What is the retail sales invoice template in Vietnam?

What is the retail sales invoice template in Vietnam?

A sales invoice is an indispensable part of business activities, especially for retail retains. A retail sales invoice template helps save time, allows easy customization, and enhances efficient management.

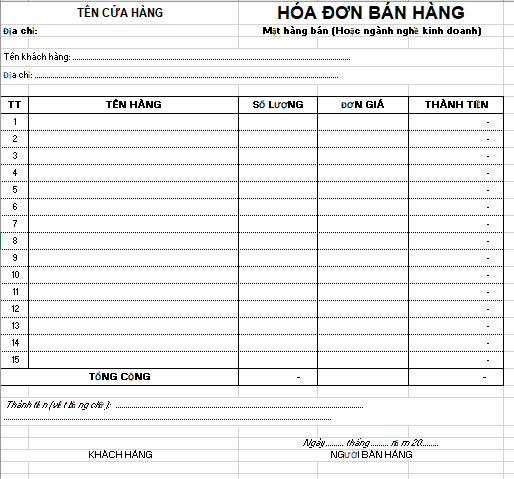

Currently, the law does not specifically regulate the format of retail sales invoices in Excel format. Therefore, individuals and organizations who are sellers can refer to the retail sales invoice template below:

retail sales invoice Template...Download

What is the retail sales invoice template in Vietnam? (Image from the Internet)

How to preserve and retain invoices and records in Vietnam?

Pursuant to Article 6 Decree 123/2020/ND-CP, regulations are as follows:

Storage and retention of Invoices and records

- Invoices and records must be stored and retained ensuring:

a) Safety, confidentiality, integrity, completeness, and no alteration or distortion throughout the retention period;

b) Proper and full retention duration as stipulated by accounting laws.

- Electronic invoices and records are stored and retained through electronic means. Agencies, organizations, and individuals have the right to select and apply forms of storage and retention of electronic invoices and records that suit their operational characteristics and technological capabilities. Electronic invoices and records must be ready for printing on paper or retrieval upon request.

- Invoices printed by tax authorities, invoices self-printed or placed for printing must be stored and retained according to the following requirements:

a) Unissued invoices and records are stored and retained in a warehouse following the record storage and retention policies for valuable records.

b) Invoices and records already issued within accounting units are retained according to the regulations for retention and storage of accounting records.

c) Invoices and records already issued by organizations, households, and individuals that are not accounting units are retained and stored as the private property of such organizations, households, and individuals.

Thus, the storage and retention of invoices and records is carried out as follows:

- Invoices and records must be stored and retained ensuring:

+ Safety, confidentiality, integrity, completeness, and no alteration or distortion throughout the retention period;

+ Proper and full retention duration as stipulated by accounting laws.

- Electronic invoices and records are stored and retained through electronic means. Agencies, organizations, and individuals have the right to select and apply forms of storage and retention of electronic invoices and records that suit their operational characteristics and technological capabilities. Electronic invoices and records must be ready for printing on paper or retrieval upon request.

- Invoices printed by tax authorities, invoices self-printed or placed for printing must be stored and retained according to the following requirements:

+ Unissued invoices and records are stored and retained in a warehouse following the record storage and retention policies for valuable records.

+ Invoices and records already issued within accounting units are retained according to the regulations for retention and storage of accounting records.

+ Invoices and records already issued by organizations, households, and individuals that are not accounting units are retained and stored as the private property of such organizations, households, and individuals.

What are the principles for issuance, management and use of invoices and records in Vietnam?

Pursuant to Article 4 Decree 123/2020/ND-CP, the principles for issuance, management and use of invoices and records are as follows:

(1) When selling goods or providing services, the seller must issue an invoice to the buyer (including cases where goods, services are used for promotion, advertising, as samples; goods, services are given, donated, exchanged, or used as payment in lieu of wages to employees, and for internal consumption (excluding internal transfers for continued production); goods are dispatched in forms of lending, borrowing, or return of goods) and must fully record the contents as prescribed in Article 10 Decree 123/2020/ND-CP. If using electronic invoices, they must follow the standard data format of the tax authority as regulated in Article 12 Decree 123/2020/ND-CP.

(2) When withholding personal income tax, when collecting taxes, fees, and charges, the tax withholding organization, the fee and charge collection organization, the tax collection organization must issue tax withholding statements, tax, fee, charge receipts to the individuals whose income is subject to tax withholding, who pay taxes, fees, and charges and must fully record the contents as prescribed in Article 32 Decree 123/2020/ND-CP. If using electronic receipts, they must follow the standard data format of the tax authority. In the case of individual authorization for tax finalization, no tax withholding statement is issued.

For individuals not signing a labor contract or signing a contract under three months, organizations, individuals paying the income may choose to issue a tax withholding statement for each tax withholding or issue one tax withholding statement for multiple tax withholdings within one tax period.

For individuals signing labor contracts from three months or more, organizations, individuals paying the income only issue one tax withholding statement in one tax period.

(3) Before using invoices and receipts, enterprises, economic organizations, other organizations, business households, individuals, tax, fee, and charge collection organizations must register with the tax authority or notify the issuance as prescribed in Articles 15, 34, and clause 1 Article 36 Decree 123/2020/ND-CP.

For invoices and receipts printed by tax authorities, the tax authority carries out the issuance notification according to clause 3 Article 24 and clause 2 Article 36 Decree 123/2020/ND-CP.

(4) Organizations, households, and individuals in business activities must report on the use of invoices purchased from tax authorities, and report on the use of receipts issued or self-printed, or purchased receipts from tax authorities according to Articles 29 and 38 Decree 123/2020/ND-CP.

(5) The registration, management, and use of electronic invoices and records must comply with the laws on electronic transactions, accounting, tax, tax management, and the regulations of this Decree.

(6) The data of invoices and records when selling goods and providing services, the data of records in the implementation of tax payment, tax withholding, and payment of taxes, fees, and charges serve as a database for tax management and provide invoice and record information to related organizations and individuals.

(7) The seller of goods and services being enterprises, economic organizations, or other organizations may delegate a third party to issue electronic invoices for the sale of goods and services. Invoices authorized to a third party must still indicate the selling entity's name as the principal. Authorization must be in writing between the delegating and the delegated party, which fully includes information about the authorized invoice (purpose of authorization; duration of authorization; method of invoice payment authorization) and notify the tax authority when registering the use of electronic invoices.

If an authorized invoice is an electronic invoice without a tax authority code, the principal must transfer the electronic invoice data to the tax authority through a service provider. The Ministry of Finance will provide specific guidance on this content.

(8) The fee and charge collection organizations may authorize a third party to issue fee and charge receipts. Receipts authorized to a third party must still display the name of the fee and charge collection organization as the principal. Authorization must be recorded in writing between the delegating and the delegated party, detailing all information about the authorized receipt (purpose of authorization; duration of authorization; method of receipt payment authorization) and must notify the tax authority when announcing the issuance of receipts.