What is the supplementary declaration of purchased goods and services subject to 8% VAT into the Appendix for VAT reduction in Vietnam according to Resolution 142/2024?

What is the supplementary declaration of purchased goods and services subject to 8% VAT into the Appendix for VAT reduction in Vietnam according to Resolution 142/2024?

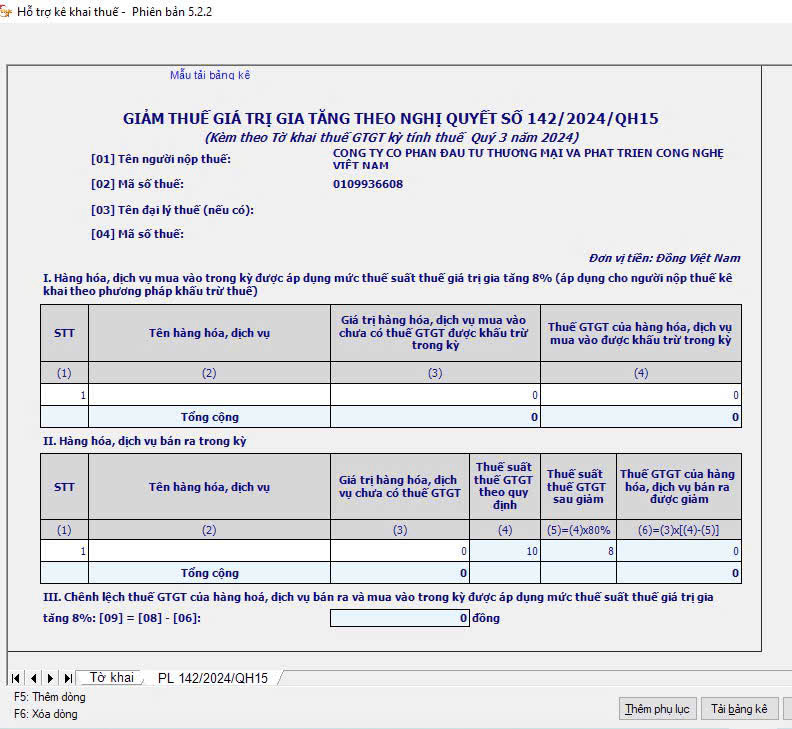

According to the interface for declaring VAT returns with the 2% VAT reduction Appendix pursuant to Resolution 142/2024/QH15, it has been updated on the HTKK version 5.2.2.

Simultaneously, based on the procedure for implementing VAT reduction according to Decree 72/2024/ND-CP, the guidance is as follows:

- For business establishments calculating VAT using the credit method and applying an 8% VAT rate, when issuing VAT invoices for goods and services subject to VAT reduction, they should record "8%" at the VAT rate line; the VAT amount; and the total amount payable by the buyer.

Based on the VAT invoice, the business selling goods and services declares output VAT, and the business purchasing goods and services declares input VAT credit according to the reduced tax stated on the VAT invoice.

Thus, when declaring the 2% VAT reduction Appendix in HTKK 5.2.2 according to Resolution 142/2024/QH15, it is necessary to supplementaryly declare purchase invoices for services during the period subject to an 8% VAT rate.

What is the supplementary declaration of purchased goods and services subject to 8% VAT into the Appendix for VAT reduction in Vietnam according to Resolution 142/2024? (Image from the Internet)

What goods and services are not eligible for VAT reduction in Vietnam in 2024?

Article 1 of Decree 72/2024/ND-CP stipulates VAT reduction for groups of goods and services currently subject to a 10% tax rate, except for the following groups:

- Telecommunications, financial, banking, securities, insurance activities, real estate business, metals and fabricated metal products, mining products (excluding coal mining), coke, refined petroleum, chemical products.

Details are in Appendix I issued together with Decree 72/2024/ND-CP.

- Goods and services subject to special consumption tax.

Details are in Appendix II issued together with Decree 72/2024/ND-CP.

- Information technology according to IT law.

Details are in Appendix III issued together with Decree 72/2024/ND-CP.

- VAT reduction for each type of goods and services specified in Clause 1, Article 1 of Decree 72/2024/ND-CP is uniformly applied at import, production, processing, and commercial trading stages. For coal mining products sold (including cases where coal is mined and then undergoes sorting and classification through a closed process before being sold), they are subject to VAT reduction. Coal products in Appendix I issued with Decree 72/2024/ND-CP at stages other than mining sale are not eligible for VAT reduction.

Corporations, economic groups executing the closed process for selling coal mining products are also eligible for VAT reduction for coal mining products sold.

In cases where goods and services listed in Appendices I, II, and III issued with Decree 72/2024/ND-CP fall under non-VAT taxable or 5% VAT taxable subjects according to the Law on VAT, they comply with the relevant provisions and are not eligible for VAT reduction.

How to issue VAT reduction invoices in Vietnam according to Decree 72?

Based on Clauses 3 and 4, Article 1 of Decree 72/2024/ND-CP, which regulate the order and procedures for reducing VAT, the issuance of VAT reduction invoices is as follows:

VAT Reduction

…

3. Order and procedures

a) For business establishments specified at Point a, Clause 2 of this Article, when issuing VAT invoices for providing goods and services eligible for VAT reduction, at the VAT rate line write “8%”; the VAT amount; and the total amount payable by the buyer. Based on the VAT invoice, the selling business declares output VAT, and the purchasing business declares input VAT credit according to the reduced tax stated on the VAT invoice.

b) For business establishments specified at Point b, Clause 2 of this Article, when issuing sales invoices for providing goods and services eligible for VAT reduction, list the full amount of goods and services before reduction at the “Amount” column, and at the “Total goods and services amount” line state the amount after reducing 20% of the percentage rate on revenue, also noting: “has reduced... (amount) equivalent to 20% of the percentage rate for VAT calculation according to Resolution No. 142/2024/QH15.”

4. In cases where a business establishment specified at Point a, Clause 2 of this Article sells goods or provides services with different tax rates, the VAT invoice must clearly state the tax rate for each item according to the provisions at Clause 3 of this Article.

For business establishments specified at Point b, Clause 2 of this Article, when selling goods or providing services, the sales invoice must clearly state the amount reduced according to the procedures outlined in Clause 3 of this Article.

…

Thus, when issuing a VAT invoice, the VAT reduction should be recorded as follows:

- For business establishments calculating VAT using the credit method:

+ At the tax rate line: Write 8%

+ Record fully: VAT amount and the Total amount that the buyer must pay.

In cases where the business sells goods and provides services with different tax rates, the VAT invoice must state clearly the tax rate for each item in accordance with the procedures for issuing invoices.

- For business establishments (including business households, business individuals) calculating VAT by percentage on revenue:

+ "Amount" column: Record the full amount of goods and services before reduction.

+ At the "Total goods, services amount" line: Record the amount reduced by 20% of the percentage rate on revenue, noting: “reduced by... (amount) equivalent to 20% percentage rate to calculate VAT according to Resolution No. 142/2024/QH15.”

In the case that the business sells goods or provides services, the sales invoice must clearly specify the reduced amount in accordance with the procedures for issuing invoices.