What is the statement form of duties on imported raw materials, supplies for refundable import duties in Vietnam?

What is the statement form of duties on imported raw materials, supplies for refundable import duties in Vietnam?

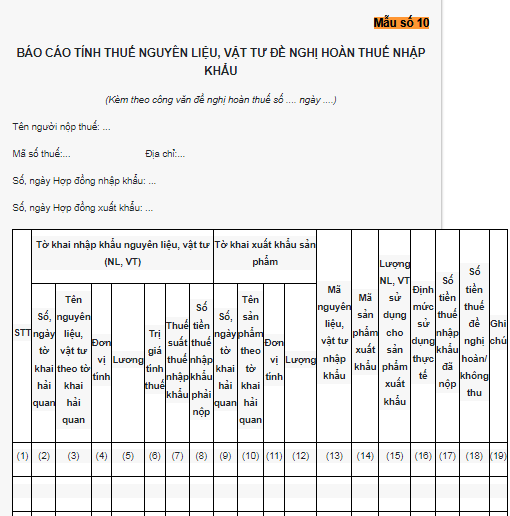

According to Appendix 7 of the Tax Exemption, Reduction, Refund, Non-Collection Forms issued under Decree 18/2021/ND-CP, the statement form of duties on imported raw materials, supplies for refundable import duties is Form No. 10 as follows:

Download Statement form of duties on imported raw materials, supplies for refundable import duties

What is the statement form of duties on imported raw materials, supplies for refundable import duties in Vietnam? (Image from Internet)

What is the purpose of the statement form of duties on imported raw materials, supplies for refundable import duties in Vietnam?

Based on Clause 5, Article 36 of Decree 134/2016/ND-CP (amended by Point d, Clause 20, Clause 18, Article 1 Decree 18/2021/ND-CP and the provision rescinded by Point a, Clause 2, Article 2 Decree 18/2021/ND-CP) stipulates as follows:

Tax refund for imported goods used for production and business but exported products.

...

5. Tax refund documentation includes:

a) Official Dispatch requesting the refund of export tax, import duty for exported or imported goods sent via the electronic data processing system of the customs authority according to the information criteria in Form No. 01 of Appendix VIIa or a dispatch requesting the refund of export, import duty according to Form No. 09 in Appendix VII issued along with this Decree: 01 original.

b) Payment documents for exported, imported goods if payment is completed: 01 copy

c) Export, import contract and invoice according to the export, import contract for buying and selling goods; entrustment export, import contract if it is in the form of entrusted export, import: 01 copy

The taxpayer declares on the customs declaration for exported goods information about the number, contract date, and name of the goods purchaser.

d) Report on the tax calculation of imported raw materials, supplies, components (according to Form No. 10 in Appendix VII issued along with the Decree).

The refund of import duty for raw materials, supplies, components must correspond with the actual quantity, type of raw materials, supplies, components imported and used to produce the actual exported product;

đ) Processing contract signed with foreign customers (in the case of importing raw materials, supplies, components to produce goods, then using these products to process exported goods according to a processing contract with foreign countries): 01 copy

e) Documents proving the presence of a production facility in Vietnam; proof of ownership or right to use machinery, equipment at the production facility suitable for the importation of raw materials, supplies, components to produce goods: 01 copy

...

Thus, it can be seen that the statement form of duties on imported raw materials, supplies for refundable import duties is one of the necessary documents for the tax refund application for imported goods used in production and business but where products have been exported.

When is import duty refunded in Vietnam?

According to Point c, Clause 1, Article 19 of the Export Tax, import duty Law 2016 stipulates as follows:

Refund of tax

1. Cases of tax refund:

a) Taxpayers who have paid import duty, export tax but no goods are imported, exported or goods are imported, exported less than the taxable imported, exported goods;

b) Taxpayers who have paid export tax but the exported goods must be re-imported will be refunded export tax and do not have to pay import duty;

c) Taxpayers who have paid import duty but the imported goods have to be re-exported will be refunded import duty and do not have to pay export tax;

d) Taxpayers who have paid tax for imported goods for production, business but have entered into the production of export goods and have exported products;

đ) Taxpayers who have paid tax for machinery, equipment, tools, transport means of organizations or individuals allowed to temporary import, re-export, except in the case of leasing for implementing investment projects, construction, installation, serving production, when re-exported abroad or exported to non-tariff zones.

The import duty refunded is based on the remaining usage value of the goods when re-exported calculated by the usage time and remain in Vietnam. If the goods are no longer in usable condition, import duty paid will not be refunded.

No refund for tax amount below the minimum threshold as stipulated by the Government.

2. Goods specified at Points a, b, and c, Clause 1 of this Article are eligible for tax refunds when not used, machined, or processed.

Thus, according to these regulations, an import duty refund is available in cases where taxpayers who have paid import duty but the goods must be re-exported.