What is the significance of the 1st day of the 12th lunar month in Vietnam? Is the deadline for paying the second installment of land rent for 2024 the 1st day of the 12th lunar month?

What is the significance of the 1st day of the 12th lunar month in Vietnam?

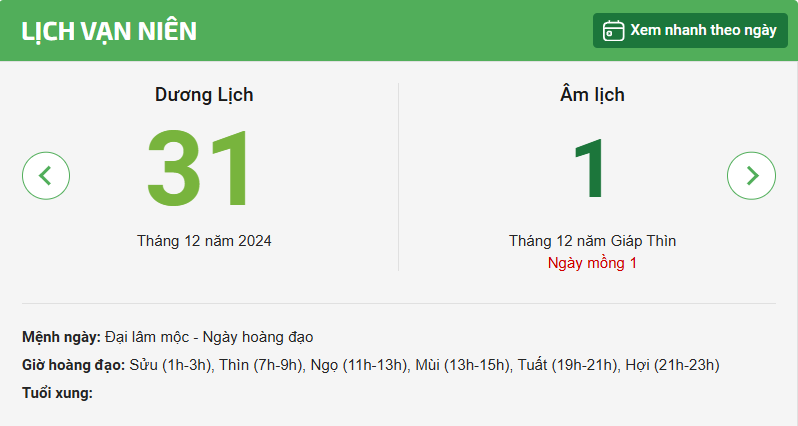

Based on the lunar calendar of 2024 and the solar calendar of 2025, the 1st day of the 12th lunar month marks the beginning of the last month of the lunar year 2024, falling on Tuesday, December 31, 2024, according to the solar calendar.

Note: The information about the 1st day of the 12th lunar month is for reference only.

What is the significance of the 1st day of the 12th lunar month in Vietnam? Is the deadline for paying the second installment of land rent for 2024 the 1st day of the 12th lunar month?

Vietnam: Is the deadline for paying the second installment of land rent for 2024 the 1st day of the 12th lunar month?

According to Clause 4, Article 4 of Decree 64/2024/ND-CP, the extended deadline for paying land rent in 2024 is as follows:

Extension of tax payment and land rent

...

- For land rent

The extension for paying land rent applies to 50% of the payable land rent arising in 2024 (the second installment in 2024) for enterprises, organizations, households, and individuals under the provisions of Article 3 of this Decree receiving direct land lease from the State through a Decision or Contract with a competent state agency in the form of annual land rent payment. The extension period is 2 months from October 31, 2024.

This regulation also applies to cases where enterprises, organizations, households, and individuals have multiple Decisions or Contracts for direct land leases from the state and engage in various production and business activities, including those in economic sectors specified in Clauses 1, 2, and 3 of Article 3 of this Decree.

...

Thus, the extension period for 50% of the payable land rent for 2024 (the second installment for 2024) for enterprises, organizations, households, and individuals under the regulation in Article 3 of Decree 64/2024/ND-CP receiving direct land lease from the State through a Decision or Contract with a competent state agency in the form of annual land rent payment is 2 months from October 31, 2024.

Therefore, the deadline for paying the second installment of land rent for 2024 mentioned above is December 31, 2024, which corresponds to the 1st day of the 12th lunar month.

Will late payment interest be charged on the land rent during the extension period in Vietnam?

According to Clause 4, Article 5 of Decree 64/2024/ND-CP, the procedure for extension is regulated as follows:

Procedure for extension

...

- No late payment interest will be charged on the tax, and land rent extended within the extension period (including cases where the taxpayer submits a Request for Extension to the tax authority after filing the tax declaration dossier as prescribed in Clause 1 of this Article, and cases where the competent authority upon inspection or audit determines the taxpayer entitled to the extension has an increased payable amount for the extended tax periods). If the tax authority has calculated late payment interest for cases entitled to an extension under this Decree, the tax authority shall adjust and not charge late payment interest.

...

Thus, land rent during the extension period will not be subject to late payment interest, including cases where the taxpayer submits a Request for Extension to the tax authority after filing the tax declaration and cases where the competent authority upon inspection or audit determines the taxpayer entitled to the extension has an increased payable amount for the extended tax periods.

If the tax authority has calculated late payment interest (if any) on the dossiers entitled to an extension, the tax authority shall adjust and not charge late payment interest.

When will a eligible person not receive a land rent extension in Vietnam?

According to Clause 2, Article 5 of Decree 64/2024/ND-CP, the procedure for extension is regulated as follows:

Procedure for extension

...

- The taxpayer must self-determine and take responsibility for ensuring the request for extension is in accordance with the designated subjects in this Decree. If the taxpayer submits the Request for Extension to the tax authority after September 30, 2024, it will not be eligible for a tax or land rent extension according to this Decree. If the taxpayer amends the tax declaration dossier of the extended tax period, leading to an increased payable amount, and submits it to the tax authority before the end of the extended payment deadline, the extended tax amount will include the increased payable amount due to the amendment. If the taxpayer amends the tax declaration dossier after the extended payment deadline, the additional amount due to the amendment will not be extended.

...

Thus, a person eligible for a land rent extension will not receive it if they submit the Request for Extension to the tax authority after September 30, 2024.