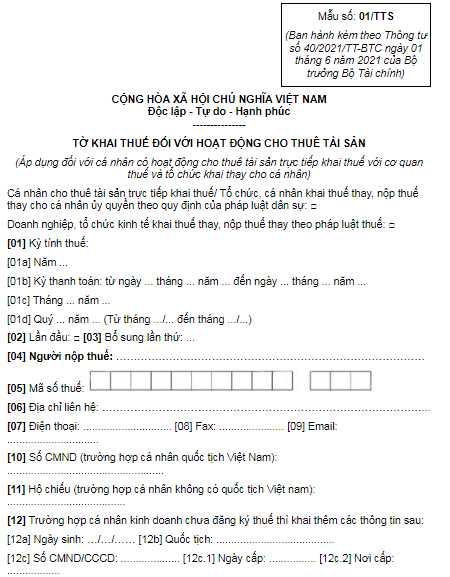

The tax declaration form for property leasing activities is Form No. 01/TTS, issued together with Circular 40/2021/TT-BTC as follows:

Download the tax declaration form for property leasing activities.

What is the tax declaration form for property leasing activities in Vietnam? (Image from the Internet)

How to calculate tax for lessors who are individuals in Vietnam?

Based on Clause 1, Article 9 of Circular 40/2021/TT-BTC amended by Clause 3, Article 1 of Circular 100/2021/TT-BTC, the regulations are as follows:

- lessors who are individuals include those who generate revenue from leasing properties such as houses, premises, shops, factories, warehouses (excluding lodging services); leasing transportation means, machines, and equipment without operators; and leasing other properties without accompanying services. Lodging services excluded from property leasing activities under this guidance include:

+ Providing short-term lodging for tourists and other transient visitors.+ Providing long-term lodging not in apartment form for students, workers, and similar groups.+ Providing lodging along with food services or entertainment facilities.

- lessors who are individuals declare taxes on each payment cycle occurrence (determined by the start of the lease period of each payment cycle) or annually on a calendar year basis. Individuals can declare taxes for each contract or multiple contracts on one declaration form if the leased properties are within the same tax authority jurisdiction.

- Individuals only leasing property for part of the year with an annual rental income of 100 million VND or less are exempt from VAT and personal income tax (PIT). If the tenant pays for multiple years in advance, the revenue for determining tax liability is prorated annually.

- For individuals receiving advance payments for multiple years, the tax is declared and paid once for the total advance revenue. The lump-sum tax is the aggregate tax of each calendar year according to regulations. If there are changes in the lease terms resulting in changes to the taxable revenue, payment cycles, or lease duration, individuals must adjust and supplement their tax declarations according to the Law on Tax Administration for the relevant taxation period with changes.

Does the tax declaration dossier for lessors who are individuals require a tax declaration form in Vietnam?

Based on Clause 1, Article 14 of Circular 40/2021/TT-BTC, the tax declaration dossier for lessors who are individuals is as follows:

- The tax declaration dossier for direct tax declaration by lessors who are individuals with the tax authority as specified in sub-point a, point 8.5, Appendix I - List of tax declaration dossiers issued together with Decree 126/2020/ND-CP of the Government of Vietnam. Specifically:

+ Tax declaration form for property leasing activities (applicable to lessors who are individuals directly declaring tax with the tax authority and organizations declaring on behalf of individuals) as per Form No. 01/TTS Download issued together with Circular 40/2021/TT-BTC;

+ Annex detailing property lease contracts (applicable to lessors who are individuals directly declaring tax with the tax authority if it is the first tax declaration of the contract or contract annex) per Form No. 01-1/BK-TTS Download issued together with Circular 40/2021/TT-BTC;

+ Copy of the property lease contract, contract annex (if it is the first tax declaration of the contract or contract annex);

+ Copy of the Power of Attorney as per legal regulations (in case the individual leasing property authorizes a legal representative to perform tax procedures).

The tax authority has the right to request the original documents for verification of the copy's accuracy against the originals.

Thus, the tax declaration dossier for lessors who are individuals directly must include the tax declaration form for property leasing activities.

What are the procedures for submitting tax declaration dossiers for direct tax declaration by lessors who are individuals in Vietnam?

Based on Clause 1, Article 14 of Circular 40/2021/TT-BTC, the procedures for submitting tax declaration dossiers for lessors who are individuals are as follows:

* Regarding the place of submitting the tax declaration dossier

The place for submitting the tax declaration dossier for lessors who are individuals, directly declaring tax with the tax authority, as stipulated in Clause 1, Article 45 of the Law on Tax Administration 2019. Specifically:

+ Individuals with income from leasing property (excluding real estate in Vietnam) submit tax declaration dossiers to the Tax Department that directly manages the place of residence.

+ Individuals with income from leasing real estate in Vietnam submit the tax declaration dossier to the Tax Department that directly manages the location of the leased real estate.

* Regarding the deadline for submitting the tax declaration dossier

- The deadline for submitting the tax declaration dossier for lessors who are individuals directly declaring tax with the tax authority is specified in point a, Clause 2 and Clause 3, Article 44 of the Law on Tax Administration 2019. Specifically:

+ The deadline for submitting the tax declaration dossier for individuals declaring tax on each payment cycle occurrence is no later than the 10th day from the start of the lease period for that payment cycle.

+ The deadline for submitting the tax declaration dossier for individuals declaring one-time annual tax is no later than the last day of the first month of the following calendar year.

* Regarding the deadline for tax payment

The tax payment deadline for lessors who are individuals directly declaring tax with the tax authority is as stipulated in Clause 1, Article 55 of the Law on Tax Administration 2019. Specifically, the tax payment deadline is the last day of the tax declaration dossier submission deadline. In the case of supplementary tax declarations, the tax payment deadline is the tax declaration dossier submission deadline for the taxation period with the error.