What is the significance of the 21st day of the 12th lunar month? Is the deadline for the tax authority to send a payment notice to the fixed-tax payer on the 21st day of the 12th lunar month in Vietnam?

What is the significance of the 21st day of the 12th lunar month in Vietnam?

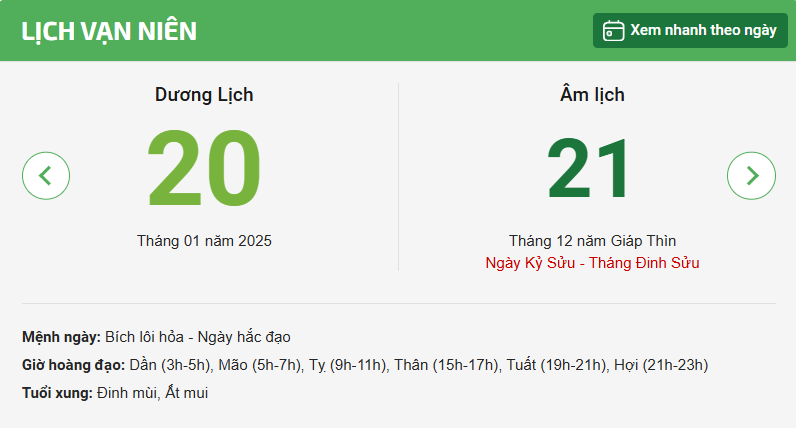

Based on the Lunar Calendar of 2024 and the Gregorian Calendar of 2025, the 21st day of the 12th lunar month is the day Ky Suu, falling on Monday, January 20, 2025.

Note: Information about what the 21st day of the 12th lunar month signifies is for reference purposes only.

What is the significance of the 21st day of the 12th lunar month? Is the deadline for the tax authority to send a payment notice to the fixed-tax payer on the 21st day of the 12th lunar month in Vietnam? (Image from Internet)

Is the deadline for the tax authority to send a payment notice to the fixed-tax payer on the 21st day of the 12th lunar month in Vietnam?

According to Clause 8, Article 13 of Circular 40/2021/TT-BTC, the deadline for paying tax for fixed-tax payers is regulated as follows:

Tax management for fixed-tax payers

...

- Sending tax notifications and tax payment deadlines

a) Sending tax notifications

a.1) The tax authority sends the Tax Payment Notice using form No. 01/TB-CNKD issued in accordance with Decree No. 126/2020/ND-CP dated October 19, 2020, by the Government of Vietnam, along with the Public Disclosure Table using form No. 01/CKTT-CNKD issued in accordance with this Circular to the fixed-tax payer (including both those subject to tax and those not subject to tax) no later than January 20 annually. The notice is sent directly to the fixed-tax payer (with acknowledgment of receipt from the taxpayer) or via postal service as a registered mail.

...

As such, for the fixed-tax payers subject to tax and those not subject to tax in 2024, the tax authority will send the Tax Payment Notice using form 01/TB-CNKD to each fixed-tax payer. The deadline for the tax authority to send the payment notice to the fixed-tax payer is no later than January 20, 2025, corresponding to the 21st day of the 12th lunar month.

How does the tax authority publicly disclose the list of fixed-tax payers subject to tax for the first term in Vietnam?

According to Clause 5, Article 13 of Circular 40/2021/TT-BTC, the public disclosure of the list of fixed-tax payers subject to tax for the first term is carried out as follows:

(1) The Tax Department publicly discloses the list of fixed-tax payers subject to tax for the first term at the one-stop service unit of the Tax Department, People’s Committee of districts and towns; at doors, gates, or locations convenient for information access, convenient venues of the People’s Committee headquarters of wards and commune-level towns; Tax Team offices; Market management boards for public and fixed-tax payers’ oversight. The first-term posting period is from December 20 to December 31 annually.

(2) The Tax Department sends publicly disclosed documents listing fixed-tax payers subject to tax for the first term to the People’s Council and Fatherland Front of districts, towns, wards, and commune-level towns no later than December 20 annually, indicating the address and time for the Tax Department to receive feedback (if any) from the People’s Council and Fatherland Front of districts, towns, wards, and commune-level towns. The deadline for the Tax Department to receive feedback (if any) is no later than December 31.

(3) No later than December 20 annually, the Tax Department sends each fixed-tax payer a Notification on the projected revenue, tax level using form No. 01/TBTDK-CNKD along with the Public Disclosure Table using form No. 01/CKTT-CNKD (hereafter called Public Disclosure Table) issued in accordance with Circular 40/2021/TT-BTC, indicating the address and time for which the Tax Department will receive feedback (if any) from the fixed-tax payer no later than December 31. The notification is sent directly to the fixed-tax payer (with acknowledgment of receipt from the taxpayer) or via postal service as a registered mail.

The Public Disclosure Table for each fixed-tax payer is prepared by locality. For markets, streets, neighborhoods, residential groups with two hundred (200) fixed-tax payers or less, the Tax Department prints and issues a Public Disclosure Table for each fixed-tax payer within the locality. For markets, streets, neighborhoods, residential groups with over 200 fixed-tax payers, the Tax Department prints and issues a Public Disclosure Table for up to 200 fixed-tax payers within the locality. Specifically, for markets with over 200 fixed-tax payers, the Tax Department prints and issues the Public Disclosure Table by trade.

If the tax authority has managed to publicly disclose the Public Disclosure Table on the Electronic Portal of the tax authority, it is not required to send the Public Disclosure Table using form No. 01/CKTT-CNKD along with the Notification on the projected revenue, tax level using form No. 01/TBTDK-CNKD issued in accordance with Circular 40/2021/TT-BTC.

(4) The Tax Department is responsible for publicly disclosing the posting locations, addresses for receiving feedback (phone number, fax number, address at the one-stop service unit, email address) regarding the public disclosure content to inform fixed-tax payers accordingly.

(5) The Tax Department is responsible for summarizing feedback on the first-term public disclosure content of the fixed-tax payers subject to tax, from the public, taxpayers, People’s Council, and Fatherland Front of districts, wards, commune-level towns to research adjustments, and additions to management targets, projected revenue, and tax levels before consulting the Tax Advisory Council.