What is the table for determining PIT on income from salaries and remunerations in Vietnam?

What is the table for determining PIT on income from salaries and remunerations in Vietnam?

Based on Clause 3, Article 19 of Circular 80/2021/TT-BTC, which stipulates regulations on tax declaration, tax calculation, and distribution of personal income tax, as follows:

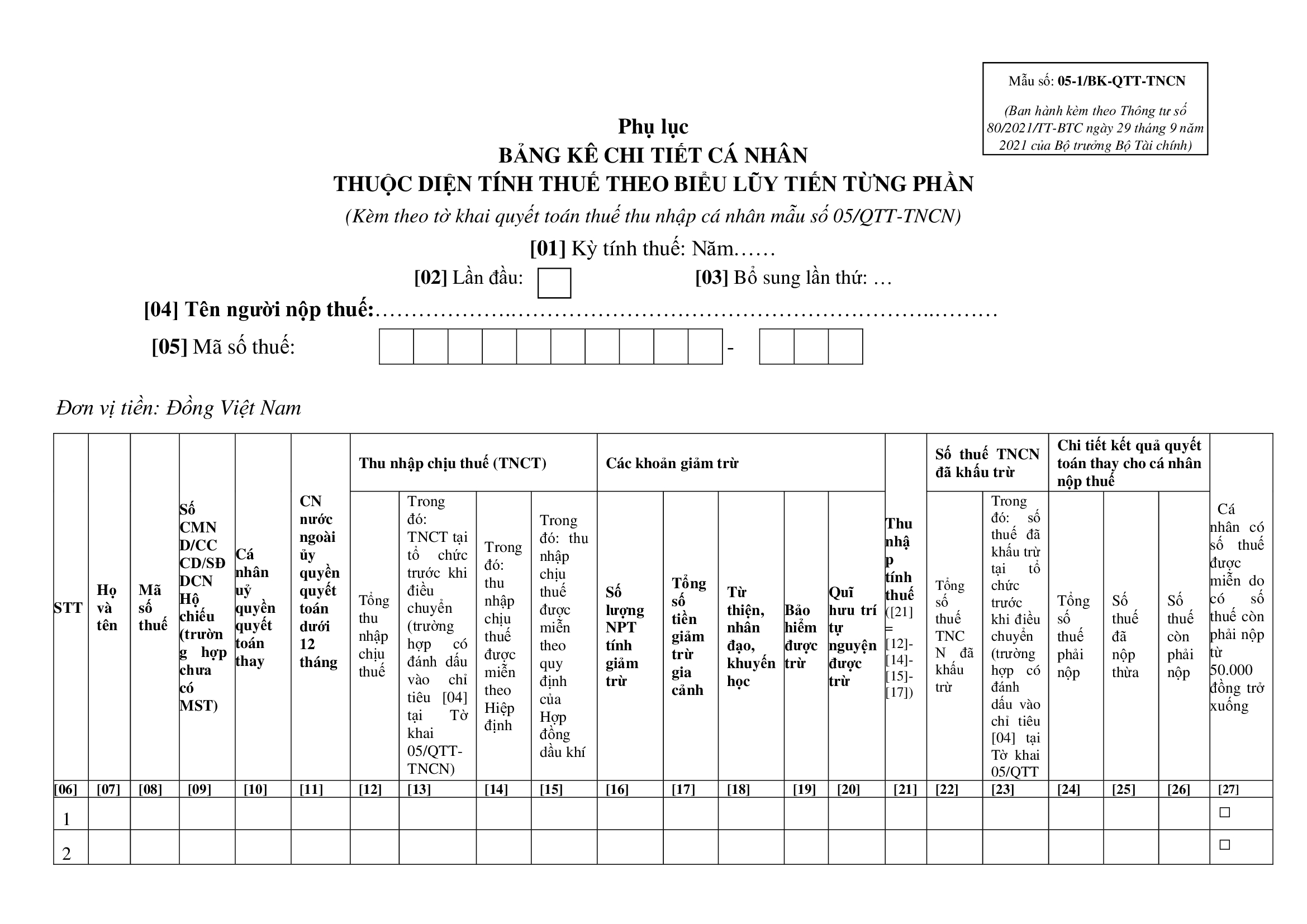

The appendix of the table for determining personal income tax payable on earnings from wages, salaries, and winnings is implemented according to the provisions in Appendix Form 05-1/PBT-KK-TNCN issued together with Circular 80/2021/TT-BTC, as follows:

Download Form 05-1/PBT-KK-TNCN here.

What is the table for determining PIT on income from salaries and remunerations in Vietnam? (Image from the Internet)

What are guidelines for PIT declaration on income from salaries and remunerations in Vietnam?

Based on Clause 3, Article 19 of Circular 80/2021/TT-BTC, which stipulates guidelines on tax declaration, tax calculation, and distribution of personal income tax as follows:

(1) Taxpayers who pay wages and salaries to employees working at dependent units, business locations in different provinces from the headquarters, implement personal income tax withholding on the income from wages and salaries as prescribed and submit the tax declaration dossier, including:

- Tax declaration dossier according to Form No. 05/KK-TNCN,

- Appendix of the table for determining personal income tax payable for localities entitled to revenue sources according to Form No. 05-1/PBT-KK-TNCN issued together with Appendix II Circular 80/2021/TT-BTC to the directly managing tax authority;

- Pay personal income tax on income from wages and salaries to the state budget for each province where employees work as stipulated in Clause 4, Article 12 of Circular 80/2021/TT-BTC.

Personal income tax for each province is determined monthly or quarterly according to the personal income tax declaration period and is not re-determined when finalizing personal income tax.

(2) Individuals with income from wages and salaries directly declaring tax with the tax authority include: resident individuals with income from wages and salaries paid from abroad; non-resident individuals with income from wages and salaries arising in Vietnam but paid from abroad; individuals with income from wages and salaries paid by International organizations, Embassies, Consulates in Vietnam but not yet withheld taxes; individuals receiving stock bonuses from the paying unit.

What are regulations on PIT distribution in Vietnam?

Based on Clause 2, Article 19 of Circular 80/2021/TT-BTC, the regulations are as follows:

Tax Declaration, Tax Calculation, and Distribution of Personal Income Tax

1. distribution Cases:

a) Withholding personal income tax on wages and salaries paid at the headquarters for employees working at dependent units, business locations in different provinces.

b) Withholding personal income tax on winnings of individuals winning electronic lottery prizes.

2. distribution Method:

a) Allocating personal income tax on wages and salaries:

Taxpayers determine separately the personal income tax to be allocated on income from wages and salaries of individuals working in each province according to the actual withheld tax of each individual. If employees are transferred, rotated, or seconded, then based on the time of income payment, the personal income tax withheld is calculated for the province where the employee is working at that time.

b) Allocating personal income tax on winnings of individuals winning electronic lottery prizes:

Taxpayers determine separately the personal income tax payable on winnings of individuals winning electronic lottery prizes in each province where the individual registers to participate through telecommunications or internet distribution methods and where electronic lottery tickets are issued through end devices based on the actual withheld tax of each individual.

...

The personal income tax distribution method includes:

- Allocating personal income tax on wages and salaries:

Taxpayers determine separately the personal income tax to be allocated on income from wages and salaries of individuals working in each province according to the actual withheld tax of each individual.

In the case of employees being transferred, rotated, or seconded, based on the time of income payment, the province in which the employee is working at that time is considered for the personal income tax withheld.

- Allocating personal income tax on winnings of individuals winning electronic lottery prizes:

Taxpayers determine separately the personal income tax payable on winnings of individuals winning electronic lottery prizes in each province where the individual registers to participate through telecommunications or internet distribution methods and where electronic lottery tickets are issued through end devices based on the actual withheld tax of each individual.