What is the structure of the TIN in Vietnam? What is the latest personal TIN notification form for 2024?

What is the structure of the TIN in Vietnam?

According to Clause 1, Article 5 of Circular 105/2020/TT-BTC, the structure of the TIN is specified as follows:

N1N2N3N4N5N6N7N8N9N10 - N11N12N13

Where:

- The first two digits N1N2 are the prefix of the TIN.

- The seven digits N3N4N5N6N7N8N9 are arranged in a sequential structure ranging from 0000001 to 9999999.

- The digit N10 is the check digit.

- The three digits N11N12N13 are serial numbers from 001 to 999.

- The hyphen (-) is the character that separates the group of the first 10 digits and the group of the last 3 digits.

What is the structure of the TIN in Vietnam? What is the latest personal TIN notification form for 2024? (Image from the Internet)

Vietnam: How is the structure of the TIN classified?

According to Clause 3, Article 5 of Circular 105/2020/TT-BTC, the structure of the TIN is specified as follows:

- The 10-digit TIN is used for enterprises, cooperatives, organizations with legal status, or organizations without legal status but directly arising tax obligations; representatives of households, business households, and other individuals (hereinafter referred to as independent units).

- The 13-digit TIN, with a hyphen (-) used to separate the first 10 digits and the last 3 digits, is used for dependent units and other entities.

- Taxpayers who are economic organizations or other organizations as stipulated in Points a, b, c, d, n, Clause 2, Article 4 of Circular 105/2020/TT-BTC with or without legal status but directly arising tax obligations and are fully responsible for all tax obligations before the law are assigned a 10-digit TIN.

Dependent units established according to the law of the aforementioned taxpayers, if arising tax obligations and directly declaring and paying taxes, will be assigned a 13-digit TIN.

- Foreign contractors, and foreign sub-contractors according to Points đ, Clause 2, Article 4 of Circular 105/2020/TT-BTC registering to pay contractor tax directly with the tax authority will be assigned a 10-digit TIN for each contract.

In case a foreign contractor forms a partnership with Vietnamese economic organizations to conduct business in Vietnam based on a contractor contract and the parties involved in the partnership establish a Partnership Executive Board, the Board will handle accounting, have a bank account, issue invoices;

Or the Vietnamese economic organization participating in the partnership is responsible for joint accounting and profit-sharing for the participating parties, it will be assigned a 10-digit TIN to declare and pay tax for the contractor contract.

If a foreign contractor, foreign sub-contractor has an office in Vietnam and is declared and paid contractor tax by the Vietnamese side, the foreign contractor and sub-contractor will be assigned a 10-digit TIN to declare all other tax obligations (excluding contractor tax) in Vietnam and provide the TIN to the Vietnamese side.

- Foreign suppliers as specified in Point e, Clause 2, Article 4 of Circular 105/2020/TT-BTC who do not have a TIN in Vietnam at the time of direct taxpayer registration with the tax authority will be assigned a 10-digit TIN.

Foreign suppliers use the assigned TIN to directly declare, pay tax, or provide the TIN to organizations or individuals in Vietnam authorized or provide it to commercial banks, intermediary payment service providers to withhold, pay tax on behalf of the supplier, and declare it on the tax deduction list of foreign suppliers in Vietnam.

- Organizations, individuals, withholding and paying tax on behalf of others as stipulated in Point g, Clause 2, Article 4 of Circular 105/2020/TT-BTC will be assigned a 10-digit TIN (hereinafter referred to as tax representative code) to declare and pay tax on behalf of the foreign contractor, foreign sub-contractor, foreign supplier, organization, and individuals with business contracts or cooperation documents.

Foreign contractors, foreign sub-contractors according to Point đ, Clause 2, Article 4 of Circular 105/2020/TT-BTC declared and paid for by the Vietnamese side will be assigned a 13-digit TIN according to the tax representative code of the Vietnamese side to certify the completion of tax obligations in Vietnam.

When the taxpayer changes taxpayer registration information, temporarily suspends operation, business, resumes operation, business ahead of schedule, terminates the effectiveness of the TIN, and restores the TIN following taxpayer TIN regulations, the tax representative code will be updated by the tax authority accordingly.

Taxpayers are not required to submit documents according to Chapter 2 of Circular 105/2020/TT-BTC concerning the tax representative code.

- Operators, joint operating companies, joint venture enterprises, or organizations assigned by the Government of Vietnam to receive the shared profit of oil, gas from overlapping areas as specified in Point h, Clause 2, Article 4 of Circular 105/2020/TT-BTC will be assigned a 10-digit TIN for each oil and gas contract or equivalent document.

Contractors, investors participating in oil and gas contracts are assigned a 13-digit TIN following the 10-digit TIN for each oil and gas contract to carry out tax obligations (including corporate income tax from the transfer of rights in the oil and gas contract).

The Parent Company - Vietnam National Oil and Gas Group representing the host country receiving the shared profit from oil and gas contracts will be assigned a 13-digit TIN following the 10-digit TIN for each oil and gas contract to declare and pay tax on the shared profit from each oil and gas contract.

- Taxpayers who are households, business households, business individuals, and other individuals as stipulated in Points i, k, l, n, Clause 2, Article 4 of Circular 105/2020/TT-BTC are assigned a 10-digit TIN for household representatives, business household representatives, individuals, and a 13-digit TIN for business locations of business households, business individuals.

- Organizations, individuals as specified in Point m, Clause 2, Article 4 of Circular 105/2020/TT-BTC with one or more collection authorization contracts with a tax authority will be assigned a single tax representative code to collect the taxpayer's money and pay it into the state budget.

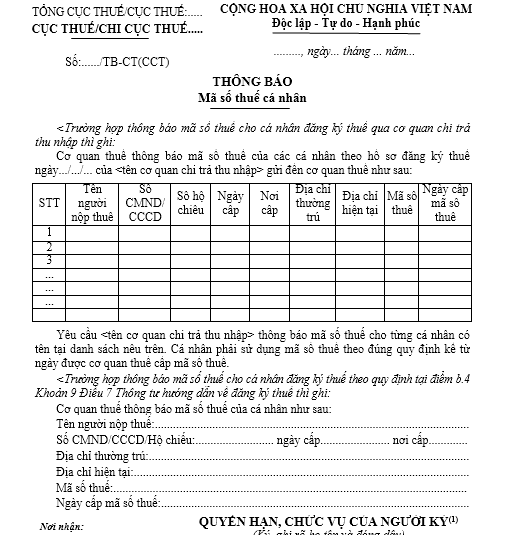

What is the latest personal TIN notification form for 2024 in Vietnam?

The personal TIN notification follows Form No. 14-MST issued together with Circular 105/2020/TT-BTC.

>>> Download The latest personal TIN notification form for 2024.